Medigen Vaccine Biologics Corp (高端疫苗) has applied to the Australian medicines regulator for provisional approval of its COVID-19 vaccine, the pharmaceutical company said in a filing with the Taipei Exchange yesterday.

The company yesterday delivered the necessary documents to the Australian Therapeutic Goods Administration (TGA), but did not say when the regulator would complete its review, the filing showed.

The TGA in November last year gave the Medigen vaccine a provisional determination, the first step to provisional approval, corporate data showed.

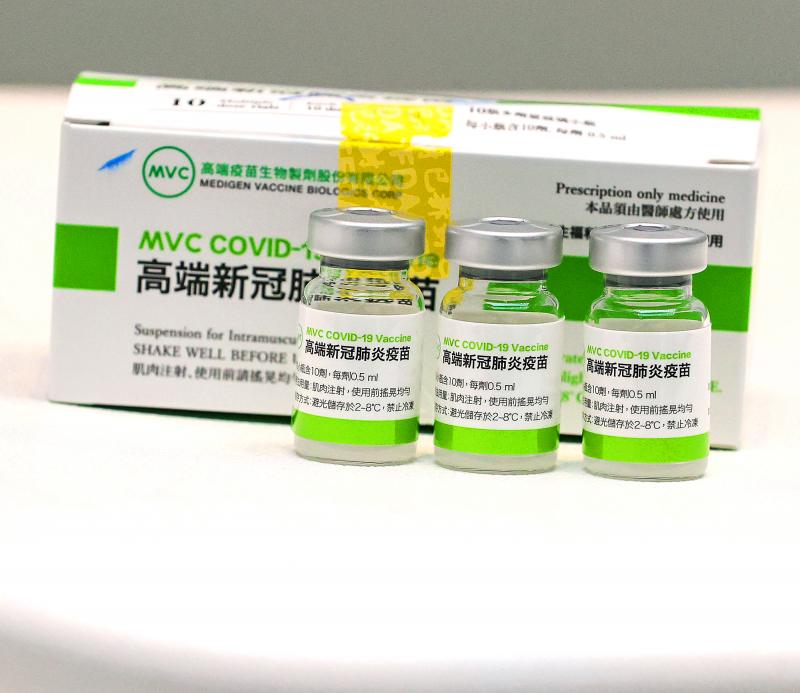

Photo: CNA

The step allows for provisional registration of medicines on the basis of preliminary clinical data.

The TGA said it requires comprehensive non-clinical data on safety, quality and compliance with “good manufacturing practice,” the same as for prescription medicine.

The TGA is one of the world’s most credible regulatory authorities as defined by the WHO, Medigen said in the filing.

The COVID-19 vaccines from AstraZeneca PLC, Moderna Inc, Pfizer Inc and BioNTech SE, Johnson & Johnson, and Novavax Inc have obtained provisional approvals from the TGA.

Medigen’s COVID-19 vaccine has been given emergency use authorization in Taiwan and Paraguay, and the company is waiting for a review to be completed in the Kingdom of Eswatini, while New Zealand, Palau, Indonesia, Belize and Thailand exempt travelers who have received the vaccine without requiring strict quarantine measures, it said.

Medigen reported a net loss of NT$140 million (US$4.76 million) in the first quarter, or losses per share of NT$0.66.

First-quarter revenue advanced to NT$326 million from NT$3 million a year earlier, with gross margin of 64 percent.

The company’s operating expenses grew 27.5 percent annually to NT$361 million last quarter due to higher marketing and research spending, company data showed.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the