US stocks edged higher on Friday as technology companies and banks rose. The S&P 500 closed above 2,500 for the first time as stocks had one of their best weeks this year.

Stocks wobbled in early trading after the US Department of Commerce said retail sales slipped last month and the US Federal Reserve said industrial production dropped last month, mostly because of Hurricane Harvey.

However, big names such as Apple Inc and Boeing Co took the market higher.

Stocks made big gains on Monday as Hurricane Irma weakened and they did not do too much after that, but still wound up with their biggest weekly gain since the beginning of January.

Rick Rieder, the chief investment officer for BlackRock Inc’s global fixed income business, said retail sales and inflation have been weak because technological changes keep reducing the prices of clothes, food, travel and mobile phone plans.

That lowers measurements of sales revenue, such as the one the government released on Friday, but he said they keep people buying — even though the same technological changes can also lower people’s wages.

“We get everything cheaper than we used to because of the Internet and delivery mechanisms,” Rieder said. “The price is coming down so quickly that it’s helping demand.”

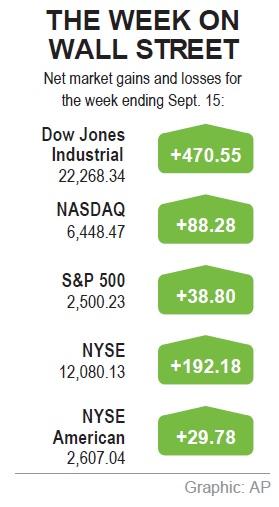

The S&P 500 on Friday gained 4.61 points, or 0.2 percent, to a record 2,500.23, an increase of 1.6 percent from 2,461.43 on Sept. 8.

The Dow Jones Industrial Average on Friday rose 64.86 points, or 0.3 percent, to end at 22,268.34, its fourth record close in a row and up 2.2 percent from a close of 21,797.79 a week earlier.

The NASDAQ Composite added 19.38 points, or 0.3 percent, to close at 6,448.47, rising 1.4 percent from 6,360.19 on Sept. 8.

The Russell 2000 index of smaller company stocks picked up 6.69 points, or 0.5 percent, to end at 1,431.71, an increase of 2.3 percent from 1,399.43 a week earlier.

Industrial production in the US last month fell 0.9 percent, the biggest drop in eight years, as Harvey knocked numerous oil refining, plastics and chemicals factories out of business for a time. Many of those factories are based in the Gulf Coast region that Harvey hit.

The Fed said the weather and flooding was responsible for almost all of the loss.

Apple picked up US$1.60, or 1 percent, to US$159.88 after three days of declines.

Chipmaker Nvidia Corp jumped US$10.71, or 6.3 percent, to US$180.11 and hard drive maker Western Digital Corp gained US$2.73, or 3.2 percent, to US$88.52.

Shares of software maker Oracle Corp absorbed their biggest loss in four years. The company’s first-quarter profit and sales were better than investors expected, but analysts were concerned about forecasts for its cloud-computing business. Oracle lost US$4.05, or 7.7 percent, to US$48.74.

Boeing rose US$3.77, or 1.5 percent, to US$249 as the aerospace company continued to set record highs. Its stock is up 60 percent this year.

Credit monitoring companies continued to fall as US Senate Democrats introduced a bill that would prevent the companies from charging fees to consumers who want their credit frozen.

In many states, the companies collect fees in return for freezing accounts.

Some consumers have chosen to freeze their credit after Equifax Inc said the personal information of 143 million Americans was exposed after a breach of its systems. They are trying to prevent identity thieves from using their information to open fraudulent accounts.

Equifax fell US$3.68, or 3.8 percent, to a two-year low of US$92.98. The stock began plunging on Sept. 8 after the company disclosed the breach, and this week it took its biggest weekly loss since the end of 1998.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors