The supply of high-end NOR flash memory chips is to remain tight for the remainder of the year due to growing demand from the medical, automotive and industrial segments, memorychip maker Macronix International Co (旺宏電子) said on Thursday.

The Hsinchu-based chipmaker’s comments came amid growing concern that a supply surfeit is looming that would drag down chip prices next quarter.

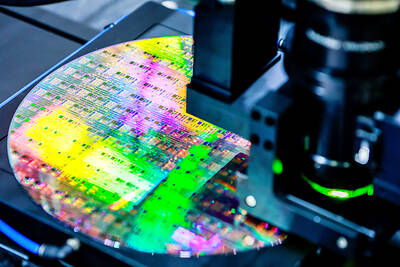

Macronix is the world’s biggest supplier of NOR flash memory chips.

Market researcher TrendForce Corp (集邦科技) last month said that PC DRAM chip prices would likely fall 2 percent quarterly in the final quarter of this year, ending nine quarters of price hikes, while prices of NAND flash memory chips might face a steeper quarter-on-quarter decline of 10 percent.

“Generally speaking, low-quality and low-density [NOR flash memory chips] will continue to be under oversupply pressure. However, high-quality and high-density [chips] will be in short supply for the rest of this year,” Macronix chairman Miin Wu (吳敏求) told reporters on Thursday.

Marconix has focused on manufacturing high-density and high-quality memory chips in a bid to fend off competition from Chinese latecomers.

“It takes longer for automotive components to go through the whole qualification process, as those components will later be used in cars for about 20 years,” Wu said. “However, as long as the company enters the [supply chain], it will be a stable business.”

Macronix’s long-term efforts have gained traction, as NOR flash memory chips used in the automotive, medical and industrial segments contributed 26 percent to its total NOR flash memory revenue in the second quarter, compared with 12 percent a year earlier, company data showed.

The revenue contribution from those three segments would continue to rise in the foreseeable future, as a growing number of memory chips are equipped in a wider range of medical devices, such as blood sugar monitoring devices, and in vehicles, Wu said.

Commenting on an escalating US-China trade war, Wu said that the company has found that some clients were considering moving their production lines back to Taiwan or to Southeast Asian nations to circumvent US tariffs.

US President Donald Trump on Monday said that the US would impose 10 percent tariffs on US$200 billion of Chinese imports, on top of 25 percent tariffs already levied against about US$50 billion of Chinese goods.

Trump also threatened to tax all imports from China to the US.

The trade dispute between the world’s two largest economies would dampen consumer demand to some extent, which might indirectly affect Macronix’s business in the second half of the year, Wu said.

Normally, revenue in the second half of the year accounts for 60 percent of the company’s total annual revenue, but this year’s amount might be a little lower, he said, citing uncertainty due to the trade war.

TECH TITAN: Pandemic-era demand for semiconductors turbocharged the nation’s GDP per capita to surpass South Korea’s, but it still remains half that of Singapore Taiwan is set to surpass South Korea this year in terms of wealth for the first time in more than two decades, marking a shift in Asia’s economic ranks made possible by the ascent of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). According to the latest forecasts released on Thursday by the central bank, Taiwan’s GDP is expected to expand 4.55 percent this year, a further upward revision from the 4.45 percent estimate made by the statistics bureau last month. The growth trajectory puts Taiwan on track to exceed South Korea’s GDP per capita — a key measure of living standards — a

Samsung Electronics Co shares jumped 4.47 percent yesterday after reports it has won approval from Nvidia Corp for the use of advanced high-bandwidth memory (HBM) chips, which marks a breakthrough for the South Korean technology leader. The stock closed at 83,500 won in Seoul, the highest since July 31 last year. Yesterday’s gain comes after local media, including the Korea Economic Daily, reported that Samsung’s 12-layer HBM3E product recently passed Nvidia’s qualification tests. That clears the components for use in the artificial intelligence (AI) accelerators essential to the training of AI models from ChatGPT to DeepSeek (深度求索), and finally allows Samsung

Taiwan has imposed restrictions on the export of chips to South Africa over national security concerns, taking the unusual step of using its dominance of chip markets to pressure a country that is closely allied with China. Taiwan requires preapproval for the bulk of chips sold to the African nation, the International Trade Administration said in a statement. The decision emerged after Pretoria tried to downgrade Taipei’s representative office and force its move to Johannesburg from Pretoria, the Ministry of Foreign Affairs has said. The move reflects Taiwan’s economic clout and a growing frustration with getting sidelined by Beijing in the diplomatic community. Taiwan

READY TO HELP: Should TSMC require assistance, the government would fully cooperate in helping to speed up the establishment of the Chiayi plant, an official said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said its investment plans in Taiwan are “unchanged” amid speculation that the chipmaker might have suspended construction work on its second chip packaging plant in Chiayi County and plans to move equipment arranged for the plant to the US. The Chinese-language Economic Daily News reported earlier yesterday that TSMC had halted the construction of the chip packaging plant, which was scheduled to be completed next year and begin mass production in 2028. TSMC did not directly address whether construction of the plant had halted, but said its investment plans in Taiwan remain “unchanged.” The chipmaker started