Australia would heavily tax the booming profits of its mining companies under a tax system overhaul proposed yesterday that also would invest in infrastructure to support mining operations and reduce corporate taxes.

The new 40 percent tax on resource profits targets industries that have grown rapidly as they’ve produced the raw materials that feed burgeoning Chinese and Indian manufacturing demand.

Mining royalties currently paid to Australian state governments do not reflect rising commodity prices. The government says mining profits rose by A$80 billion (US$74 billion) in the past decade, yet government revenues from resources increased by only A$9 billion.

Andrew Forrest, chief executive of Fortescue Metals Group Ltd, last week warned that higher taxes on mining could “kill the golden goose” that had kept the country out of recession during the global economic downturn. Mine companies also say higher taxes would stifle investment in the resource sector and cost jobs.

The tax overhaul Australian Prime Minister Kevin Rudd proposes requires parliament’s endorsement to become law. It would introduce the so-called Resource Super Profits Tax in July 2012. The company tax rate would be cut from 30 percent to 29 percent in July 2013 and to 28 percent a year later.

The government forecasts that the cut in company tax combined with the mining tax will increase GDP by 0.7 percent a year.

“These changes will not be welcomed by every business or every interest group, but they are the considered, responsible changes we need if we are to turn our success during the global recession into enduring gains for our economy, our people and our nation,” Rudd said in a statement.

Treasurer Wayne Swan told reporters he could not say whether tax legislation would be introduced to parliament before national elections are held at a date to be set late this year.

Under the tax overhaul, resource-rich states would continue to reap mining royalties, but the federal government would refund those costs to mining companies before calculating their federal tax debt.

The tax would be levied on profits after all the costs of mining operations, capital investment and dividends to shareholders are deducted.

Marginally viable mine companies would potentially be better off in cases where the costs of extracting minerals barely cover royalty charges because of a price downturn or when the ore deposit is almost exhausted.

About A$5.6 billion of the mining tax revenue would be spent over a decade on public infrastructure critical to the industry such as ports, rail and roads.

The government argues the tax shift would prevent a “two-speed economy” emerging in Australia where non-resource industries such as manufacturing, construction and tourism cannot attract investment or staff because they cannot afford to match the lucrative wages offered by the mining industry.

Also as part of the tax overhaul, the government would increase the proportion of salaries that workers must save for their retirement.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong

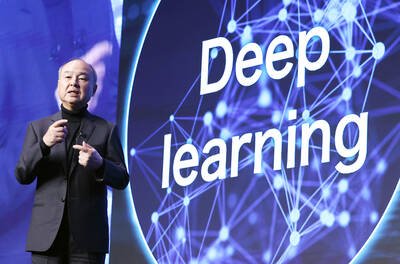

AI: Softbank’s stake increases in Nvidia and TSMC reflect Masayoshi Son’s effort to gain a foothold in key nodes of the AI value chain, from chip design to data infrastructure Softbank Group Corp is building up stakes in Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the latest reflection of founder Masayoshi Son’s focus on the tools and hardware underpinning artificial intelligence (AI). The Japanese technology investor raised its stake in Nvidia to about US$3 billion by the end of March, up from US$1 billion in the prior quarter, regulatory filings showed. It bought about US$330 million worth of TSMC shares and US$170 million in Oracle Corp, they showed. Softbank’s signature Vision Fund has also monetized almost US$2 billion of public and private assets in the first half of this year,

A proposed 100 percent tariff on chip imports announced by US President Donald Trump could shift more of Taiwan’s semiconductor production overseas, a Taiwan Institute of Economic Research (TIER) researcher said yesterday. Trump’s tariff policy will accelerate the global semiconductor industry’s pace to establish roots in the US, leading to higher supply chain costs and ultimately raising prices of consumer electronics and creating uncertainty for future market demand, Arisa Liu (劉佩真) at the institute’s Taiwan Industry Economics Database said in a telephone interview. Trump’s move signals his intention to "restore the glory of the US semiconductor industry," Liu noted, saying that