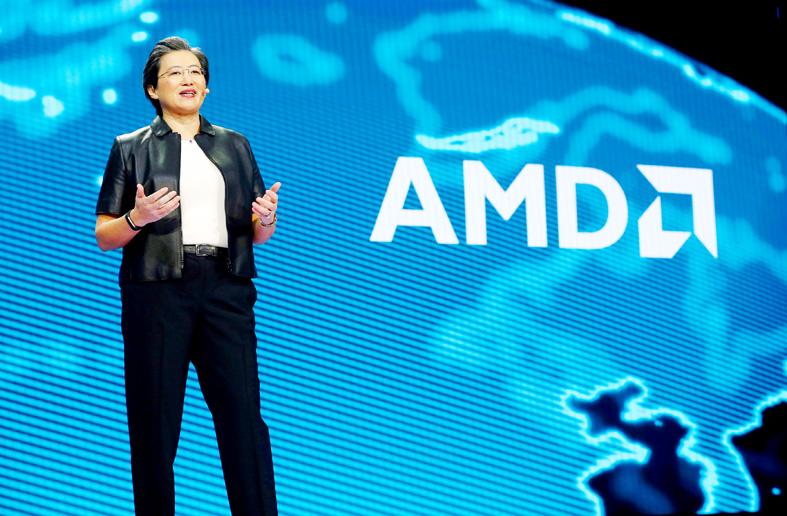

Advanced Micro Devices Inc (AMD) CEO Lisa Su (蘇姿丰) spent her first six years at the helm turning around the troubled chipmaker. She slashed debt, and oversaw products that launched on time and performed as advertised.

Now she is moving beyond cleanup to challenge Intel Corp for the lead in computer chips.

The 51-year-old engineer — among the few female CEOs in technology — on Tuesday unveiled a US$35 billion all-stock acquisition of Xilinx Inc, one of the largest chip deals ever.

Photo: Reuters

In interviews and conference calls, Su said that there are few limits to her ambition.

“We have an even bigger place in the industry over the next five years than we’ve had in the last five,” she said.

Since taking over in 2014, Su has erased AMD’s reputation as an accident-prone supplier of cheap processors struggling to survive in Intel’s shadow — something her predecessors failed to do.

Buying Xilinx, a maker of programmable silicon, would take AMD into new areas such as automotive and communications networking, while bolstering its offerings in the lucrative market for cloud data center components, analysts said.

If the transaction closes next year as planned, the company’s annual research-and-development budget would jump to more than US$2.7 billion, they added.

That is still small compared with Intel’s budget, but it is a crucial ingredient if AMD is to seriously challenge the industry’s leaders.

Born in Taiwan, Su graduated from the Bronx High School of Science in New York City and got her doctorate from the Massachusetts Institute of Technology. She worked at companies including Texas Instruments Inc and International Business Machines Corp, and in 2012 arrived at AMD as a senior vice president.

An early success was getting AMD chips in the dominant gaming consoles, Microsoft Corp’s Xbox One and Sony Corp’s PlayStation. Most of her progress has come from a methodical focus on meeting customer demands — a stark contrast to former AMD CEOs who were known for splashy product launches that often did not deliver.

While she has been involved in chip industry innovation, Su dislikes portrayals of her as a lab-bound technical genius, describing herself as an OK engineer, and saying that one of her main skills is the ability to understand engineers and help them make the best high-level decisions, not do the work for them.

In her usual practical fashion, she presented the Xilinx deal to investors as a transaction that would improve AMD’s finances first and then transition the combined company to future technical leadership.

“I haven’t talked a lot about M&A [mergers and acquisitions] because I didn’t think there was a need to do M&A for M&A’s sake,” she said. “This is about what’s the next step for AMD and Xilinx is the best franchise in the industry.”

Su wants her company to be more than just another supplier of components. She sees Xilinx helping AMD set the industry’s agenda by defining new technology, something that has mostly been the preserve of Intel in computing for half a century.

Getting to this position has not been easy. When Su took the top job, she was AMD’s fourth CEO in a decade. The company had lost money in six of those 10 years as products either launched late, performed below expectations or had to be fixed later.

One of her biggest decisions in 2018 has helped Su keep her promises and set the stage for AMD’s next chapter. The company outsourced production of its best chips to Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). Soon after, TSMC overtook Intel in production technology. Now AMD’s processors are often as capable as Intel’s — sometimes better. When she announced the Xilinx agreement, Su was careful to point out that her acquisition target also relies on TSMC’s production prowess.

Intel is going through an unprecedented series of stumbles with its once peerless manufacturing. It has only just started shipping large numbers of 10-nanometer chips, more than three years late. AMD and its customers are already enjoying the benefits — price, performance and power efficiency — of more advanced 7-nanometer manufacturing.

That type of technical leadership helped persuade Xilinx CEO Victor Peng (彭明博) to join Su.

“We had a great path as a standalone company,” said Peng, who is to become AMD president and continue to run the Xilinx business. “We looked at the landscape and we thought about this carefully. This is about choosing to be part of an even greater company — which is AMD.”

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received