Softbank Group Corp plans to keep a stake in the chip designer Arm Ltd, even if it sells a partial interest to Nvidia Corp, the Nikkei reported.

The companies are negotiating terms, the newspaper reported, citing sources.

Softbank might take a stake in Nvidia after it buys Arm, the report said.

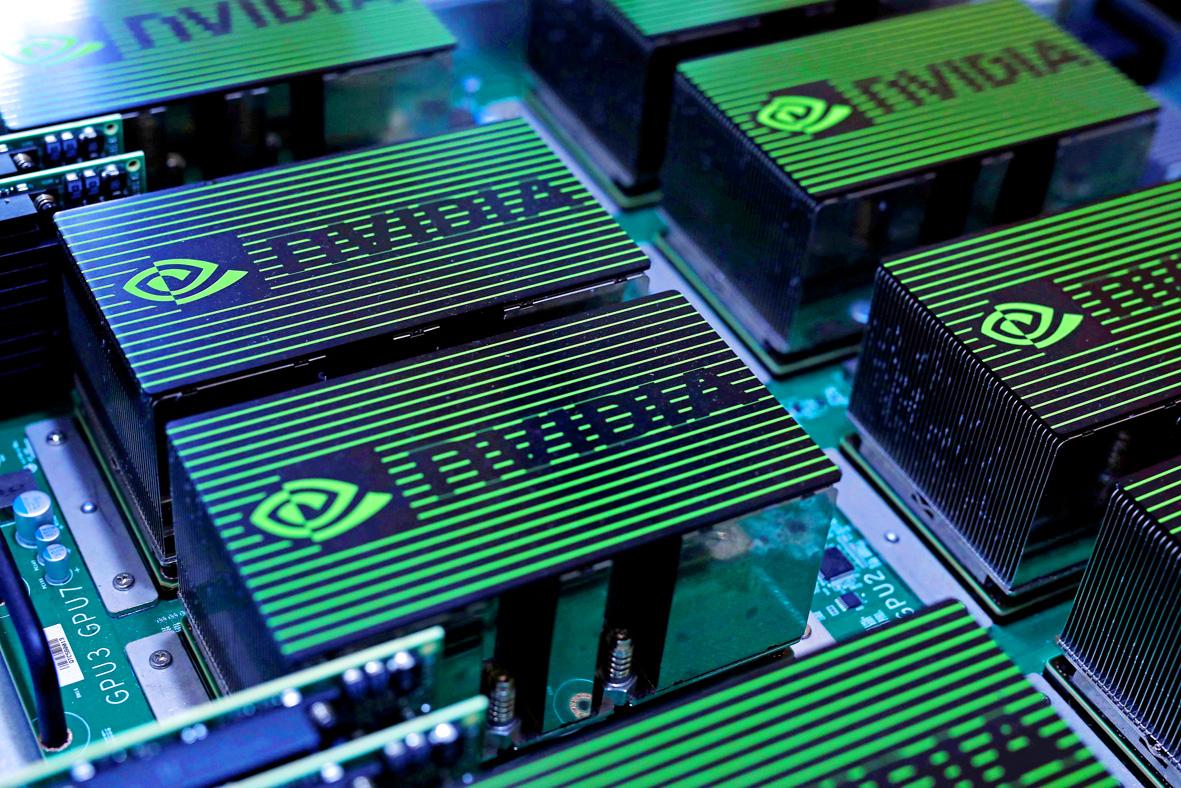

Photo: Reuters

Nvidia and Arm might also merge through a share swap, and Softbank would become a major shareholder in the combined company, it said.

The two parties aim to reach a deal in the next few weeks, the sources said, asking not to be identified because the information is private.

Nvidia is the only suitor in concrete discussions with Softbank, the sources said.

A deal for Arm could be the largest ever in the semiconductor industry, which has been consolidating in the past few years as companies seek to diversify and add scale.

However, any deal with Nvidia, which is a customer of Arm, would likely trigger regulatory scrutiny, as well as a wave of opposition from other users.

Cambridge, England-based Arm’s technology underpins chips that are crucial to most modern electronics, including those that dominate the smartphone market, an area in which Nvidia has failed to gain a foothold.

Customers including Apple Inc, Qualcomm Inc, Advanced Micro Devices Inc (AMD) and Intel Corp could demand assurances that a new owner would continue providing equal access to Arm’s instruction set.

Such concerns resulted in Softbank, a neutral company, buying Arm the last time it was for sale. It bought Arm for US$32 billion four years ago.

No final decisions have been made, and the negotiations could drag on longer or fall apart, the sources said.

Representatives for Nvidia, Softbank and Arm declined to comment.

“With Nvidia’s low-cost fabless model enabling it to focus on R&D, engineering and programming, the fit with Arm would be perfect,” Mirabaud Securities Ltd analyst Neil Campling said.

Nvidia is the largest maker of graphics processing units (GPU) and it is spreading the use of the gaming component into new areas such as artificial intelligence processing in data centers and self-driving vehicles.

Marrying its own capabilities with central processing units (CPU) designed by Arm could enable it to take on Intel and AMD in a more comprehensive way, Rosenblatt Securities Inc analyst Hans Mosesmann said.

He said that Nvidia would have to pay an estimated US$55 billion for Arm.

“You need control of both CPU and GPU roadmaps and this, of course, includes data centers,” he wrote in a note on Friday. “Strategically, Nvidia needs a scalable CPU that can be integrated into its GPU roadmap, as is the case with AMD and Intel.”

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new