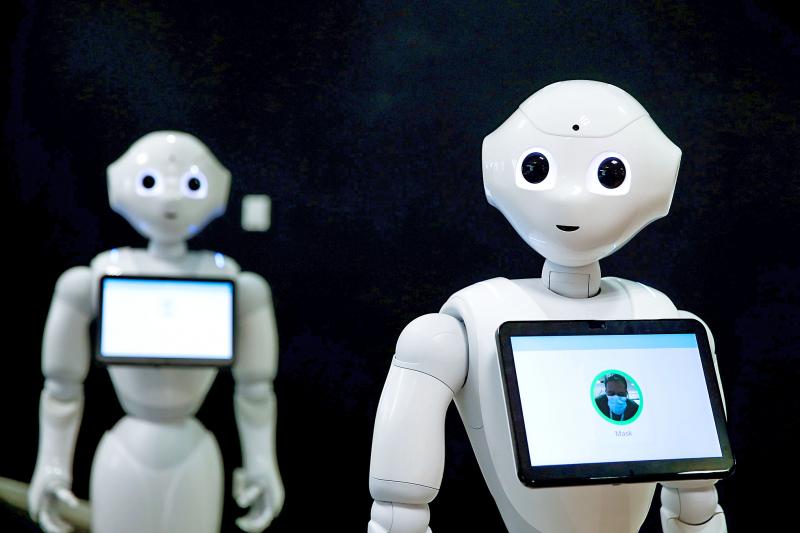

Softbank Group Corp is slashing jobs at its global robotics business and has stopped producing its Pepper robot, according to sources and documents reviewed by Reuters, as the conglomerate downgrades its industry ambitions.

Production of the humanoid Pepper, touted as the first robot with “a heart,” was stopped last year, three sources familiar with the matter and the documents said.

It would be costly to restart production, two of the sources said.

Photo: Reuters

Built by Hon Hai Precision Industry Co (鴻海精密), known as Foxconn Technology Group (富士康科技集團) outside of Taiwan, Pepper was meant to help plug labor shortages, but struggled to find a global customer base.

Only 27,000 were produced, one of the sources said.

The pullback reflects the fading of Softbank chief executive Masayoshi Son’s plan to make the company the leader in the robotics industry, producing human-like machines that could serve customers and babysit children.

As part of the retrenchment, Softbank plans to eliminate about half of its 330 positions in France in September, the sources said, cutting into the historical heart of the business, whose origins lie in Softbank’s 2012 acquisition of French robotics firm Aldebaran.

Half of the workers have already been cut from smaller sales operations in the US and UK, three of the sources said, with employees in Japan redeployed from the robotics business.

All the sources declined to be named as they are not permitted to speak to the media.

In France, negotiations on layoffs are ongoing with final numbers not decided, a Softbank spokesperson said.

Staff have also been laid off in the US and UK and redeployed in Japan, the spokesperson said, declining to provide further deals.

Softbank “will continue to make significant investments in next-generation robots to serve our customers and partners,” the French robotics business said in a statement.

The job cuts in France were first reported by French business Web site Le Journal du Net.

Softbank Robotics launched the chest-high Pepper in 2014 and it became the face of the conglomerate, embodying Son’s optimistic vision of a technology-powered future as he built his overseas investing operations.

Behind the scenes, culture clashes between the French business and Tokyo management hurt the robot’s development, and its sales were impacted by its limited functionality and unreliability, the sources said.

Softbank, which propped up Pepper sales by placing the robot in its mobile phone stores, has shifted focus to products such as cleaning robot Whiz. The French business was increasingly sidelined, the sources said.

The conglomerate has been selling assets including the majority of its stake in robotics firm Boston Dynamics Inc as Son focuses more on investing through the Vision Fund.

Softbank retains exposure to robotics and automation technology, owning SB Logistics, and with stakes in robotics firm Berkshire Grey and warehouse robotics firm AutoStore.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong

RESHAPING COMMERCE: Major industrialized economies accepted 15 percent duties on their products, while charges on items from Mexico, Canada and China are even bigger US President Donald Trump has unveiled a slew of new tariffs that boosted the average US rate on goods from across the world, forging ahead with his turbulent effort to reshape international commerce. The baseline rates for many trading partners remain unchanged at 10 percent from the duties Trump imposed in April, easing the worst fears of investors after the president had previously said they could double. Yet his move to raise tariffs on some Canadian goods to 35 percent threatens to inject fresh tensions into an already strained relationship, while nations such as Switzerland and New Zealand also saw increased