On day 50 of his life as a chief executive, Jack L. Stahl of Revlon was spending much of his time on a drugstore floor, stacking lipsticks and eye shadow into a new display case he had just assembled.

That April morning, Stahl and a volunteer army of 250 Revlon employees had fanned out across Manhattan to outfit drugstores with shiny new showcases designed to grab customers' attention. The employees' shirts predicted victory: "Revlon Takes Manhattan."

It was an unusually aggressive and expensive campaign for a debt-ridden company stuck in a defensive mode in recent years.

PHOTO: NY TIMES

Before Stahl became chief executive in February, Revlon had focused on cutting losses and costs. Now Stahl, a former No. 2 at the Coca-Cola Co, says Revlon is past pruning and ready to grow.

"Revlon has a name. It is right now bigger than the business," Stahl said in October in a conference call with securities analysts.

"Our strategy is to make the business as big as the name."

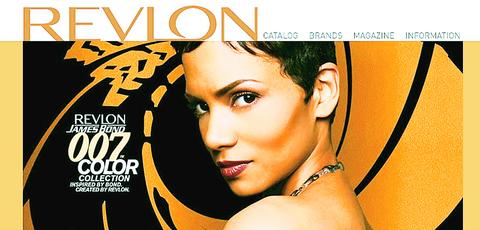

With only about US$59 million in cash and US$32 million in unused credit as of Sept. 30, Revlon is spending close to US$70 million on display cases, up from US$44 million last year, and "significantly" more on marketing. In its showiest move, Revlon has created a color collection tied to the James Bond films, notably the latest release, Die Another Day, which opened on Nov. 22 nationwide. Halle Berry, a Revlon spokeswoman, is a star of the film.

That adds up to a sizable gamble for a business saddled with US$1.7 billion in debt and projected interest payments of US$156 million this year. Revlon's majority owner, Ronald O. Perelman, has promised to advance Revlon US$40 million if necessary, but the company ran that much of a cash deficit in its third quarter alone. Moreover, with no contract binding him to supply the money, Perelman may leave Revlon to fend for itself in bankruptcy court. Credit analysts warn that Revlon could default in the first quarter of next year.

But Stahl has evidently concluded that running risks may be the only way to reverse 16 consecutive quarters of losses and to reclaim market share lost to L'Oreal and Procter & Gamble, which makes the Cover Girl and Max Factor brands.

Maintaining focus

Stahl declined to be interviewed, saying through a spokeswoman that he wanted to focus on Revlon instead of himself.

Nevertheless, Stahl, 49, has tied his fortunes to Revlon's. He has put himself at the command of Perelman, who has proved to be controlling and fickle: Perelman dismissed each of Revlon's last two chief executives in scarcely two years. While pleasing Perelman, Stahl must balance Revlon's responsibility to save cash and pay debts, and its competing need to pay for developing and marketing new products. Failure would undermine the reputation that Stahl built at Coca-Cola during his 22 years there.

At Coke, Stahl once was on a path to the chief executive suite. He had been named chief financial officer at 36, the youngest person to hold that position at the company. A few years later, he became president of its North America group, responsible for 30 percent of the company's sales and 20 percent of its profits.

During Stahl's six-year reign, the unit's market share increased to 45 percent from 40 percent, and its average annual growth rate tripled.

He became Coca-Cola's president and chief operating officer in 2000 but left in March 2001 in a shake-up. It is unclear whether Stahl quit or was pushed, but he and Douglas Daft, the chief executive, had different visions for the company.

In February 2002, the news that Stahl would join Revlon momentarily raised the ailing company's stock price -- and many eyebrows.

Here was a manager who almost certainly had his pick of positions. Furthermore, Coca-Cola had given him US$3.5 million in severance and other benefits, so he did not need the work. Nonetheless, he chose to lead a company that others might have considered a losing proposition.

As a start, he expanded the rejuvenation of display cases to drugstores nationwide. He carried out the Bond promotion. He lured top executives from Clairol and Coca-Cola and created a management structure more like the decentralized organization he set up while No. 2 at Coke. He began writing a weekly employee newsletter and said he wanted Revlon on lists of the top 100 companies for employees.

Stahl has shadowed market researchers into consumers' homes to chat about the brand and made a splash at the annual meeting of the National Association of Chain Drug Stores by seeking advice from seemingly everyone.

Suzanne Grayson, a marketing consultant who worked for Revlon in the 1960s and 1970s, sat beside Stahl at an industry dinner in October.

"He wasn't interested in talking about himself; he was interested in learning," Grayson said. "He seemed to be quite interested in what Revlon was like and what made it great and what did I think was missing now."

She told him to capitalize on Revlon's famous brand with new cosmetics.

"The most important thing Jack can do is put on lipstick," she said with a laugh. "Get into product."

Revlon is already achieving promising market-share numbers based largely on its 007 Color Collection.

Figures from Information Resources Inc. show that Revlon market share in the four weeks ended Nov. 3 rose to 23 percent, from 21 percent a year earlier, putting it ahead of P&G, which fell to 21 percent from 25 percent, but behind L'Oreal, which remained at 33 percent.

"This is the first month in years that they've really had an increase in market share," Chalhoub said.

In a good omen for Revlon's 007 products, "Die Another Day" had the best opening weekend of all 20 Bond films. But Revlon's gains in market share may not offset the money spent promoting the Bond collection.

Whether it sells or bombs, the agent held responsible will be Stahl, Jack Stahl.

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

NEW PRODUCTS: MediaTek plans to roll out new products this quarter, including a flagship mobile phone chip and a GB10 chip that it is codeveloping with Nvidia Corp MediaTek Inc (聯發科) yesterday projected that revenue this quarter would dip by 7 to 13 percent to between NT$130.1 billion and NT$140 billion (US$4.38 billion and US$4.71 billion), compared with NT$150.37 billion last quarter, which it attributed to subdued front-loading demand and unfavorable foreign exchange rates. The Hsinchu-based chip designer said that the forecast factored in the negative effects of an estimated 6 percent appreciation of the New Taiwan dollar against the greenback. “As some demand has been pulled into the first half of the year and resulted in a different quarterly pattern, we expect the third quarter revenue to decline sequentially,”

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co. (TSMC), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co. (better known as Foxconn) ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose 60 places to reach No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc. at 348th, Pegatron Corp. at 461st, CPC Corp., Taiwan at 494th and Wistron Corp. at 496th. According to Fortune, the world’s

DIVERSIFYING: Taiwanese investors are reassessing their preference for US dollar assets and moving toward Europe amid a global shift away from the greenback Taiwanese investors are reassessing their long-held preference for US-dollar assets, shifting their bets to Europe in the latest move by global investors away from the greenback. Taiwanese funds holding European assets have seen an influx of investments recently, pushing their combined value to NT$13.7 billion (US$461 million) as of the end of last month, the highest since 2019, according to data compiled by Bloomberg. Over the first half of this year, Taiwanese investors have also poured NT$14.1 billion into Europe-focused funds based overseas, bringing total assets up to NT$134.8 billion, according to data from the Securities Investment Trust and Consulting Association (SITCA),