Silicon wafer supplier Formosa Sumco Technology Corp (台勝科) yesterday gave an upbeat outlook for the current quarter, as it expects that deteriorating supply constraints would continue to drive up wafer prices, which would help it defy a slowdown in consumer electronics demand.

The company said chip demand is strongly underpinned by exuberant demand from 5G-related devices, automotive electronics and power management chips, which most semiconductor companies consider long-term growth engines.

Customers’ silicon wafer inventories are running low due to prolonged supply-demand imbalances over the past few quarters, the company said in a presentation at an investors’ conference.

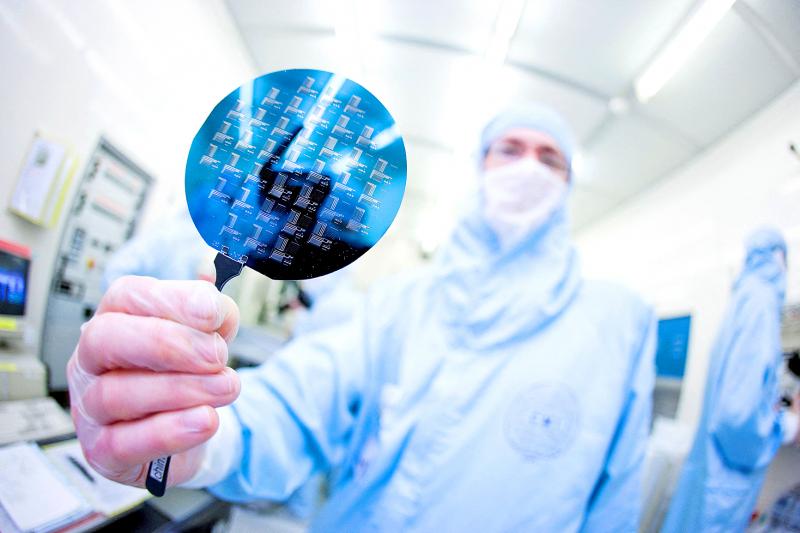

Photo: Reuters

“Tight supply of 12-inch silicon wafers for logic and memory chips aggravated during the second quarter. The company is unable to allocate any wafers for customers who did not ink long-term supply contracts,” Formosa Sumco said. “We are also unable to catch up with customers’ demand for 8-inch wafers.”

Formosa Sumco expects supply constraints to extend at least into this quarter, leading to further price increases on the spot market, the company said.

Formosa Sumco, which was founded by Japan-based Komatsu Ltd and Taiwan’s Formosa Plastics Group (FPG, 台塑集團) in 1995, said wafer demand exceeded supply last quarter, which drove up 8-inch and 12-inch wafer spot prices.

The company signed more long-term supply agreements with customers last quarter, extending the coverage to most of its silicon wafers, it said, adding that the contract prices have picked up during the first three months of this year.

Formosa Sumco budgeted NT$18.9 billion (US$643.1 million) for capital spending this year, far exceeding last year’s investment of NT$1.4 billion, as it is seeking to set up a new 12-inch fab in Yunlin County’s Mailiao Township (麥寮) that would cost NT$28.26 billion.

The company aims to ramp up output, with the new factory scheduled to start production in 2024.

The new investment also reflects Formosa Sumco’s bullish view about the silicon wafer market for the coming years.

The company yesterday said that the silicon wafers scarcity would likely persist, given robust market demand and decreases in customers’ wafer inventories.

Global supply of 12-inch silicon wafers would be 3 percent below market demand this year, it said, adding that the supply gap might widen to about 10 percent next year.

Geopolitical tensions, as well as COVID-19-induced supply chain disruptions and lockdowns in China, have affected consumer electronics demand, the company said, but added that this would not dampen customers’ demand for silicon wafers, as they are adjusting product portfolios to cope with the weaker consumer market.

Formosa Sumco shares rose 2.32 percent to NT$265 yesterday, outperforming rival GlobalWafers Inc (環球晶圓), whose stock price rose 0.64 percent to NT$626.

The TAIEX slid 0.73 percent.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

Nvidia Corp’s GB300 platform is expected to account for 70 to 80 percent of global artificial intelligence (AI) server rack shipments this year, while adoption of its next-generation Vera Rubin 200 platform is to gradually gain momentum after the third quarter of the year, TrendForce Corp (集邦科技) said. Servers based on Nvidia’s GB300 chips entered mass production last quarter and they are expected to become the mainstay models for Taiwanese server manufacturers this year, Trendforce analyst Frank Kung (龔明德) said in an interview. This year is expected to be a breakout year for AI servers based on a variety of chips, as

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)