First-year premium income from online insurance polices sold in January skyrocketed 115 percent year-on-year, as insurers’ new product designs and improved user experience begin to bear fruit, the Financial Supervisory Commission (FSC) said yesterday.

“As it is usually more convenient, faster and costs less to purchase insurance online than buying from conventional channels, local consumers are getting used to buying insurance online,” Insurance Bureau Deputy Director-General Chang Yu-hui (張玉煇) told a news conference.

Online policy sales by 17 life insurers in January totaled NT$202.5 million (US$6.55 million), with 37,657 policies sold, Chang said.

Interest-sensitive annuity was the most popular product, generating revenue of NT$191 million, as its returns are usually higher than that of bank deposits, but it bears less risk than investment-linked insurance, the commission said.

Travel accident insurance ranked second in terms of popularity, generating NT$9.1 million over the period, followed by NT$880,000 made from endowment assurance, commission data showed.

Endowment assurance pays the full sum assured to the beneficiaries if the insured dies during the policy term, or to the insured if they survive, it said.

Cathay Life Insurance Co (國泰人壽) was the most successful, reporting sales totaling NT$76.23 million, followed by Fubon Life Insurance Co’s (富邦人壽) revenue of NT$73.44 million and Taiwan Life Insurance Co (台灣人壽保險), which booked sales of NT$21.6 million, the commission said.

Fifteen property insurers sold a total of 79,442 policies, generating NT$111.36 million in premiums, with automobile policy premiums totaling NT$58.72 million, motorcycle policy premiums totaling NT$26.25 million and travel accident insurance policy premiums tallying NT$24.49 million, it said.

Fubon Life led the way in terms of revenue with NT$40.34 million, followed by the NT$23.25 million reported by Tokio Marine Newa Insurance Corp (新安東京海上產險) and MSIG Mingtai Insurance Co’s (明台產險) NT$11.62 million, it added.

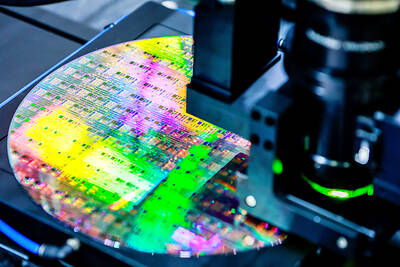

TECH TITAN: Pandemic-era demand for semiconductors turbocharged the nation’s GDP per capita to surpass South Korea’s, but it still remains half that of Singapore Taiwan is set to surpass South Korea this year in terms of wealth for the first time in more than two decades, marking a shift in Asia’s economic ranks made possible by the ascent of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). According to the latest forecasts released on Thursday by the central bank, Taiwan’s GDP is expected to expand 4.55 percent this year, a further upward revision from the 4.45 percent estimate made by the statistics bureau last month. The growth trajectory puts Taiwan on track to exceed South Korea’s GDP per capita — a key measure of living standards — a

Samsung Electronics Co shares jumped 4.47 percent yesterday after reports it has won approval from Nvidia Corp for the use of advanced high-bandwidth memory (HBM) chips, which marks a breakthrough for the South Korean technology leader. The stock closed at 83,500 won in Seoul, the highest since July 31 last year. Yesterday’s gain comes after local media, including the Korea Economic Daily, reported that Samsung’s 12-layer HBM3E product recently passed Nvidia’s qualification tests. That clears the components for use in the artificial intelligence (AI) accelerators essential to the training of AI models from ChatGPT to DeepSeek (深度求索), and finally allows Samsung

Taiwan has imposed restrictions on the export of chips to South Africa over national security concerns, taking the unusual step of using its dominance of chip markets to pressure a country that is closely allied with China. Taiwan requires preapproval for the bulk of chips sold to the African nation, the International Trade Administration said in a statement. The decision emerged after Pretoria tried to downgrade Taipei’s representative office and force its move to Johannesburg from Pretoria, the Ministry of Foreign Affairs has said. The move reflects Taiwan’s economic clout and a growing frustration with getting sidelined by Beijing in the diplomatic community. Taiwan

READY TO HELP: Should TSMC require assistance, the government would fully cooperate in helping to speed up the establishment of the Chiayi plant, an official said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said its investment plans in Taiwan are “unchanged” amid speculation that the chipmaker might have suspended construction work on its second chip packaging plant in Chiayi County and plans to move equipment arranged for the plant to the US. The Chinese-language Economic Daily News reported earlier yesterday that TSMC had halted the construction of the chip packaging plant, which was scheduled to be completed next year and begin mass production in 2028. TSMC did not directly address whether construction of the plant had halted, but said its investment plans in Taiwan remain “unchanged.” The chipmaker started