ING Direct, the online bank best known for the orange ball tossed around in its commercials, has gained a profitable foothold in the US by wooing customers fed up with the minuscule interest rates offered by most banks.

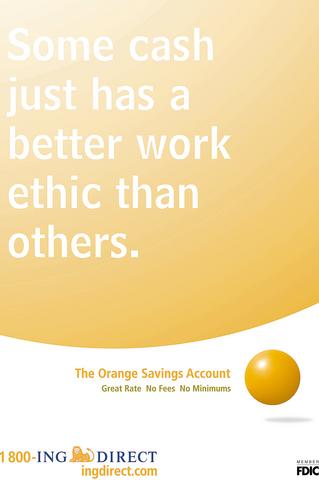

Next week, ING Direct will introduce a US$50 million fine-tuning of that approach from Bartle Bogle Hegarty, as it attempts to convince skittish stock market investors that its savings accounts would also make a fine investment option.

PHOTO: NY TIMES

ING Direct, a subsidiary of the Dutch financial services company ING, wants to add 500,000 new customers this year, to go with the the 1 million it has acquired since entering the US market in September 2000.

But the online bank's inroads into the US market could run into some obstacles. If the stock market's fortunes rise, or the traditional banks increase their interest rates, ING Direct's key selling point could lose some of its attraction.

ING Direct executives do not seem too worried. The online bank's products have become increasingly attractive as investors bail out of the declining stock market only to be underwhelmed by the interest rates banks are paying on savings accounts or money-market funds.

"Its financial instruments are as safe as a bank and safer than the stock market," said Jerry Silva, an analyst with TowerGroup, a Needham, Mass.-based research company that is part of Reuters. "And it gives you flexibility and doesn't lock you in the way a traditional CD would."

As of Jan. 31, ING Direct's annual interest rate on its savings account, the only account it offers, will be 2.3 percent. Currently, the average savings account interest rate is 0.80 percent, while the average money market account pays an interest rate of 0.73 percent, according to Bankrate.

ING Direct has used this spread to become the 95th largest bank in the US in less than three years of operation, according to the latest rankings from American Banker. The bank is already profitable, posting a nine-month net profit of US$21.5 million through Sept. 30, compared to a US$32.5 million net loss in the same period the previous year.

ING Direct has avoided the fate of a number of other Internet banks by keeping its costs and offerings to a minimum. Customers can bank either online or by phone. And ING Direct does not offer checking accounts or impose any fees, service charges or minimum requirements on its products.

To maintain its momentum, ING Direct is tweaking its approach. It dropped its original agency, Howard, Merrell & Partners, of Raleigh, North Carolina, and is boosting its spending by US$15 million from last year and more than doubling the US$22 million it spent in 2001.

David Lewis, ING Direct's chief marketing officer, said the bank's original ads were directed at "value-conscious, savvy, thrifty, well-informed consumers who like finding a good deal."

He said the new ads are aimed at these customers, as well as at individuals who would normally not view a savings account as a good place for their funds.

This group would be more likely to use money-market funds, scoffing at savings accounts as unsophisticated and a poor investment, with a low yield, he said. "The new campaign is meant to expand the category, to show that the account has a great yield and can be looked at as liquid," he said.

The campaign's two TV commercials, which will debut Feb. 3 and 17, combine film and animation, and retain the orange ball. The first spot shows a disheveled man roaming through his home while his animated money dances around the rooms. Fed up with the money's aimless activity, he sits down at his computer and signs up for the company's "orange" savings account.

The second spot depicts money rushing out of a bank vault, through the streets of a city, to a car dealership, where its owner is considering the purchase of a vintage car.

"We wanted the spots to be about people's relationship to money," said Kevin McKeon, executive creative director of the New York office of Bartle Bogle Hegarty, which is 49 percent owned by the Publicis Groupe.

Ian Rubin, research director of Financial Insights, a subsidiary of International Data Corp, a Framingham, Massachusetts-based consulting firm, said: "I think the message is great. They're saying `This can be fun, it doesn't have to be stodgy.' If it gets people thinking about savings accounts and CDs who wouldn't think twice about them, it can drive a lot of people to look at ING as an option."

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) secured a record 70.2 percent share of the global foundry business in the second quarter, up from 67.6 percent the previous quarter, and continued widening its lead over second-placed Samsung Electronics Co, TrendForce Corp (集邦科技) said on Monday. TSMC posted US$30.24 billion in sales in the April-to-June period, up 18.5 percent from the previous quarter, driven by major smartphone customers entering their ramp-up cycle and robust demand for artificial intelligence chips, laptops and PCs, which boosted wafer shipments and average selling prices, TrendForce said in a report. Samsung’s sales also grew in the second quarter, up

LIMITED IMPACT: Investor confidence was likely sustained by its relatively small exposure to the Chinese market, as only less advanced chips are made in Nanjing Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) saw its stock price close steady yesterday in a sign that the loss of the validated end user (VEU) status for its Nanjing, China, fab should have a mild impact on the world’s biggest contract chipmaker financially and technologically. Media reports about the waiver loss sent TSMC down 1.29 percent during the early trading session yesterday, but the stock soon regained strength and ended at NT$1,160, unchanged from Tuesday. Investors’ confidence in TSMC was likely built on its relatively small exposure to the Chinese market, as Chinese customers contributed about 9 percent to TSMC’s revenue last

With this year’s Semicon Taiwan trade show set to kick off on Wednesday, market attention has turned to the mass production of advanced packaging technologies and capacity expansion in Taiwan and the US. With traditional scaling reaching physical limits, heterogeneous integration and packaging technologies have emerged as key solutions. Surging demand for artificial intelligence (AI), high-performance computing (HPC) and high-bandwidth memory (HBM) chips has put technologies such as chip-on-wafer-on-substrate (CoWoS), integrated fan-out (InFO), system on integrated chips (SoIC), 3D IC and fan-out panel-level packaging (FOPLP) at the center of semiconductor innovation, making them a major focus at this year’s trade show, according

DEBUT: The trade show is to feature 17 national pavilions, a new high for the event, including from Canada, Costa Rica, Lithuania, Sweden and Vietnam for the first time The Semicon Taiwan trade show, which opens on Wednesday, is expected to see a new high in the number of exhibitors and visitors from around the world, said its organizer, SEMI, which has described the annual event as the “Olympics of the semiconductor industry.” SEMI, which represents companies in the electronics manufacturing and design supply chain, and touts the annual exhibition as the most influential semiconductor trade show in the world, said more than 1,200 enterprises from 56 countries are to showcase their innovations across more than 4,100 booths, and that the event could attract 100,000 visitors. This year’s event features 17