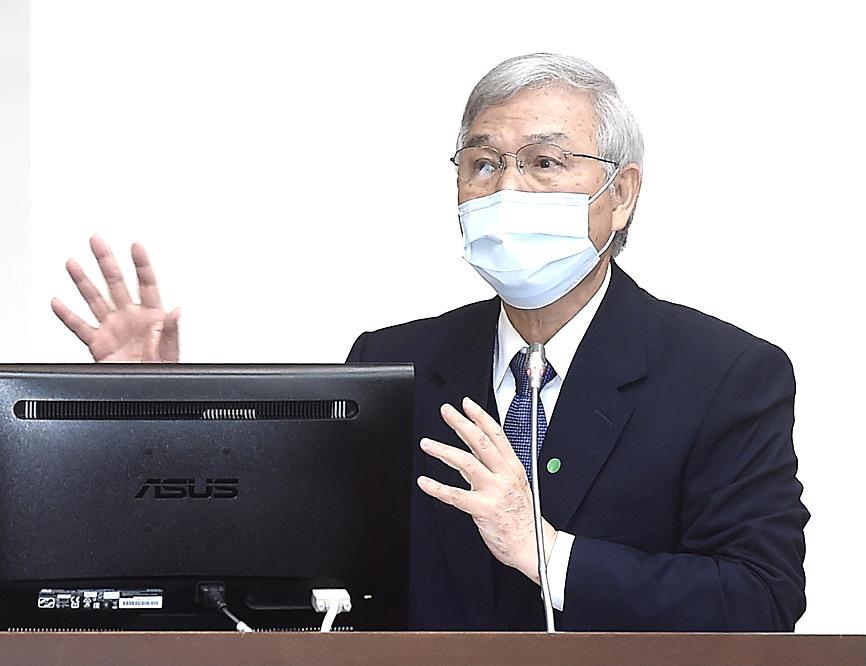

A huge increase in foreign-exchange interventions could lead to the US labeling Taiwan a currency manipulator, central bank Governor Yang Chin-long (楊金龍) said yesterday, but he added that the designation is unlikely to have any immediate negative impact on the nation’s export-dependent economy.

“It is possible that Taiwan might be listed as a manipulator,” Yang told lawmakers in Taipei as he delivered a report.

However, Yang said that the US’ criteria for labeling another economy a currency manipulator are no longer suitable, as the global economy has changed over the past year.

Photo: Chien Jung-fong, Taipei Times

Taiwan’s high-trade surplus with the US, one of the US Department of the Treasury’s three criteria, is due to strong demand from US companies for semiconductors, rather than any perceived unfair advantage Taiwan has gained from its currency intervention, Yang said.

“If they want to reduce our trade surplus with them, then we could just stop selling them our chips,” he told lawmakers. “But they need them.”

The central bank stepped up its intervention in markets in the second half of last year as it tried to stop the New Taiwan dollar from strengthening on the back of the booming economy and trade.

Although being listed as a manipulator by the US has no immediate or specific consequences, Yang said the central bank would discuss its interventions and trade surplus with US Treasury officials.

The central bank’s net currency purchases surged more than 600 percent to US$39.1 billion last year, according to the report Yang delivered to lawmakers.

That equals 5.8 percent of Taiwan’s GDP, according to Bloomberg calculations, well above the US Treasury’s 2 percent threshold. In 2019, the central bank reported net purchases of US$5.5 billion.

Yang said that capital inflows had slowed since mid-January.

The central bank reported conducting what it calls currency “smoothing” operations in January, but not in the past month, according to earlier statements.

The US Treasury has three criteria for listing an economy as a currency manipulator: a current-account surplus equivalent to 2 percent of GDP, a bilateral trade surplus of at least US$20 billion and “persistent, one-sided” foreign-exchange interventions worth at least 2 percent of GDP.

Taiwan was added to the currency watch list in the latest US report in December last year, but was not listed a currency manipulator.

The US cited the “persistently large” current account surplus of 10.9 percent of GDP in the year to June and a US$25 billion trade surplus with the US as reasons for its addition to the watch list.

Being designated a currency manipulator requires the US to engage with the perceived offender to address the imbalance.

Yang said the central bank would revise upward its economic growth forecast on Thursday next week, when the bank’s board of directors is set to meet at its quarterly meeting to decide if it is necessary to adjust the bank’s monetary policy.

The bank on Dec. 17 last year predicted the economy to expand 3.68 percent this year, while the Directorate-General of Budget, Accounting and Statistics on Feb. 20 upgraded the GDP growth forecast for this year to 4.64 percent, up from the previous forecast of 3.83 percent.

The nation’s economy has grown steadily and the inflation outlook remains mild, but Taiwan still faces potential external risks, such as the effectiveness of COVID-19 vaccines, fluctuations in global financial markets and uncertainties in the international trade environment, Yang said.

Additional reporting by staff writer

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the