As in the US, initial public offering (IPO) activity in Asia has had its strongest start to a year, but the frenzy for new shares is likely to taper off as demand falls back in the next few months.

Asian companies, like their global peers, notched their best first quarter for listings ever, thanks to a flood of liquidity during the COVID-19 pandemic, low interest rates and rallying stock markets.

Asian firms raised US$49.3 billion through IPOs at home and abroad — a 154 percent jump over the same period last year, data compiled by Bloomberg showed.

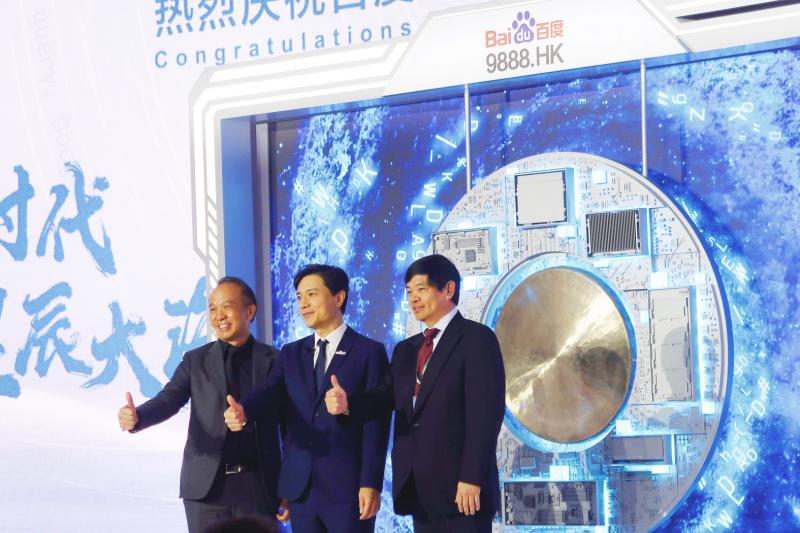

Photo: Reuters

IPOs globally raised an unprecedented US$215 billion, with almost half of that haul coming from the record wave of issuances by special-purpose acquisition companies (SPAC) in the US.

Now, a global rotation out of highly valued technology and healthcare stocks that have dominated market activity, as well as fading excitement around SPACs in the US, is clouding the outlook for new deals.

“Inevitably, there is a mark to market of comparable valuations,” said William Smiley, cohead of equity capital markets at Goldman Sachs Group Inc in Asia ex-Japan. “In terms of our pipeline, there hasn’t been any significant impact from the recent rotation, but opportunistic issuance may have decelerated.”

Asia’s IPO space faces an added challenge — the travails of Chinese technology firms, which dominate fundraising in the region.

These companies are facing a crackdown against monopolistic practices at home and are also in focus as US-China tensions rise. For instance, the US last month moved forward with a law that could result in Chinese firms that do not comply with US auditing standards being removed from stock exchanges in the US.

The red flags are already there, with the investor mania seen earlier this year for deals like the one by Chinese TikTok rival Kuaishou Technology (快手) starting to die down.

Chinese fintech company Bairong Inc (百融雲創), which raised US$507 million, delivered the worst debut in three years among Hong Kong IPOs valued at more than US$500 million when the shares fell 16 percent on Wednesday last week.

US-listed Chinese search giant Baidu Inc (百度) and streaming service Bilibili Inc (嗶哩嗶哩) last month raised a combined US$5.7 billion through secondary listings in Hong Kong, but had lackluster debuts.

In contrast, investors were seen scrambling for a piece of Kuaishou’s US$6.2 billion Hong Kong IPO, the biggest listing globally so far this year, and South Korean e-commerce giant Coupang Inc’s US$4.6 billion float.

That said, muted investor appetite for listings is not affecting other hopeful companies.

