Moscow real-estate executives Boris Azarenko and Denis Kitaev should write the UK Home Office a thank-you note.

Their company — luxury apartment developer Vesper — is seeing a pickup in demand from wealthy Russians, as British measures against money laundering block many from London, once their favorite city.

In one way, Russian President Vladimir Putin is also a winner from the UK’s efforts as well as international sanctions imposed over Russia’s annexation of Crimea, the poisoning of former spy Sergei Skripal and his daughter in England, and Russian meddling in US elections in 2016.

Putin for years has called for rich Russians to bring their assets back home. Wealthy Russians have over the past two decades been major buyers of property in Paris, London, New York and other international cities.

Now there are signs that sanctions and tightened money-laundering measures are having some effect. Last year, there were more than 1,000 luxury property sales in Moscow, up from 790 in 2017, totaling more than 77 billion rubles (US$1.17 billion), according to broker Knight Frank.

Luxury property markets in Moscow have held up well even as the economy has been in the doldrums since sanctions and demand for real estate in other global cities has cooled.

“If previously we had some kind of dogma that a wealthy person needs a house in London or New York, now it’s not a rare proposal from our clients to take their property in Chelsea as partial payment for a new apartment in Moscow,” said Azarenko, 41, the general director of Vesper, the biggest developer of luxury property in Moscow.

Russia has plenty of rich people. There are at least 189,500 ultra-high net worth individuals in the country controlling about US$1.1 trillion, according to Capgemini estimates.

It is also incredibly unequal. There are 26 Russians on the Bloomberg Billionaires Index, a ranking of the world’s 500 wealthiest people, worth about a combined US$271 billion.

While Vesper builds new properties, such as its Brodsky building, most of its projects are massive renovations of Czarist-era properties. It redesigns them inside and out, and adds amenities like built-in saunas, gyms, underground parking garages, and ornate, secure lobbies. Most of the buildings are in prime locations in the center of Moscow.

Vesper favors naming the properties after Russian writers. Bulgakov House is near Patriarch’s Ponds, the setting for the opening chapters of Mikhail Bulgakov’s novel The Master and Margarita; the Chekhov building is near the Chekhov Metro Station.

The six-story Nabokov, another newly built property, is named after writer Vladimir Nabokov, an avid butterfly collector, and features 150 brightly colored glass butterflies on the ceiling of the lobby.

The vast white cube in the center of Moscow is covered in 42,800 bars of Portuguese limestone, and has 14 units and a penthouse.

Vesper has created more than 103,000m2 of new residential space in the past three years. Azarenko shares the business, which was founded in 2010 and had 12.6 billion rubles of revenue last year, with Kitaev, 41.

The partners’ strategy is typically to acquire century-old buildings cheaply and turn them into ready-to-move-in apartments, which is a new idea for Moscow. Gulrich House, an old mansion built in the early 20th-century by Gustav Gulrich in the heart of Moscow, was first renovated in this way.

The Nabokov, one of Vesper’s recent projects, was built from scratch.

Priced at 1.9 million rubles per square meter, the apartments in Nabokov are about 10 percent cheaper than similar properties in Manhattan.

Azarenko said that prices have not changed much in dollar terms since sanctions were imposed in 2014, while the ruble has depreciated by about 50 percent since that time.

He added that buyers from information technologies, pharmaceuticals and agriculture have increasingly expressed interest, after the Russian government imposed measures limiting imports from Western countries in some of these industries.

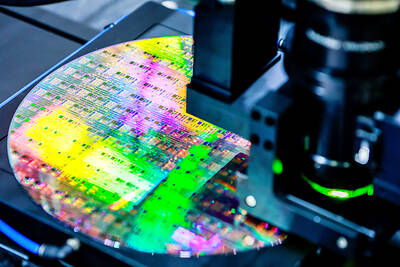

TECH TITAN: Pandemic-era demand for semiconductors turbocharged the nation’s GDP per capita to surpass South Korea’s, but it still remains half that of Singapore Taiwan is set to surpass South Korea this year in terms of wealth for the first time in more than two decades, marking a shift in Asia’s economic ranks made possible by the ascent of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). According to the latest forecasts released on Thursday by the central bank, Taiwan’s GDP is expected to expand 4.55 percent this year, a further upward revision from the 4.45 percent estimate made by the statistics bureau last month. The growth trajectory puts Taiwan on track to exceed South Korea’s GDP per capita — a key measure of living standards — a

Samsung Electronics Co shares jumped 4.47 percent yesterday after reports it has won approval from Nvidia Corp for the use of advanced high-bandwidth memory (HBM) chips, which marks a breakthrough for the South Korean technology leader. The stock closed at 83,500 won in Seoul, the highest since July 31 last year. Yesterday’s gain comes after local media, including the Korea Economic Daily, reported that Samsung’s 12-layer HBM3E product recently passed Nvidia’s qualification tests. That clears the components for use in the artificial intelligence (AI) accelerators essential to the training of AI models from ChatGPT to DeepSeek (深度求索), and finally allows Samsung

Taiwan has imposed restrictions on the export of chips to South Africa over national security concerns, taking the unusual step of using its dominance of chip markets to pressure a country that is closely allied with China. Taiwan requires preapproval for the bulk of chips sold to the African nation, the International Trade Administration said in a statement. The decision emerged after Pretoria tried to downgrade Taipei’s representative office and force its move to Johannesburg from Pretoria, the Ministry of Foreign Affairs has said. The move reflects Taiwan’s economic clout and a growing frustration with getting sidelined by Beijing in the diplomatic community. Taiwan

READY TO HELP: Should TSMC require assistance, the government would fully cooperate in helping to speed up the establishment of the Chiayi plant, an official said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said its investment plans in Taiwan are “unchanged” amid speculation that the chipmaker might have suspended construction work on its second chip packaging plant in Chiayi County and plans to move equipment arranged for the plant to the US. The Chinese-language Economic Daily News reported earlier yesterday that TSMC had halted the construction of the chip packaging plant, which was scheduled to be completed next year and begin mass production in 2028. TSMC did not directly address whether construction of the plant had halted, but said its investment plans in Taiwan remain “unchanged.” The chipmaker started