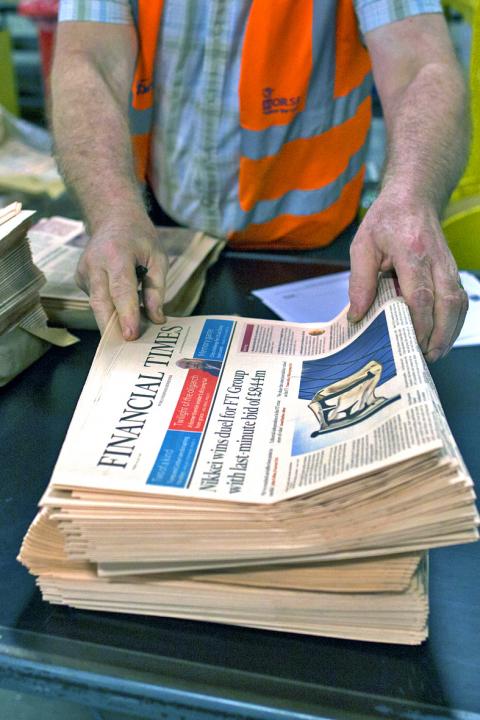

Japanese media group Nikkei Inc has agreed to buy the Financial Times (FT) from Britain’s Pearson PLC for US$1.3 billion, putting one of the world’s premier business newspapers in the hands of a company influential at home, but little known outside Japan.

The deal, struck after Nikkei beat Germany’s Axel Springer AG to the prize, marks the biggest acquisition by a Japanese media organization and is a coup for the employee-owned firm, which lends its name to the main Japanese stock market index.

In the Financial Times it has acquired an authoritative global newspaper that commands strong loyalty from its readers and has coped better than others with the shift to online publishing. It was one of the first newspapers to successfully charge for access to its Web site.

Photo: Bloomberg

Established in 1884 and first printed on pink paper in 1893 to stand out from rivals, the FT has employed some of the leading figures in media and politics, including News Corp CEO Robert Thomson, former British chancellor of the exchequer Nigel Lawson and Ed Balls, an adviser to former British prime minister Gordon Brown.

“I am extremely proud of teaming up with the Financial Times, one of the most prestigious news organizations in the world,” Nikkei group chairman and CEO Tsuneo Kita said. “We share the same journalistic values.”

The Nikkei Shimbun, which has a circulation surpassing 3 million for its morning edition alone, enjoys a must-read reputation for financial and business news in Japan, but has struggled to break out of its home market.

The paper, with its deep ties to corporate Japan, has also faced criticism for running earnings “previews,” which are considered to be leaks, days ahead of corporate results at a time when Japanese Prime Minister Shinzo Abe’s government has been pushing for greater corporate transparency.

As the news broke of the Nikkei deal, an FT journalist tweeted a photograph showing staff in their newsroom crowded around a television watching the developments.

According to tweets from journalists who were addressed by the paper’s management, FT editor Lionel Barber told staff the deal “was not and is not a shotgun marriage,” saying there had been hours of conversation.

Reporters at the paper told Reuters there was some apprehension, as they knew very little about their new owner, but there was also relief they had not been bought by Bloomberg — another potential buyer — which could have resulted in duplication of staff roles and more potential job cuts.

Chief executive John Fallon told reporters he believed that like Pearson, the new owner had a commitment to the “fairness and accuracy of its reporting, and to the integrity and independence of its journalism.”

The sale of the FT Group is expected to close during the fourth quarter of this year and does not include its 50 percent stake in The Economist magazine or the London headquarters of the newspaper on the banks of the River Thames.

“It is hard to argue with the price,” said Richard Marwood, senior fund manager at AXA Investment Managers, a shareholder in Pearson.

Barclays said the price represented a multiple of 35 times earnings before interest, tax and appreciation.

The sale will leave Pearson as the world leader in education publishing and the owner of a 47 percent stake in the Penguin Random House book publisher.

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

STABLE DEMAND: Delta supplies US clients in the aerospace, defense and machinery segments, and expects second-half sales to be similar to the first half Delta Electronics Inc (台達電) expects its US automation business to remain steady in the second half, with no signs of weakening client demand. With demand from US clients remaining solid, its performance in the second half is expected to be similar to that of the first half, Andy Liu (劉佳容), general manager of the company’s industrial automation business group, said on the sidelines of the Taiwan Automation Intelligence and Robot Show in Taipei on Wednesday. The company earlier reported that revenue from its automation business grew 7 percent year-on-year to NT$27.22 billion (US$889.98 million) in the first half, accounting for 11 percent

A German company is putting used electric vehicle batteries to new use by stacking them into fridge-size units that homes and businesses can use to store their excess solar and wind energy. This week, the company Voltfang — which means “catching volts” — opened its first industrial site in Aachen, Germany, near the Belgian and Dutch borders. With about 100 staff, Voltfang says it is the biggest facility of its kind in Europe in the budding sector of refurbishing lithium-ion batteries. Its CEO David Oudsandji hopes it would help Europe’s biggest economy ween itself off fossil fuels and increasingly rely on climate-friendly renewables. While