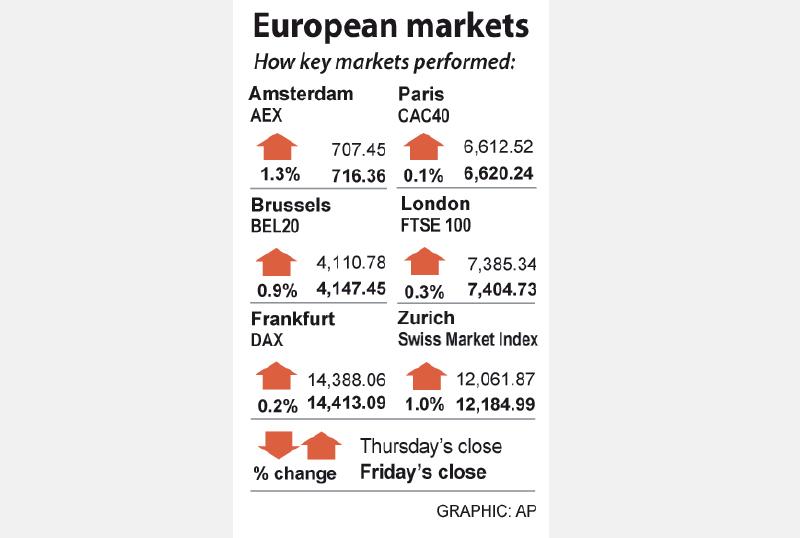

European shares rose on Friday, adding to the strong gains earlier this week, as investors focused on Russia-Ukraine peace negotiations and digested the talks between US President Joe Biden and Chinese President Xi Jinping (習近平).

The pan-European STOXX 600 closed 0.9 percent higher, with technology stocks leading the gains.

The benchmark index posted its best weekly performance since November 2020 on optimism that peace would be negotiated in the Ukraine conflict that has rattled global markets.

“It’s been a weird week, because although we still got everything going on in Ukraine, we’ve also been sort of pulled back to the normal hustle and bustle, and investors do like normality,” AJ Bell financial analyst Danni Hewson said.

Biden and Xi spoke on a video call on Friday about Russia’s invasion of Ukraine, and Chinese media said Xi underlined that such conflicts are in no-one’s interests.

Aiding sentiment, Russia paid US$117 million in interest due on two sovereign US-dollar bonds, easing doubts about its ability to honor external debt after harsh sanctions imposed by the West.

“In European markets, we’re very close to the levels we’re at before the war. We’re very far from pricing a negative scenario here,” Unigestion SA head of portfolio management Alexandre Deruaz said.

“The impact on the growth cycle is coming from oil. We’ve passed the point of maximum price in the short term for oil. So everybody is recognizing that inflation is going through the roof, but at some point it will have a lesser impact,” he said.

The UK’s Vodafone Group PLC rose 1.3 percent after Reuters reported that global infrastructure funds have approached the telecom giant to invest in its US$16 billion mast company Vantage Towers. The latter’s stock gained 10.8 percent.

German real-estate giant Vonovia SE slipped 3.3 percent even as it said it was on course for “significant growth” after a record year and the acquisition of smaller rival Deutsche Wohnen last year.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors