China Airlines Ltd (CAL, 中華航空) and EVA Airways Corp (長榮航空) yesterday announced that they are to trial the International Air Transport Association’s (IATA) Travel Pass, a mobile application that allows people to store and share verified certification of COVID-19 tests or vaccination.

CAL from Aug. 30 would use the IATA’s digital initiative for passengers flying to Taiwan from five airports in North America — Los Angles, Ontario, San Francisco, New York and Vancouver — and from Frankfurt, Germany; London; and Singapore, it said in a statement.

CAL would consider Travel Pass for more flights after it and the IATA evaluate the trial, the airline said.

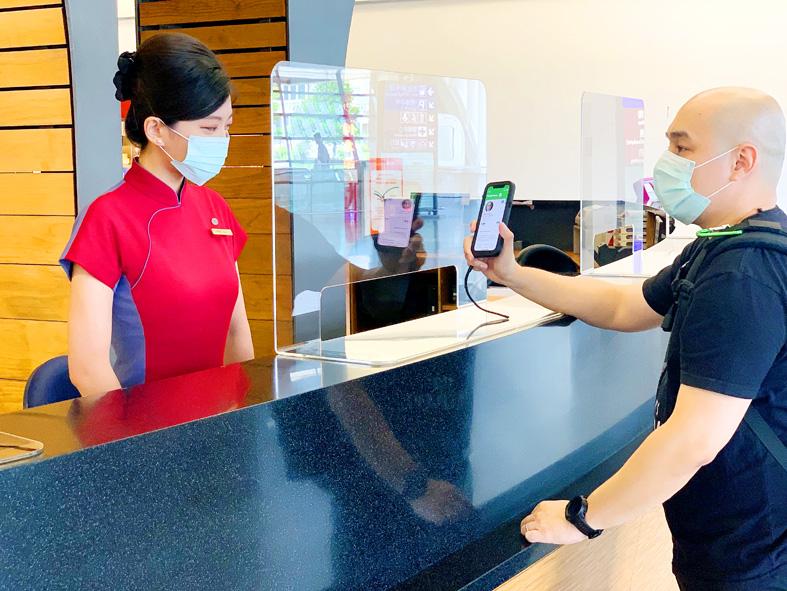

Photo courtesy of China Airlines Ltd

EVA Air said in a statement that after four months of discussions with the IATA, from next month it is to test the mobile application for people flying from Paris to Taiwan.

The Travel Pass is expected to help airlines to assess certifications for COVID-19 tests or vaccinations more efficiently and conveniently than the paper-based process, the two airlines said.

Before departure, passengers would download the Travel Pass app, which would inform them which type of COVID-19 test or vaccination is required for the journey, as well as where they can get tested or vaccinated, the airlines said.

After they are tested or vaccinated at a lab or test center authorized by the Travel Pass, certification would be securely sent to the app to be stored, they said.

They would show the certification to airlines, which would not involve physical contact, the airlines said.

“It is foreseeable that for a long while, passengers will need to have a negative polymerase chain reaction test result and vaccination certificate before boarding a plane, as governments do not intend to relax such restrictions even as borders reopen,” EVA Air said.

Digital tools such as Travel Pass would play an important role in borders reopening, as they reduce physical contact during the data verification process and help airlines avoid misreading data, EVA said.

As governments are updating travel restrictions amid changes in the COVID-19 situation, digital initiatives would also provide passengers the latest information and ensure that they meet the latest requirements, EVA Air said.

CAUTIOUS RECOVERY: While the manufacturing sector returned to growth amid the US-China trade truce, firms remain wary as uncertainty clouds the outlook, the CIER said The local manufacturing sector returned to expansion last month, as the official purchasing managers’ index (PMI) rose 2.1 points to 51.0, driven by a temporary easing in US-China trade tensions, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The PMI gauges the health of the manufacturing industry, with readings above 50 indicating expansion and those below 50 signaling contraction. “Firms are not as pessimistic as they were in April, but they remain far from optimistic,” CIER president Lien Hsien-ming (連賢明) said at a news conference. The full impact of US tariff decisions is unlikely to become clear until later this month

With an approval rating of just two percent, Peruvian President Dina Boluarte might be the world’s most unpopular leader, according to pollsters. Protests greeted her rise to power 29 months ago, and have marked her entire term — joined by assorted scandals, investigations, controversies and a surge in gang violence. The 63-year-old is the target of a dozen probes, including for her alleged failure to declare gifts of luxury jewels and watches, a scandal inevitably dubbed “Rolexgate.” She is also under the microscope for a two-week undeclared absence for nose surgery — which she insists was medical, not cosmetic — and is

GROWING CONCERN: Some senior Trump administration officials opposed the UAE expansion over fears that another TSMC project could jeopardize its US investment Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is evaluating building an advanced production facility in the United Arab Emirates (UAE) and has discussed the possibility with officials in US President Donald Trump’s administration, people familiar with the matter said, in a potentially major bet on the Middle East that would only come to fruition with Washington’s approval. The company has had multiple meetings in the past few months with US Special Envoy to the Middle East Steve Witkoff and officials from MGX, an influential investment vehicle overseen by the UAE president’s brother, the people said. The conversations are a continuation of talks that

Alchip Technologies Ltd (世芯), an application-specific integrated circuit (ASIC) designer specializing in artificial-intelligence (AI) chips, yesterday said that small-volume production of 3-nanometer (nm) chips for a key customer is on track to start by the end of this year, dismissing speculation about delays in producing advanced chips. As Alchip is transitioning from 7-nanometer and 5-nanometer process technology to 3 nanometers, investors and shareholders have been closely monitoring whether the company is navigating through such transition smoothly. “We are proceeding well in [building] this generation [of chips]. It appears to me that no revision will be required. We have achieved success in designing