Major silicon wafer suppliers’ sales last month met market expectations, and the positive effects of their price hikes are expected to persist in the second half of this year, Yuanta Securities Investment Consulting Co (元大投顧) said yesterday.

Wafers are expected to remain in short supply, benefiting major suppliers in the near term, Yuanta said in a research note.

GlobalWafers Inc (環球晶圓) posted record revenue of NT$6.04 billion (US$203.08 million) for last month, up 14.9 percent month-on-month and 25.8 percent year-on-year, which Yuanta attributed to intensive renewals of the company’s long-term agreements in the second quarter, resulting in higher average selling prices.

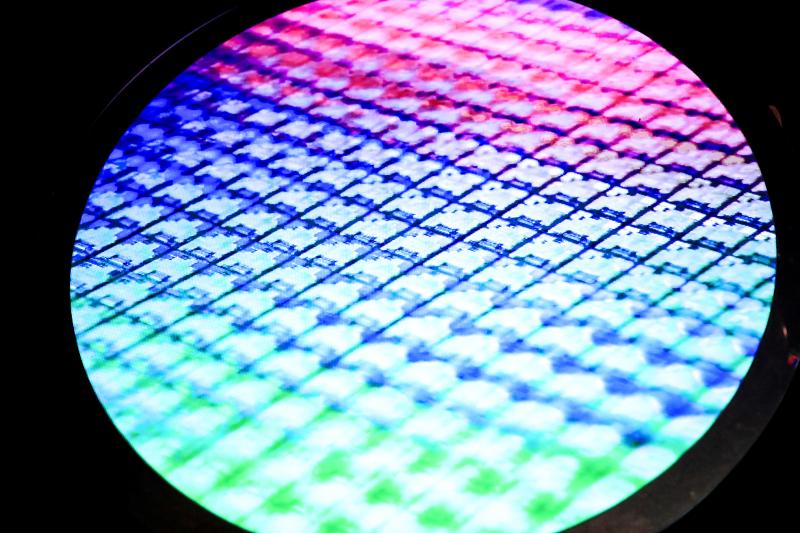

Photo: Cheng I-Hwa, Bloomberg

“We expect GlobalWafers’ sales to rise by 4 percent quarter-on-quarter this quarter, given the tight 12-inch supply-demand balance,” Yuanta said.

Formosa Sumco Technology Corp’s (台勝科) revenue for last month grew 1.9 percent monthly and 44.7 percent annually to NT$1.36 billion, the highest figure in 40 months, while Wafer Works Corp (合晶科技) reported revenue of NT$1.01 billion for last month, up 2.36 percent from a month earlier and 21.77 percent from a year earlier, company data showed.

In the first five months, GlobalWafers’ combined revenue totaled NT$27.61 billion, up 12.1 percent from a year earlier, while Formosa Sumco’s rose 32.6 percent to NT$6.43 billion and Wafer Works’ increased 27.97 percent to NT$5.05 billion, the data showed.

Yuanta forecast that Formosa Sumco and Wafer Works would continue to increase their average selling prices of products, as they need to conduct price negotiations every six months for many of their long-term contracts.

Coupled with a persistently tight supply of 8-inch and 12-inch wafers, the companies are expected to report a 5 percent upside in price quotes in the second half of the year, the note said.

Last week, Japanese silicon wafer supplier Sumco Corp reportedly planned to raise long-term agreement prices by 30 percent from this year to 2024, while Shin-Etsu Chemical Co proposed raising prices in 2024 to pass on depreciation costs from its new plant to its customers, a Nikkei Asia report said.

Formosa Sumco also said that the 12-inch supply-demand gap would likely grow to 10 percent next year, Yuanta said.

“We believe this development will support a pricing uptrend and be positive for the overall silicon wafer sector,” it said.

Taiwan’s long-term economic competitiveness will hinge not only on national champions like Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) but also on the widespread adoption of artificial intelligence (AI) and other emerging technologies, a US-based scholar has said. At a lecture in Taipei on Tuesday, Jeffrey Ding, assistant professor of political science at the George Washington University and author of "Technology and the Rise of Great Powers," argued that historical experience shows that general-purpose technologies (GPTs) — such as electricity, computers and now AI — shape long-term economic advantages through their diffusion across the broader economy. "What really matters is not who pioneers

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

TAIWAN VALUE CHAIN: Foxtron is to fully own Luxgen following the transaction and it plans to launch a new electric model, the Foxtron Bria, in Taiwan next year Yulon Motor Co (裕隆汽車) yesterday said that its board of directors approved the disposal of its electric vehicle (EV) unit, Luxgen Motor Co (納智捷汽車), to Foxtron Vehicle Technologies Co (鴻華先進) for NT$787.6 million (US$24.98 million). Foxtron, a half-half joint venture between Yulon affiliate Hua-Chuang Automobile Information Technical Center Co (華創車電) and Hon Hai Precision Industry Co (鴻海精密), expects to wrap up the deal in the first quarter of next year. Foxtron would fully own Luxgen following the transaction, including five car distributing companies, outlets and all employees. The deal is subject to the approval of the Fair Trade Commission, Foxtron said. “Foxtron will be

INFLATION CONSIDERATION: The BOJ governor said that it would ‘keep making appropriate decisions’ and would adjust depending on the economy and prices The Bank of Japan (BOJ) yesterday raised its benchmark interest rate to the highest in 30 years and said more increases are in the pipeline if conditions allow, in a sign of growing conviction that it can attain the stable inflation target it has pursued for more than a decade. Bank of Japan Governor Kazuo Ueda’s policy board increased the rate by 0.2 percentage points to 0.75 percent, in a unanimous decision, the bank said in a statement. The central bank cited the rising likelihood of its economic outlook being realized. The rate change was expected by all 50 economists surveyed by Bloomberg. The