India’s federal police agency yesterday cleared the country’s Tata Group, saying it had committed no wrongdoing in a massive telecoms scandal that has rocked the government.

The Central Bureau of Investigation told a court that Tata Telecom, an arm of the sprawling tea-to-steel group, was not a “beneficiary” in the case that the national auditor estimates cost the state nearly US$40 billion in lost revenue.

There was “no illegality in the granting of [2G] licenses to the Tatas,” the police agency said in its submission to the New Delhi court.

“The real beneficiaries are the new people who got new licenses,” the submission said.

Prosecutors allege former Indian telecom minister A. Raja sold telecom licenses at give-away prices in 2008 to favored companies that paid bribes to gain sought-after 2G bandwidth in the world’s fastest-growing mobile phone market.

Tata Group is one of India’s most respected business houses headed by Ratan Tata.

More than a dozen people are in jail over the telecoms scandal, notably Raja, other top officials and business executives from companies such as mobile giant Reliance Communications.

Indian tycoon Anil Ambani, who heads the Reliance ADA Group that owns Reliance Communications, was questioned by the parliamentary Public Accounts Committee over the sale of telecoms licenses, but has not been charged.

All those accused in the case by police have denied any wrongdoing.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong

A proposed 100 percent tariff on chip imports announced by US President Donald Trump could shift more of Taiwan’s semiconductor production overseas, a Taiwan Institute of Economic Research (TIER) researcher said yesterday. Trump’s tariff policy will accelerate the global semiconductor industry’s pace to establish roots in the US, leading to higher supply chain costs and ultimately raising prices of consumer electronics and creating uncertainty for future market demand, Arisa Liu (劉佩真) at the institute’s Taiwan Industry Economics Database said in a telephone interview. Trump’s move signals his intention to "restore the glory of the US semiconductor industry," Liu noted, saying that

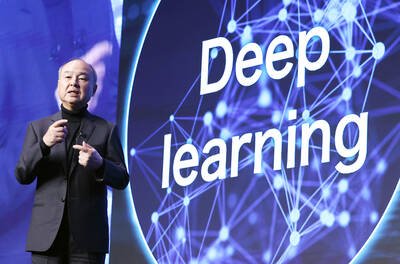

AI: Softbank’s stake increases in Nvidia and TSMC reflect Masayoshi Son’s effort to gain a foothold in key nodes of the AI value chain, from chip design to data infrastructure Softbank Group Corp is building up stakes in Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the latest reflection of founder Masayoshi Son’s focus on the tools and hardware underpinning artificial intelligence (AI). The Japanese technology investor raised its stake in Nvidia to about US$3 billion by the end of March, up from US$1 billion in the prior quarter, regulatory filings showed. It bought about US$330 million worth of TSMC shares and US$170 million in Oracle Corp, they showed. Softbank’s signature Vision Fund has also monetized almost US$2 billion of public and private assets in the first half of this year,