The US dollar pushed its winning streak to seven straight months for the first time in a decade as a wave of easing by the world’s major central banks enhanced the appeal of US assets.

The euro posted its biggest monthly decline since September 2011 after the European Central Bank’s announcement of sovereign-bond purchases on Jan. 22. Russia’s ruble plunged after an unexpected interest-rate cut and Canadian dollar fell to an almost six-year low. Treasuries had the best January in 27 years. The US unemployment rate is forecast to remain at a more than six-year low before the Feb. 6 report as the Federal Reserve looks to tighten monetary policy.

“In a world where everyone’s easing policies, standing still is relative tightening,” Alan Ruskin, the global head of G-10 foreign exchange at Deutsche Bank AG, said in a telephone interview. “Traders will be reluctant to sell the US dollar on anything more than a day trade.”

The Bloomberg Dollar Spot Index, a gauge of the currency’s performance against 10 major peers, rose 3.3 percent in January to close at 1,167.89, its highest in data going back to 2004. It never before posted a seven-month winning streak.

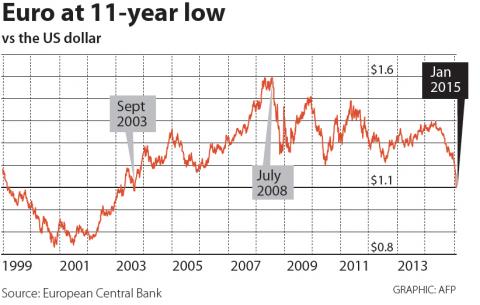

The greenback rose 6.7 percent to US$1.1291 per euro for a seventh month of gains.

The yen strengthened 1.9 percent to break a six-month skid versus the greenback.

The shekel was the biggest gainer of the dollar’s 31 major peers this week, rising 2 percent, after the Bank of Israel held its benchmark rate at a record low. The ruble was the biggest loser, sliding to its weakest since December after Russia’s central bank cut the benchmark rate from an 11-year high.

Canada’s dollar fell for a 10th week, the longest stretch since 2000, after the Bank of Canada last week surprised markets by reducing its benchmark rate for the first time since 2010 to counter “the recent sharp drop in oil prices,” the nation’s largest export. New Zealand’s dollar touched a more than three-year low as the central bank shifted its policy bias to neutral, saying the currency remains unjustifiably and unsustainably high.

The euro declined versus 14 of its 16 major counterparts in January and touched an 11-year low after ECB President Mario Draghi unveiled a program of sovereign-debt purchases to supplement existing easing measures. The central bank will buy 60 billion euros (US$68 billion) a month of bonds until at least September 2016, Draghi said on Jan. 22.

The British pound depreciated 0.5 percent to £0.7513 per euro, the biggest weekly decline since the five-day period ending Dec. 12. The sterling strengthened 0.3 percent to US$1.5030, snapping a six-week run of declines.

Asia’s emerging-market currencies retreated for a fifth month, the longest run of declines since the region’s financial crisis in 1998, as monetary easing by nations including Singapore and India spurred demand for US dollars.

Singapore said it would slow the pace of exchange-rate appreciation against a basket of currencies, becoming at least the ninth nation to loosen policy this month.

The Monetary Authority of Singapore will reduce the slope of the policy band for the city-state’s dollar, while keeping a “modest and gradual appreciation,” it said on Thursday.

The move follows surprise interest-rate cuts by Denmark, Turkey, India, Canada and Peru this month as global central banks seek to shore up growth amid dwindling inflation. The European Central Bank announced a bond-buying program that will debase the euro.

The Bloomberg-JPMorgan Asia Dollar Index, which tracks the region’s 10 most-active currencies excluding the yen, dropped 0.6 percent last month, contributing to a 3.9 percent retreat since August last year.

The New Taiwan dollar dropped the most in three weeks.

The NT dollar closed down 0.6 percent, the most since Jan. 5, to NT$31.512 against its US counterpart, Taipei Forex Inc prices show.

The ringgit retreated 3.6 percent in January, Asia’s biggest decline, as a 14 percent slump in Brent crude worsened prospects for Malaysia, a net oil exporter. Indonesia’s rupiah lost 2.3 percent, the Singapore dollar depreciated 2 percent, and the won fell 0.3 percent.

The yuan weakened 0.8 percent, a third monthly decline, after reports showed Chinese industrial profits fell the most in at least three years in December and the nation’s foreign-exchange reserves dropped for a fourth month.

MARKET LEADERSHIP: Investors are flocking to Nvidia, drawn by the company’s long-term fundamntals, dominant position in the AI sector, and pricing and margin power Two years after Nvidia Corp made history by becoming the first chipmaker to achieve a US$1 trillion market capitalization, an even more remarkable milestone is within its grasp: becoming the first company to reach US$4 trillion. After the emergence of China’s DeepSeek (深度求索) sent the stock plunging earlier this year and stoked concerns that outlays on artificial intelligence (AI) infrastructure were set to slow, Nvidia shares have rallied back to a record. The company’s biggest customers remain full steam ahead on spending, much of which is flowing to its computing systems. Microsoft Corp, Meta Platforms Inc, Amazon.com Inc and Alphabet Inc are

Luxury fashion powerhouse Prada SpA has acknowledged the ancient Indian roots of its new sandal design after the debut of the open-toe footwear sparked a furor among Indian artisans and politicians thousands of miles from the catwalk in Italy. Images from Prada’s fashion show in Milan last weekend showed models wearing leather sandals with a braided design that resembled handmade Kolhapuri slippers with designs dating back to the 12th century. A wave of criticism in the media and from lawmakers followed over the Italian brand’s lack of public acknowledgement of the Indian sandal design, which is named after a city in the

The US overtaking China as Taiwan’s top export destination could boost industrial development and wage growth, given the US is a high-income economy, an economist said yesterday. However, Taiwan still needs to diversify its export markets due to the unpredictability of US President Donald Trump’s administration, said Chiou Jiunn-rong (邱俊榮), an economics professor at National Central University. Taiwan’s exports soared to a record US$51.74 billion last month, driven by strong demand for artificial intelligence (AI) products and continued orders, with information and communication technology (ICT) and audio/video products leading all sectors. The US reclaimed its position as Taiwan’s top export market, accounting for

INVESTOR RESILIENCE? An analyst said that despite near-term pressures, foreign investors tend to view NT dollar strength as a positive signal for valuation multiples Morgan Stanley has flagged a potential 10 percent revenue decline for Taiwan’s tech hardware sector this year, as a sharp appreciation of the New Taiwan dollar begins to dent the earnings power of major exporters. In what appears to be the first such warning from a major foreign brokerage, the US investment bank said the currency’s strength — fueled by foreign capital inflows and expectations of US interest rate cuts — is compressing profit margins for manufacturers with heavy exposure to US dollar-denominated revenues. The local currency has surged about 10 percent against the greenback over the past quarter and yesterday breached