Launching one of the richest individuals on Earth into orbit has proved a leap too far for insurers, who are not ready to price the risk of losing Jeff Bezos or his fellow space travelers.

Amazon CEO Bezos, a lifelong space enthusiast, has been vying with Tesla Inc CEO Elon Musk and British billionaire Richard Branson to become the first billionaire to fly beyond the Earth’s atmosphere.

While insurers are well known for offering cover for even the most outlandish of risks, at a price, potential accidents in space are not yet among them.

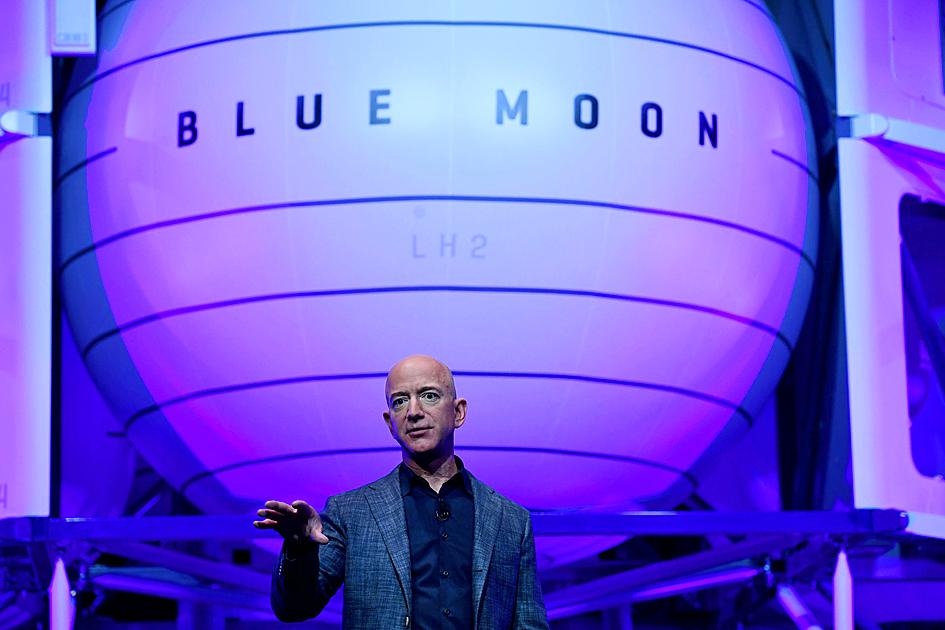

Photo: Reuters

“Space tourism involves significant risk, but is not an issue life insurers specifically ask about as yet because it is so rare for anyone to travel into space,” Insurance Information Institute spokesperson Michael Barry said.

There is a nearly US$500 million market to insure satellites, rockets and uncrewed space flight, but no legal requirement for an operator such as Blue Origin, which Bezos founded, to insure passengers for injury or death or for space tourists to have life cover, brokers and insurers said.

“We’re not aware of a case where anybody is insured against passenger liability,” said Neil Stevens, senior vice president, aviation and space at Marsh, the world’s biggest insurance broker.

Assuming they lift off as planned next month, Bezos and the other wannabe astronauts on Blue Origin’s New Shepard spacecraft would not only spend several minutes 100km above the Earth in a truck-sized capsule, they would also have to get back.

The only group that has regularly flown humans sub-orbitally since the 1960s is Branson’s Virgin Galactic. All have been tests, with one failure in 2014 resulting in a death. Blue Origin has flown 15 uncrewed sub-orbital flights with no failures, Seradata SpaceTrak data showed on June 10.

Bezos, Blue Origin and Virgin Galactic did not respond to requests for comment from Reuters on their insurance plans and flight records.

Being uninsured in space is nothing new. NASA and the US, in general, do not buy liability cover, with government launches basically insured by taxpayers, said Richard Parker of Assure Space, a unit of insurer AmTrust Financial that provides space insurance.

NASA astronauts are eligible for government life insurance programs, a NASA spokesperson said in an e-mailed response.

Charles Wetton, underwriting manager for space policies at insurer Global Aerospace, said astronauts on government-funded missions are carefully selected for their knowledge, skills and fitness and train for several years before blast off.

“They and their families understand the risks of the work they do,” Wetton said.

However, commercial space cadets may only get a few days of training for a sub-orbital flight or a few months for a ride to the International Space Station (ISS), Wetton said, adding: “These represent two very different risk profiles that insurers will take into account.”

Insurers expect ironclad waivers and contracts from commercial space travel firms, stating they will bear no burden if a passenger dies during a flight.

NASA has called for responses from the industry for its plans for a liability framework for privately funded astronaut missions to the ISS. NASA’s plans include requiring private astronauts to buy life insurance.

The only mandatory insurance in place for commercial space operators is third-party liability, mainly to cover property damage on Earth or to a flying aircraft, said Akiko Hama, client executive, space and aerospace underwriting at Global Aerospace.

A key question for how the sector develops is whether risks related to tourism fall under space or aviation insurance lines, insurers and brokers said.

The UN Outer Space Treaty and the Liability Convention of 1972 governs all activities in space and very few countries have a legal framework for commercial human spaceflight, they said.

“The aviation, aircraft insurance market, and the like, are less keen to take on risks that involve spacecraft,” Stevens said, adding that whether space tourism trips fall under aviation or space insurance is a “million dollar question.”

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)