Online music company Tencent Music Entertainment Group (騰訊音樂娛樂), microblogging service Sina Weibo Corp (微博) and online travel service Trip.com Group Ltd (攜程) are among US-traded Chinese companies seeking so-called “homecoming” listings in Hong Kong.

These secondary listings, seen as a hedge against China-US tensions, last year raised US$17 billion in Hong Kong and have amassed US$6.4 billion so far this year.

“The secondary listing trend will continue, but what should be interesting to see is whether new issuers who ultimately want to get to a dual listing, perhaps consider seeking a dual primary listing in Hong Kong and the US from the start, rather than doing a primary US listing, waiting two years and then coming to Hong Kong for the secondary listing,” said Francesco Lavatelli, head of equity capital markets for Asia-Pacific at JPMorgan Chase & Co.

Technology and healthcare firms make up the bulk of the listing pipeline in Asia, bankers said, even without the “homecoming” cohort, many of whom opted for US listings because of the investor base’s greater familiarity with new economy stocks.

Among them is healthcare start-up WeDoctor (微醫), which is planning a multibillion Hong Kong IPO and Chinese start-up Full Truck Alliance Group (滿幫集團), which is looking into a US$1 billion US listing.

“The pipeline remains quite robust, but is centered around tech and growth stocks, which are obviously seeing a little bit of a re-rating,” said Tucker Highfield, cohead of equity capital markets for Asia-Pacific at Bank of America Corp. “The thesis of good companies being able to buck the trend of volatility will continue and there’s capital available.”

Ultimately, less frothy markets and a cooling of the IPO investor mania might actually be welcome.

“Entering a more balanced market environment isn’t a bad thing. It can extend the issuance cycle and work to keep excesses in check,” Smiley said. “If there is going to be correction, you want it to be fast — a prolonged downturn kills issuance.”

Real estate agent and property developer JSL Construction & Development Co (愛山林) led the average compensation rankings among companies listed on the Taiwan Stock Exchange (TWSE) last year, while contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) finished 14th. JSL Construction paid its employees total average compensation of NT$4.78 million (US$159,701), down 13.5 percent from a year earlier, but still ahead of the most profitable listed tech giants, including TSMC, TWSE data showed. Last year, the average compensation (which includes salary, overtime, bonuses and allowances) paid by TSMC rose 21.6 percent to reach about NT$3.33 million, lifting its ranking by 10 notches

Popular vape brands such as Geek Bar might get more expensive in the US — if you can find them at all. Shipments of vapes from China to the US ground to a near halt last month from a year ago, official data showed, hit by US President Donald Trump’s tariffs and a crackdown on unauthorized e-cigarettes in the world’s biggest market for smoking alternatives. That includes Geek Bar, a brand of flavored vapes that is not authorized to sell in the US, but which had been widely available due to porous import controls. One retailer, who asked not to be named, because

SEASONAL WEAKNESS: The combined revenue of the top 10 foundries fell 5.4%, but rush orders and China’s subsidies partially offset slowing demand Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) further solidified its dominance in the global wafer foundry business in the first quarter of this year, remaining far ahead of its closest rival, Samsung Electronics Co, TrendForce Corp (集邦科技) said yesterday. TSMC posted US$25.52 billion in sales in the January-to-March period, down 5 percent from the previous quarter, but its market share rose from 67.1 percent the previous quarter to 67.6 percent, TrendForce said in a report. While smartphone-related wafer shipments declined in the first quarter due to seasonal factors, solid demand for artificial intelligence (AI) and high-performance computing (HPC) devices and urgent TV-related orders

Prices of gasoline and diesel products at domestic fuel stations are this week to rise NT$0.2 and NT$0.3 per liter respectively, after international crude oil prices increased last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week snapped a two-week losing streak as the geopolitical situation between Russia and Ukraine turned increasingly tense, CPC said in a statement. News that some oil production facilities in Alberta, Canada, were shut down due to wildfires and that US-Iran nuclear talks made no progress also helped push oil prices to a significant weekly gain, Formosa said