European shares rose on Friday and logged their first monthly gain in four months as a host of solid earnings from corporate Europe overshadowed fears of a global recession, with some positive economic data also lending support.

The pan-European STOXX 600 was up 1.28 percent to a near two-month high of 438.29, and logged its best monthly performance since November 2020. It posted a weekly gain of 2.96 percent.

Boosting sentiment, the eurozone economy grew much faster than expected in the second quarter, with gross domestic product rising 0.7 percent quarter-on-quarter in the April-to-June period for a 4 percent year-on-year gain, strongly beating expectations of a 0.2 percent quarterly and 3.4 percent annual gain.

However, inflation this month rose to another record high, with consumer price growth accelerating to 8.9 percent in the month from 8.6 percent a month earlier, far above expectations for 8.6 percent and well clear of the European Central Bank’s 2 percent target.

“The picture still looks patchy, with uneven dynamics in terms of consumption and investment — we still expect a material deterioration in the outlook in Q3 and a mildly negative print in Q4,” Morgan Stanley economists and strategists wrote in a note.

“Underlying inflationary pressure remains strong and we expect further increases in the coming months... We see mounting headwinds from slowing growth and falling input cost pressures,” they wrote.

Meanwhile, data on Thursday showed that the US economy shrank for a second straight quarter.

Worries about a recession have led to scaled down bets of central bank policy tightening, with money markets now pricing in a roughly 44 percent chance of a 50 basis-point hike by the European Central Bank in September, compared with a 50 percent chance earlier this week.

Oil stocks led gains after crude prices jumped more than US$4 a barrel as attention turned to next week’s OPEC+ meeting.

The UK’s blue-chip FTSE 100 rose on Friday, marking its best monthly performance since December last year, as a jump in commodities and a slew of upbeat earnings reports from companies like NatWest outweighed economic slowdown worries.

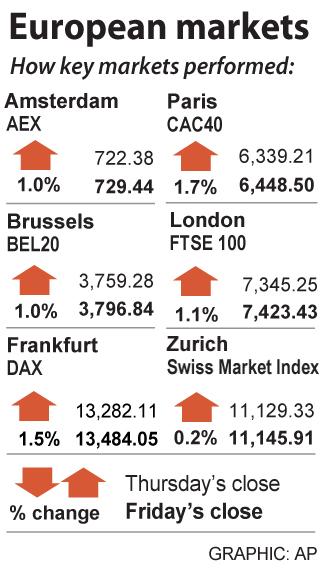

The index gained 1.06 percent to 7,423.43, rising 2.02 percent from a week earlier.

NatWest rose 8.1 percent after the bank raised its full-year forecast and made a bumper payout to shareholders, lifting the banking index 1.5 percent higher.

“The sector’s earnings so far have benefited from the rising rate environment and volatile financial markets that have boosted trading activity,” said Victoria Scholar, head of investment at Interactive Investor.

However, she added that there were concerns for financial stocks due to the shaky British macroeconomic outlook for the second half.

PATENTS: MediaTek Inc said it would not comment on ongoing legal cases, but does not expect the legal action by Huawei to affect its business operations Smartphone integrated chips designer MediaTek Inc (聯發科) on Friday said that a lawsuit filed by Chinese smartphone brand Huawei Technologies Co (華為) over alleged patent infringements would have little impact on its operations. In an announcement posted on the Taiwan Stock Exchange, MediaTek said that it would not comment on an ongoing legal case. However, the company said that Huawei’s legal action would have little impact on its operations. MediaTek’s statement came after China-based PRIP Research said on Thursday that Huawei filed a lawsuit with a Chinese district court claiming that MediaTek infringed on its patents. The infringement mentioned in the lawsuit likely involved

Taipei is today suspending work, classes and its US$2.4 trillion stock market as Typhoon Gaemi approaches Taiwan with strong winds and heavy rain. The nation is not conducting securities, currency or fixed income trading, statements from its stock and currency exchanges said. Authorities had yesterday issued a warning that the storm could affect people on land and canceled some ship crossings and domestic flights. Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) expects its local chipmaking fabs to maintain normal production, the company said in an e-mailed statement. The main chipmaker for Apple Inc and Nvidia Corp said it has activated routine typhoon alert

GROWTH: TSMC increased its projected revenue growth for this year to more than 25 percent, citing stronger-than-expected demand for AI devices and smartphones The Taiwan Institute of Economic Research (TIER, 台灣經濟研究院) yesterday raised its forecast for Taiwan’s GDP growth this year from 3.29 percent to 3.85 percent, as exports and private investment recovered faster than it predicted three months ago. The Taipei-based think tank also expects that Taiwan would see a 8.19 percent increase in exports this year, better than the 7.55 percent it projected in April, as US technology giants spent more money on artificial intelligence (AI) infrastructure and development. “There will be more AI servers going forward, but it remains to be seen if the momentum would extend to personal computers, smartphones and

Catastrophic computer outages caused by a software update from one company have once again exposed the dangers of global technological dependence on a handful of players, experts said on Friday. A flawed update sent out by the little-known security firm CrowdStrike Holdings Inc brought airlines, TV stations and myriad other aspects of daily life to a standstill. The outages affected companies or individuals that use CrowdStrike on the Microsoft Inc’s Windows platform. When they applied the update, the incompatible software crashed computers into a frozen state known as the “blue screen of death.” “Today CrowdStrike has become a household name, but not in