Most consumers probably don’t realize that 99.99 percent pure gold, silver and copper can be extracted from their discarded electronic gadgets.

Metals extracted from computer parts and other electronic devices are used as raw materials for reuse by the nation’s chipmakers and computer manufacturers — a cycle that minimizes the hazardous impact from electronic and industrial waste that is buried underground or incinerated, producing toxic fumes.

Despite the unglamorous image of the junk business, the nation’s waste management and recycling sector has over the past decade grown to be as lucrative and tech-savvy as the local information technology (IT) industry.

PHOTO: CHANG CHIA-MING, TAIPEI TIMES

In addition, the environmentally friendly recycling sector has proven to be highly recession-proof against the backdrop of the global economic downturn that has dragged down local IT exporters’ overseas shipments.

As one of the leading companies in the sector, Taoyuan-based Super Dragon Technology Co (佳龍科技), which was established in 1996 and later took over its parent firm, Chang Pwu Industrial Co (昌蒲實業), looks beyond the profit it makes from its precious metals recycling businesses.

“If we were to stop using recycled products now, we might end up running out of natural resources in just a few years,” Super Dragon chairman and founder Wu Yao-hsun (吳耀勳), 58, said in a recent interview with the Taipei Times.

PHOTO: CHANG CHIA-MING, TAIPEI TIMES

Wu, who in his late 20s started out as a gold processor for domestic jewelers, has shown an aptitude for finding diamonds in the rough.

In 1984, for example, Wu acquired four obsolete radar devices that had been used by NASA’s space shuttles for around NT$100,000 (US$3,040), out of which he recovered 600kg of silver worth NT$12.8 million.

But he barely broke even when he later decided to tap into the precious metals recycling business and swept up 4,000 tonnes of waste of all kinds along the coast of Guanyin (觀音), Taoyuan County, out of a sense of social responsibility.

“Even so, I still feel fortunate to have been able to make a contribution to society, because all that waste, if it had been allowed to sink into the sea, could have poisoned the fish we eat today,” he said.

Wu said he had been so devoted to improving the company’s competitiveness by refining the chemical extraction process that he was at one point diagnosed with nasopharyngeal carcinoma as a result of his frequent direct exposure to chemical solutions.

Today, Super Dragon boasts a monthly output of between 300kg and 500kg of gold, in addition to other metals, with a recycling capacity of 95 percent.

The company’s revenue grew 20.7 percent year-on-year to a record NT$4.35 billion last year, 85 percent of which was derived from the extraction of industrial waste or flawed products shipped directly from some of the nation’s largest electronic companies, including Taiwan Semiconductor Manufacturing Co (台積電) and United Microelectronics Corp (聯電). Another 5 percent is derived from obsolete desktop and notebook computers collected from individuals, said 35-year-old company president Ken Wu (吳界欣), the founder’s son.

Although Wu Yao-hsun vowed to boost sales past NT$5 billion this year, company revenues dropped 11.8 percent year-on-year in the first half to NT$1.91 billion.

The company is expected to start construction of its third plant in Taoyuan’s Environmental Protection Park, also in Guanyin township, with an initial investment of NT$1 billion. The facility is scheduled to be completed in October.

Despite the global downturn, the company’s factory in Suzhou, China, turned a profit of almost 1 million yuan (US$146,400) last year, while half of its competitors were closed down after failing to repay their suppliers.

Chinese electronic companies then turned to Super Dragon, which is well known for not pulling strings and giving no kickbacks, Ken Wu said.

“The current economic troubles made our suppliers realize that they should be doing business with a company like Super Dragon, which is financially viable and has a good business reputation, instead of those companies that couldn’t weather the downturn,” Ken Wu said.

The China-based factory reported 4 million yuan in net income for the first half of this year.

“With a steady supply [from electronic companies], Super Dragon will begin to see a stronger growth potential in China’s emerging market,” Wu Yao-hsun said.

The company hopes to ride on the back of China’s emerging electronic waste management and recycling industry, while, in Taiwan’s more mature market, Super Dragon is urging the government to open up to imports of industrial waste from abroad — a wish that looks likely to be granted soon.

A growing number of environmental protection groups that previously opposed imports of waste products have come to understand that these products can be 100 percent recycled into useful and even precious resources, said Lin Chih-sen (林志森), president of the Taiwan Green Productivity Foundation (台灣綠色生產力基金會).

The government is likely to relax restrictions on waste imports “by the end of this year,” Lin said.

He said that even when waste products cannot be 100 percent recycled, the domestic sector’s highly skilled waste management processes will make sure that whatever remains is guaranteed to cause no harm to the environment.

The local waste recycling sector has proved to be highly innovative and capable of producing more value-added output than its few international competitors can compete with, Lin said.

Figures compiled by the association show that the industry, which was created in 1988 out of necessity, has grown exponentially to an estimated worth of NT$48.2 billion last year, an increase of 94 percent from NT$24.9 billion in 2002.

The number of businesses also grew to 1,126 companies last year, from 305 in 2002, although the majority of them are small and medium-sized.

The number of items that can be recycled has also increased, and now includes substances such as fly ash, which can be reprocessed into cement.

The sector’s reuse rate is likely to grow further to 85 percent in 2020 from last year’s 76.5 percent, the association’s estimates show.

That will facilitate a healthier “cradle-to-cradle” loop instead of the former “cradle-to-grave” loop in which processed waste products still endanger the environment, said Lin Chien-hui (林建輝), executive secretary of the Environmental Protection Association’s recycling fund management committee.

“Another Taiwanese [economic] miracle can be created if the [waste management] sector ups its reuse and recycle rates,” while the industrial sector ups its efforts in reducing waste, Lin Chien-hui said.

Although many businesses have managed to weather the current recession, the two Lins agreed that the sector should keep up research and development efforts to boost “green innovation.”

In the case of Super Dragon, this includes turning computer keyboards into works of art, which have the potential to become priceless.

“Sooner or later, no orders will be placed to computer equipment manufacturers if they fail to commit [to the recycling of their own products],” Wu Yao-hsun said.

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the

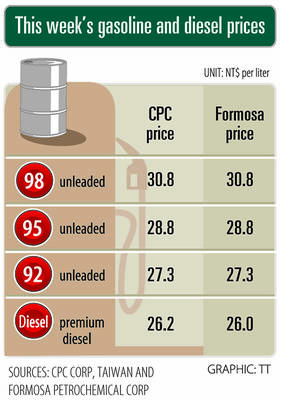

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

A German company is putting used electric vehicle batteries to new use by stacking them into fridge-size units that homes and businesses can use to store their excess solar and wind energy. This week, the company Voltfang — which means “catching volts” — opened its first industrial site in Aachen, Germany, near the Belgian and Dutch borders. With about 100 staff, Voltfang says it is the biggest facility of its kind in Europe in the budding sector of refurbishing lithium-ion batteries. Its CEO David Oudsandji hopes it would help Europe’s biggest economy ween itself off fossil fuels and increasingly rely on climate-friendly renewables. While

SinoPac Financial Holdings Co (永豐金控) is weighing whether to add a life insurance business to its portfolio, but would tread cautiously after completing three acquisitions in quick succession, president Stanley Chu (朱士廷) said yesterday. “We are carefully considering whether life insurance should play a role in SinoPac’s business map,” Chu told reporters ahead of an earnings conference. “Our priority is to ensure the success of the deals we have already made, even though we are tracking some possible targets.” Local media have reported that Mercuries Life Insurance Co (三商美邦人壽), which is seeking buyers amid financial strains, has invited three financial