US stocks on Friday ended lower, pulled down by uncertainty around a COVID-19 stimulus deal, while Tesla Inc shares jumped in heavy trading in anticipation of their addition to the S&P 500 next week.

All three major indices hit record highs at the opening before retreating. The S&P 500 technology index, which has led gains this week, was the biggest drag on the overall benchmark index.

Trading was heavy and volatile in shares of electric vehicle maker Tesla, which tomorrow is set to become the most valuable company to ever be added to Wall Street’s main benchmark index.

The stock was last up 6 percent and hit a record high. Turnover in Tesla shares topped US$120 billion shortly after 9pm GMT, with volume exceeding 200 million as the stock traded after hours, Refinitiv data showed.

“Tesla is sort of a New Age cult stock. There are people who love the product and who love the stock,” said Tim Ghriskey, chief investment strategist at Inverness Counsel in New York.

Investors could see further gains in the stock tomorrow, but possibly profit-taking after that, he said, adding that “a lot of people bought when the announcement” of the inclusion in the S&P 500 came out.

Market trading volumes were high also due to the expiration of stock index futures, stock index options, stock options and single-stock futures at the end of trade, also known as “quadruple witching.”

Volume on US exchanges was 15.8 billion shares, compared with the 11.6 billion average for the full session over the past 20 trading days.

The US Congress on Friday risked blowing through a midnight deadline to keep the government open and address the COVID-19 crisis, as a partisan fight over federal lending rules caused a fresh delay on a US$900 billion COVID-19 relief bill.

However, a last-minute agreement was struck to extend negotiations through the weekend. The House of Representatives voted 320 to 60 late on Friday to extend funding for federal agencies through today to allow negotiators to finish their stimulus package.

The US Senate quickly passed the measure by voice vote, and US President Donald Trump signed the bill hours before the deadline.

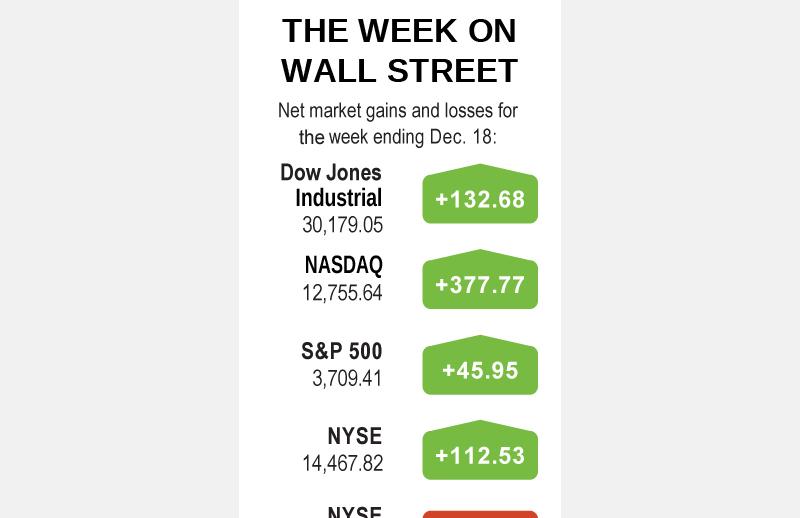

The Dow Jones Industrial Average fell 124.32 points, or 0.41 percent, to 30,179.05, the S&P 500 lost 13.07 points, or 0.35 percent, to 3,709.41 and the NASDAQ Composite dropped 9.11 points, or 0.07 percent, to 12,755.64.

For the week, the Dow was up 0.44 percent, the S&P 500 was up 1.25 percent and the NASDAQ gained 3.05 percent.

“Investors definitely want to see something come through or like to see something come through on the stimulus front sooner rather than later as COVID cases continue to rise and economic data has shown that it is beginning to deteriorate,” said Lindsey Bell, chief investment strategist at Ally Invest, in Charlotte, North Carolina.

The prospect of continued monetary and fiscal stimulus has helped stocks look past the economic impact of the COVID-19 pandemic, and set them up for strong annual gains, despite a rocky start to the year.

FedEx Corp fell 5.7 percent after it did not give an earnings forecast for next year, even as its quarterly profit almost doubled.

Declining issues outnumbered advancing ones on the NYSE by a 1.41-to-1 ratio; on the NASDAQ, a 1.26-to-1 ratio favored decliners.

The S&P 500 posted 40 new 52-week highs and no new lows; the NASDAQ Composite recorded 302 new highs and nine new lows.

Additional reporting by AFP

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that