The world's leading contract chip makers, Taiwan Semiconductor Manufacturing Corp (TMSC, 台積電) and United Microelectronics Corp (UMC,

Analysts say the key to Taiwan's foundry strength is the two leading companies' technological leadership and financial strength that have helped them maintain their edge in the highly competitive market.

James Huang (

They managed to keep manufacturing processes at least one generation ahead of their rivals, meaning that the two foundries are basically in a secure position in the world market, Huang said.

TSMC and UMC faced threats from GSMC and SMIC which, with the help of the Chinese government and their foreign partners, have been rapidly expanding their production capabilities and chipping away at the market shares of the Taiwan makers. Still, TSMC and UMC's joint market share in 2005 is forecast to remain at about 70 percent, with TSMC keeping the top spot.

Taiwan's foundry giants are facing unusual pressure for their fourth quarter revenues because of the low-price strategy adopted by SMIC and Chartered Semiconductor as the recovery of the global semiconductor industry has been slower than expected and heavyweight IC designing houses have been unable to bring down their inventory levels, triggering market worries that IC designers will reduce their orders to manufacturers.

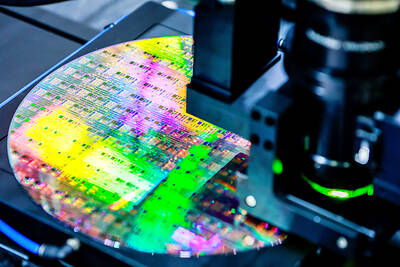

Both TSMC and UMC have worked aggressively to maintain their competitive edge by upgrading their technology. In this regard, TSMC announced in Dec. 2004 that it was using the industry-leading Nexsys 90-nanometer process in volume production for such leading companies as Altera Corp and Qualcomm Inc, the only foundry process to feature copper interconnect, low-k dielectrics, and 12-inch wafer production.

In April this year, TSMC unveiled another latest semiconductor manufacturing process -- the 65nm Nexsys Technology for SoC Design -- at a symposium attended by over 400 of the industry's leading companies, and said its first wafers to be produced by this process are expected in December.

The new technology allows designers to build logic devices with double the density of the company's industry leading 65nm technology, enabling market movers across the IC industry to save significant costs.

On Wednesday, TSMC said it has completed prototype runs for its customers drawing on 65nm technology.

Among the customers taking part in the first run were Altera, Broadcom Corp and Freescale Semiconductor Inc, all of the US, TSMC said in a statement.

UMC, for its part, also announced its leadership in the 90nm manufacturing process, an achievement that has won it big orders from such IC designing firms as Texas Instruments, ATi, nVidia, and Qualcomm.

In late August, UMC said it had reached a "milestone" of having shipped over 100,000 wafers using the 90nm process technology, becoming a leader in terms of the total number of 90nm wafers shipped as well as in revenue generated from 90nm sales.

As TSMC enjoys high satisfaction from such key IC designing houses as TI, ATi, nVidia, Microsoft Corp, Freescale, Sony Corp and Altera, it is quite unlikely that it will lose major orders to UMC, market analysts said.

TSMC and UMC's technological lead was further proved when nVidia withdrew all its orders from IBM, which launched an aggressive campaign to wrestle orders from the two Taiwan manufacturers in 2003, and directed them all back to TSMC and UMC.

TSMC has started volume production of nVidia's orders in the third quarter of this year using the 90nm process, and UMC is set to start volume production of nVidia orders in the first quarter of next year.

TSMC's R&D efforts are producing another likely result for 2006 and beyond: merging IC process technology with microelectromechanical systems (MEMS), a platform whose market value researchers estimate will grow from US$8 billion this year to US$14 billion by 2009, analysts said.

TECH TITAN: Pandemic-era demand for semiconductors turbocharged the nation’s GDP per capita to surpass South Korea’s, but it still remains half that of Singapore Taiwan is set to surpass South Korea this year in terms of wealth for the first time in more than two decades, marking a shift in Asia’s economic ranks made possible by the ascent of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). According to the latest forecasts released on Thursday by the central bank, Taiwan’s GDP is expected to expand 4.55 percent this year, a further upward revision from the 4.45 percent estimate made by the statistics bureau last month. The growth trajectory puts Taiwan on track to exceed South Korea’s GDP per capita — a key measure of living standards — a

Samsung Electronics Co shares jumped 4.47 percent yesterday after reports it has won approval from Nvidia Corp for the use of advanced high-bandwidth memory (HBM) chips, which marks a breakthrough for the South Korean technology leader. The stock closed at 83,500 won in Seoul, the highest since July 31 last year. Yesterday’s gain comes after local media, including the Korea Economic Daily, reported that Samsung’s 12-layer HBM3E product recently passed Nvidia’s qualification tests. That clears the components for use in the artificial intelligence (AI) accelerators essential to the training of AI models from ChatGPT to DeepSeek (深度求索), and finally allows Samsung

Taiwan has imposed restrictions on the export of chips to South Africa over national security concerns, taking the unusual step of using its dominance of chip markets to pressure a country that is closely allied with China. Taiwan requires preapproval for the bulk of chips sold to the African nation, the International Trade Administration said in a statement. The decision emerged after Pretoria tried to downgrade Taipei’s representative office and force its move to Johannesburg from Pretoria, the Ministry of Foreign Affairs has said. The move reflects Taiwan’s economic clout and a growing frustration with getting sidelined by Beijing in the diplomatic community. Taiwan

READY TO HELP: Should TSMC require assistance, the government would fully cooperate in helping to speed up the establishment of the Chiayi plant, an official said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said its investment plans in Taiwan are “unchanged” amid speculation that the chipmaker might have suspended construction work on its second chip packaging plant in Chiayi County and plans to move equipment arranged for the plant to the US. The Chinese-language Economic Daily News reported earlier yesterday that TSMC had halted the construction of the chip packaging plant, which was scheduled to be completed next year and begin mass production in 2028. TSMC did not directly address whether construction of the plant had halted, but said its investment plans in Taiwan remain “unchanged.” The chipmaker started