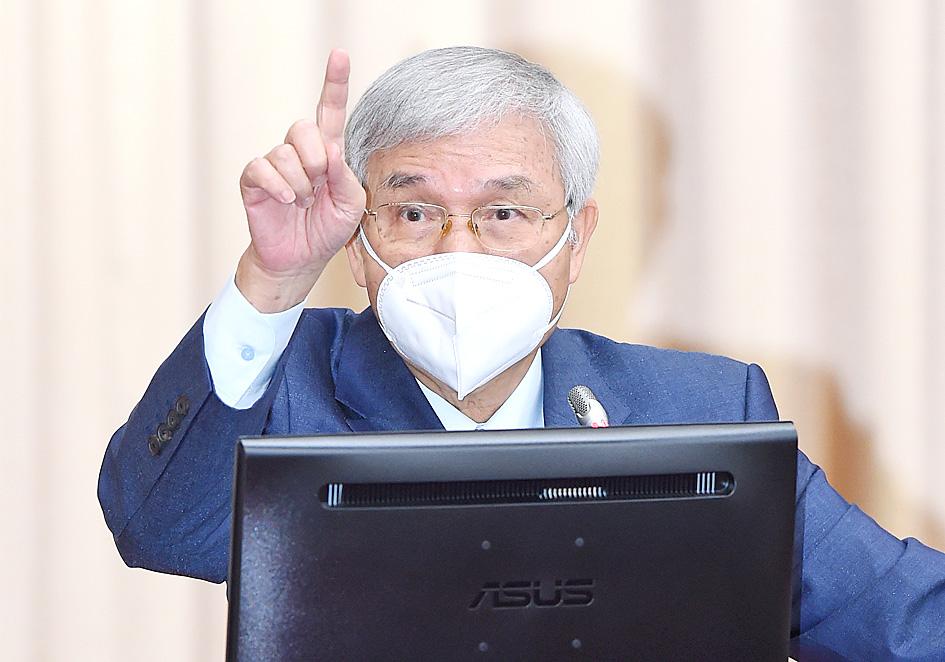

Credit control measures have achieved the goal of maintaining the nation’s financial stability, but are unlikely to make houses more affordable, central bank Governor Yang Chin-long (楊金龍) said yesterday.

Yang made the comments while fielding questions on the central bank’s operations at a meeting of the legislature’s Finance Committee.

“The series of credit controls were intended to prevent money from overflowing into the real-estate market and straining the financial system in times of credit tightening,” the governor said, adding that the US Federal Reserve has indicated plans to taper its bond-buying program later this year and to hike interest rates following better employment figures.

Photo: Liao Chen-huei, Taipei Times

Barring lenders from granting grace periods on second-home purchases in the six special municipalities, as well as Hsinchu City and Hsinchu County, was intended to prevent overleveraging on the part of individual buyers, Yang said.

Wealth management analysts have encouraged people to acquire real estate and take advantage of record-low interest rates, which average 1.31 percent for house loans.

“Micro adjustments” are necessary after two previous waves of credit controls failed to cool real-estate lending, Yang said.

The governor said that he partially agreed with the opinion of Highwealth Construction Corp (興富發) founder Cheng Chin-tien (鄭欽天) that credit controls reflect a boom in the property market.

However, developers would like to portray the market in a way that helps boost property sales and prices, Yang said.

Asked whether tightening measures would help make houses affordable again for ordinary people, the governor said that the goal has proved “unachievable” over the years and the central bank has instead sought to “induce a soft landing.”

Toward that end, the central bank is closely monitoring the market and would introduce adjustments if necessary, he added.

A central bank report shows that in the first half of the year, the bank intervened in the foreign-exchange market by buying US$8.73 billion of US dollars to slow the appreciation of the New Taiwan dollar.

Exporters have said that profit erosion caused by a strong NT dollar, which has outperformed other Asian currencies this year.

The NT dollar has hovered between NT$27.5 and NT$28 against the US dollar in the past three months, the central bank said, adding that the NT dollar’s direction hinges on global demand for the US dollar and Taiwanese exports.

Strong exports would lend support to the local currency, while bond-buying tapering and interest rate hikes by the US Fed would bolster the US dollar, Yang said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received

FORTUNES REVERSED: The new 15 percent levies left countries with a 10 percent tariff worse off and stripped away the advantage of those with a 15 percent rate In a swift reversal of fortunes, countries that had been hardest hit by US President Donald Trump’s tariffs have emerged as the biggest winners from the US Supreme Court’s decision to strike down his emergency levies. China, India and Brazil are among those now seeing lower tariff rates for shipments to the US after the court ruled Trump’s use of the International Emergency Economic Powers Act to impose duties was illegal. While Trump subsequently announced plans for a 15 percent global rate, Bloomberg Economics said that would mean an average effective tariff rate of about 12 percent — the lowest since