Wall Street’s three major indices closed higher on Friday, with the biggest boost from recently battered technology stocks, after talks between US President Joe Biden and Chinese President Xi Jinping (習近平) over the Ukraine crisis ended without big surprises.

Investors were also relieved by slowing gains in oil prices as they continued to digest the US Federal Reserve’s Wednesday interest rate increase and its aggressive plan for further hikes aimed at combating soaring inflation.

Biden warned Xi during a call that there would be “consequences” if Beijing gave material support to Russia’s invasion of Ukraine, the White House said.

Both sides stressed the need for a diplomatic solution to the crisis.

While Xi called on NATO nations to hold a dialogue with Moscow, he did not assign blame to Russia for the invasion.

“The readout from the meeting was as expected,” said Art Hogan, chief market strategist at National Securities in New York, regarding the Xi-Biden talks.

He said that since Russia-Ukraine talks were continuing, investors were tending toward optimism.

“Regarding Russia, Ukraine, the market has been more positive on news from the diplomatic front than negative on the escalation,” he said.

Hogan also cited calmer oil prices and relief that the highly anticipated Fed news was finally out.

“Instead of having fears and trepidation of what the Fed might do we have clear road map for monetary policy,” he said.

In addition to less onerous than expected Fed actions, Steve Sosnick, chief strategist at Interactive Brokers in Greenwich, Connecticut, said investors were reassured that US crude oil prices were not too far above US$100 on Friday after recently surpassing US$130.

“At least for this week oil has found a level. That’s someway positive for the market as a rising oil price is overweighted in consumer minds as an inflationary indicator,” Sosnick said. “Does the market like oil around US$100? No, but is it happier that it’s around US$100 than going up US$20 every day? Of course.”

Investors were also monitoring for any impact from Friday’s “triple witching,” in which investors unwind positions in futures and options contracts before they expire, which can lead to volatility and trading volume.

On Friday the expirations appeared to boost volume, as 18.47 billion shares changed hands on US exchanges, compared with the 14.56 billion moving average for the past 20 sessions.

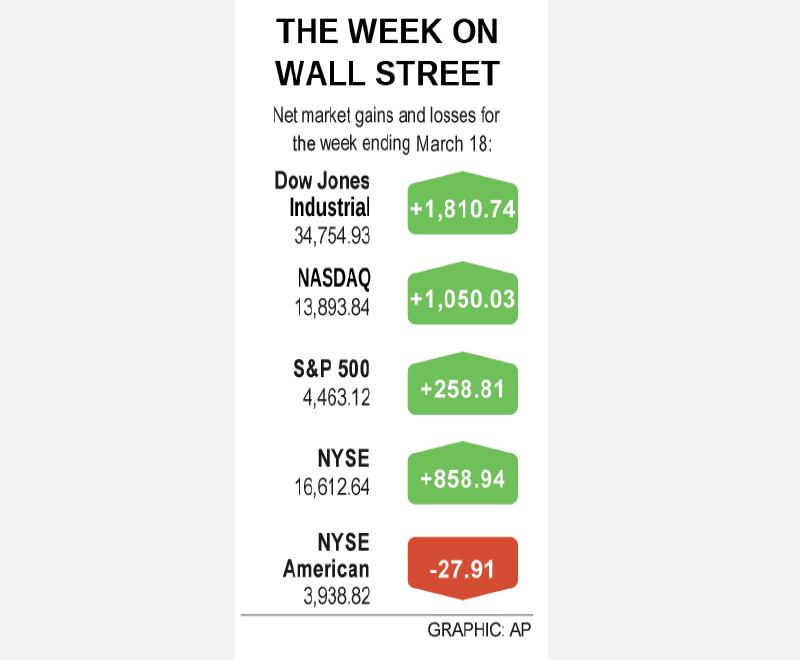

The Dow Jones Industrial Average on Friday rose 274.17 points, or 0.8 percent, to 34,754.93, the S&P 500 gained 51.45 points, or 1.17 percent, to 4,463.12 and the NASDAQ Composite added 279.06 points, or 2.05 percent, to 13,893.84.

Wall Street’s three main indices boasted their biggest weekly percentage gains since early November 2020, with the S&P adding 6.2 percent, while the Dow rose 5.5 percent and the NASDAQ jumped 8.2 percent.

Ten of the 11 major S&P 500 sectors closed higher, with heavyweight technology and consumer discretionary both finishing up 2.2 percent, while communication services rose 1.4 percent.

The only declining sector was utilities, which ended the session down 0.9 percent.

Moderna Inc closed up 6.3 percent after the drugmaker submitted a request to the US Food and Drug Administration to allow for a second booster of its COVID-19 vaccine.

Shares of Boeing Co finished up 1.4 percent after reports that the plane maker was edging toward a landmark order from Delta Air Lines for up to 100 of its 737 MAX 10 jets.

Advancing issues outnumbered declining ones on the New York Stock Exchange by a 2.20-to-1 ratio; on NASDAQ, a 2.19-to-1 ratio favored advancers.

The S&P 500 posted 19 new 52-week highs and one new low; the NASDAQ Composite recorded 44 new highs and 41 new lows.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors