A short-selling ban on the local bourse is to be removed from today, as the COVID-19 situation in Taiwan has steadily improved and local equity markets have stabilized, the Financial Supervisory Commission (FSC) announced yesterday.

The short-selling ban was implemented on March 19, when the TAIEX tumbled 5.83 percent to 8,681.34 points, the lowest in 42 months, due to fears over the spread of the coronavirus worldwide.

The ban targeted stocks on the Taiwan Stock Exchange (TWSE) and the Taipei Exchange (TPEX) that showed a decline of 3.5 percent or more on March 18.

The commission had planned to end the ban on Friday next week, but decided to relax it earlier as the TAIEX and the TPEX have recovered to where they were before the outbreak, Securities and Futures Bureau Deputy Director-General Tsai Li-ling (蔡麗玲) told a news conference in New Taipei City yesterday.

The TAIEX yesterday rose 0.23 percent to close at 11,637.11 points, compared with 11,970.63 points five months earlier, while the TPEX dipped 0.04 percent to 154.56 points, compared with 146.57 points five months earlier.

“We banned short-selling in March in a bid to curb speculative trading amid irrational declines on the stock market, but we have not seen panic selling for a while, which is why we think it is time to let the trading mechanism return to normal,” Tsai said.

Some European securities regulators, which had imposed a tighter ban than in Taiwan by prohibiting short-selling of any stock, removed their bans last month due to less-turbulent markets, she said.

Some analysts thought the ban would generate fear among investors instead of stabilizing the market, but the move helped keep the market from diving, while the slowing of the outbreak and rebounding businesses also helped maintain investor confidence, Tsai said.

Average daily market turnover was NT$110 billion (US$3.69 billion) in April and NT$115 billion last month on the Taiwan Stock Exchange, up from NT$92 billion in February, suggesting that the ban did not negatively affect turnover, she added.

“Although the regulator canceled the ban today, it is not likely that many investors will immediately begin to short-sell stocks tomorrow, as many listed companies are holding their shareholders’ meetings and investors will prefer to take a wait-and-see approach for the moment,” Moore Securities Investment Consulting Co Ltd (摩爾證券投資顧問) analyst Chang Chih-cheng (張志誠) said by telephone.

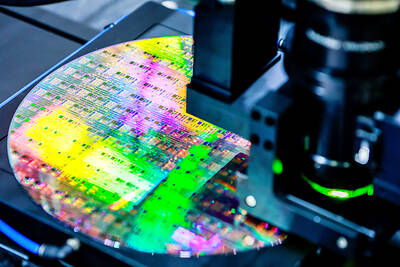

TECH TITAN: Pandemic-era demand for semiconductors turbocharged the nation’s GDP per capita to surpass South Korea’s, but it still remains half that of Singapore Taiwan is set to surpass South Korea this year in terms of wealth for the first time in more than two decades, marking a shift in Asia’s economic ranks made possible by the ascent of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). According to the latest forecasts released on Thursday by the central bank, Taiwan’s GDP is expected to expand 4.55 percent this year, a further upward revision from the 4.45 percent estimate made by the statistics bureau last month. The growth trajectory puts Taiwan on track to exceed South Korea’s GDP per capita — a key measure of living standards — a

Samsung Electronics Co shares jumped 4.47 percent yesterday after reports it has won approval from Nvidia Corp for the use of advanced high-bandwidth memory (HBM) chips, which marks a breakthrough for the South Korean technology leader. The stock closed at 83,500 won in Seoul, the highest since July 31 last year. Yesterday’s gain comes after local media, including the Korea Economic Daily, reported that Samsung’s 12-layer HBM3E product recently passed Nvidia’s qualification tests. That clears the components for use in the artificial intelligence (AI) accelerators essential to the training of AI models from ChatGPT to DeepSeek (深度求索), and finally allows Samsung

Taiwan has imposed restrictions on the export of chips to South Africa over national security concerns, taking the unusual step of using its dominance of chip markets to pressure a country that is closely allied with China. Taiwan requires preapproval for the bulk of chips sold to the African nation, the International Trade Administration said in a statement. The decision emerged after Pretoria tried to downgrade Taipei’s representative office and force its move to Johannesburg from Pretoria, the Ministry of Foreign Affairs has said. The move reflects Taiwan’s economic clout and a growing frustration with getting sidelined by Beijing in the diplomatic community. Taiwan

READY TO HELP: Should TSMC require assistance, the government would fully cooperate in helping to speed up the establishment of the Chiayi plant, an official said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said its investment plans in Taiwan are “unchanged” amid speculation that the chipmaker might have suspended construction work on its second chip packaging plant in Chiayi County and plans to move equipment arranged for the plant to the US. The Chinese-language Economic Daily News reported earlier yesterday that TSMC had halted the construction of the chip packaging plant, which was scheduled to be completed next year and begin mass production in 2028. TSMC did not directly address whether construction of the plant had halted, but said its investment plans in Taiwan remain “unchanged.” The chipmaker started