The NASDAQ ended Friday at a new peak, but the other main Wall Street indices fell, reflecting the mixed sentiment stemming from a disappointing US jobs report, which raised fears about the pace of economic recovery, but weakened the argument for near-term tapering.

On the final day of trading before the Labor Day weekend in the US, the S&P 500 and the Dow Jones Industrial Average benchmark posted marginal declines, tempering the former’s positive weekly performance and extending the latter’s run of losses to four in the past five sessions.

However, for the NASDAQ, registering a fifth win in the past six sessions and a weekly gain of 1.6 percent, investors’ support of heavyweight technology stocks — which tend to perform better in a low interest-rate environment — continues to drive it higher.

Apple Inc, Alphabet Inc and Facebook Inc all rose 0.3 to 0.4 percent.

“Tech has become bullet-proof,” Boston Partners global market research director Mike Mullaney said. “It’s the anti-COVID sector, where you want to be if you think COVID or a lack of growth is going to be an issue.”

The virus, and its impact on the pace of economic recovery in the US, was evident in the US Department of Labor’s closely watched report, which showed that non-farm payrolls increased by 235,000 jobs last month, widely missing economists’ estimate of 750,000. Payrolls had surged 1.05 million in July.

“The number’s a big disappointment and it’s clear the Delta variant [of SARS-CoV-2] had a negative impact on the labor economy this summer,” said Michael Arone, chief investment strategist at State Street Global Advisors in Boston. “You can tell because leisure and hospitality didn’t add any jobs and retail actually lost jobs. Investors will conclude that perhaps this will put the [US Federal Reserve] further on hold in terms of the timing of tapering. Markets may be okay with that.”

The S&P 500 and the NASDAQ had scaled all-time highs over the past few weeks on support from robust corporate earnings, but investors have remained generally cautious as they watch economic indicators and the jump in US infections to see how that might influence the Fed and its tapering plans.

The labor market remains the key touchstone for the Fed, with Fed Chair Jerome Powell hinting last week that reaching full employment was a pre-requisite for the central bank to start paring back its asset purchases.

Among the biggest decliners on the S&P 500 were cruise ship operators, whose businesses are highly susceptible to consumer sentiment around travel and COVID-19. Norwegian Cruise Line Holdings, Carnival Corp and Royal Caribbean Cruises all fell 3.4 to 4.4 percent.

A majority of the 11 S&P sectors closed down, with the utilities index the worst performer at 0.8 percent lower. Economically sensitive manufacturing and industrials slipped 0.7 percent and 0.6 percent respectively.

Banking stocks, which generally perform better when bond yields are higher, dropped 0.4 percent even as the benchmark 10-year US Treasury yield jumped following the report.

“I get the overall market reaction, because it feels a little bit like pricing in a potential policy error from the Fed, but I don’t understand some of the sectors’ reactions today,” Mullaney said.

Despite a labor report number well outside the consensus estimate, the overall reaction of investors was muted, continuing a trend over the past year of a decoupling of significant S&P movement in the wake of a wide miss on the payrolls report.

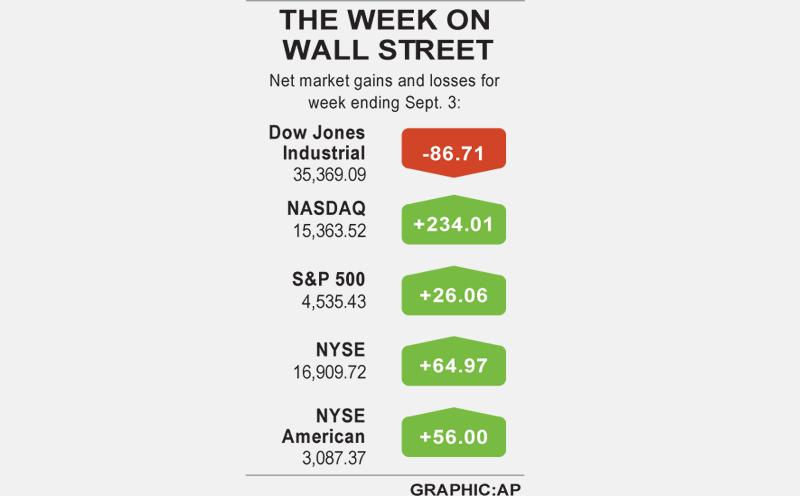

The S&P 500 on Friday lost 1.52 points, or 0.03 percent, to 4,535.43 and the Dow Jones Industrial Average fell 74.73 points, or 0.21 percent, to 35,369.09. The NASDAQ Composite added 32.34 points, or 0.21 percent, to 15,363.52.

For the week, the S&P rose 0.6 percent, the Dow dipped 0.2 percent and the NASDAQ added 1.6 percent.

Volume on US exchanges was 8.37 billion shares on Friday, compared with the 8.99 billion average for the full session over the past 20 trading days.

The S&P 500 posted 50 new 52-week highs and one new low; the NASDAQ Composite recorded 123 new highs and 21 new lows.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

The global server market is expected to grow 12.8 percent annually this year, with artificial intelligence (AI) servers projected to account for 16.5 percent, driven by continued investment in AI infrastructure by major cloud service providers (CSPs), market researcher TrendForce Corp (集邦科技) said yesterday. Global AI server shipments this year are expected to increase 28 percent year-on-year to more than 2.7 million units, driven by sustained demand from CSPs and government sovereign cloud projects, TrendForce analyst Frank Kung (龔明德) told the Taipei Times. Demand for GPU-based AI servers, including Nvidia Corp’s GB and Vera Rubin rack systems, is expected to remain high,