US stock markets, beaten down by negative economic reports, will have a holiday-shortened week to regroup before the company earnings season gets underway.

Over the past week, the Dow Jones Industrial Average shed 4.51 percent, closing on Friday at 9,686.48 points, its lowest level since Oct. 5.

The tech-heavy NASDAQ composite index dropped 5.92 percent to 2,091.79 points. The Standard & Poor’s 500 index, a broad measure of the markets, slumped 5.03 percent to 1,022.58 points.

US markets will be closed tomorrow in observance of the Independence Day holiday.

Only one key economic report is due in the holiday-shortened week: the Institute for Supply Management’s index on activity in the services sector, on Tuesday.

The major market indices spent this week mired in red, under pressure from a slew of poor economic indicators.

“It was one ugly week, and the recent data raises serious questions about the overall state of the economy,” Ryan Detrick at Schaeffer’s Investment Research said.

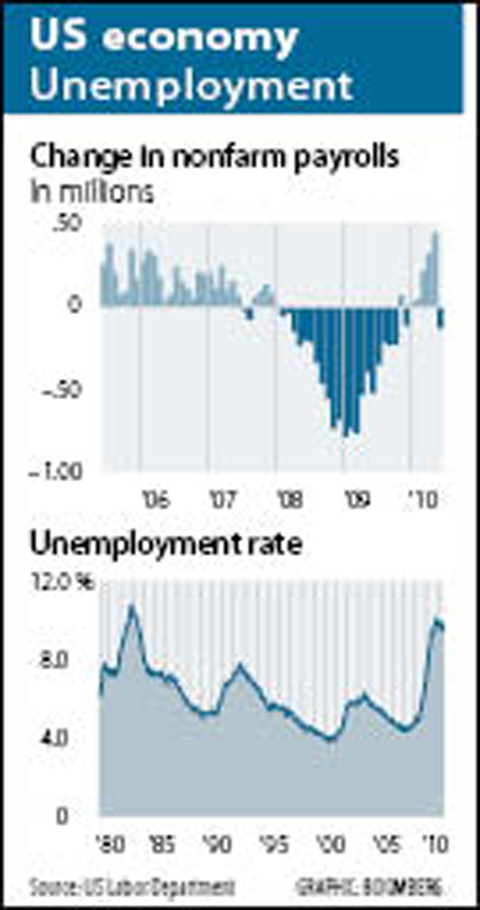

The US Labor Department’s jobs report on Friday did not help to dampen recovery fears.

The economy shed 125,000 jobs, more than expected, while the unemployment rate fell to 9.5 percent from 9.7 percent as more than a half million workers exited the workforce.

Most analysts had expected it to rise to 9.8 percent.

“The unemployment rate dropped because the labor force shrank even more rapidly as discouraged workers stopped looking for work,” analysts at Societe Generale said.

Patrick O’Hare, chief market analyst at Briefing.com, said that several indicators are flashing warning signs that an economic slowdown is on the way.

“We see a slowdown coming, but we do not see another recession,” he said. “The feeling of negativity in the market is palpable, which is why one needs to respect the possibility of a counter-trend rally of decent size in the near term that is fueled by short-covering activity.”

Lindsay Piegza at FTN Financial called last month “a pretty bad month.”

“We basically stalled. We’re not falling off a cliff but we slowed from the two previous months,” Piegza said.

The blue-chip Dow plunged 10 percent in the April-June period, the first quarterly decline since the indices rebounded from March last year’s lows.

“This does not bode well for starting out into the second half of the year. We’ve initiated a new trend,” Piegza added.

Investors will have the week to prepare for the unofficial start of earnings season on July 12, when Alcoa reports results.

“With corporate balance sheets — particularly stateside — in good shape and with dividend trends on the rise, opportunities for investors to be paid while they wait appear attractive,” John Stoltzfus of Ticonderoga Securities said.

“The message looks clear: Spare the party hats for now, keep the seat belts fastened, make shopping lists and keep an eye out for babies that’ve been and will continue to be thrown out with the bath water on down days,” Stoltzfus said.

NEXT GENERATION: The four plants in the Central Taiwan Science Park, designated Fab 25, would consist of four 1.4-nanometer wafer manufacturing plants, TSMC said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) plans to begin construction of four new plants later this year, with the aim to officially launch production of 2-nanometer semiconductor wafers by late 2028, Central Taiwan Science Park Bureau director-general Hsu Maw-shin (許茂新) said. Hsu made the announcement at an event on Friday evening celebrating the Central Taiwan Science Park’s 22nd anniversary. The second phase of the park’s expansion would commence with the initial construction of water detention ponds and other structures aimed at soil and water conservation, Hsu said. TSMC has officially leased the land, with the Central Taiwan Science Park having handed over the

AUKUS: The Australian Ambassador to the US said his country is working with the Pentagon and he is confident that submarine issues will be resolved Australian Ambassador to the US Kevin Rudd on Friday said that if Taiwan were to fall to China’s occupation, it would unleash China’s military capacities and capabilities more broadly. He also said his country is working with the Pentagon on the US Department of Defense’s review of the AUKUS submarine project and is confident that all issues raised will be resolved. Rudd, who served as Australian prime minister from 2007 to 2010 and for three months in 2013, made the remarks at the Aspen Security Forum in Colorado and stressed the longstanding US-Australia alliance and his close relationship with the US Undersecretary

‘WORLD WAR III’: Republican Representative Marjorie Taylor Greene said the aid would inflame tensions, but her amendment was rejected 421 votes against six The US House of Representatives on Friday passed the Department of Defense Appropriations Act for fiscal 2026, which includes US$500 million for Taiwan. The bill, which totals US$831.5 billion in discretionary spending, passed in a 221-209 vote. According to the bill, the funds for Taiwan would be administered by the US Defense Security Cooperation Agency and would remain available through Sept. 30, 2027, for the Taiwan Security Cooperation Initiative. The legislation authorizes the US Secretary of Defense, with the agreement of the US Secretary of State, to use the funds to assist Taiwan in procuring defense articles and services, and military training. Republican Representative

TAIWAN IS TAIWAN: US Representative Tom Tiffany said the amendment was not controversial, as ‘Taiwan is not — nor has it ever been — part of Communist China’ The US House of Representatives on Friday passed an amendment banning the US Department of Defense from creating, buying or displaying any map that shows Taiwan as part of the People’s Republic of China (PRC). The “Honest Maps” amendment was approved in a voice vote on Friday as part of the Department of Defense Appropriations Act for the 2026 fiscal year. The amendment prohibits using any funds from the act to create, buy or display maps that show Taiwan, Kinmen, Matsu, Penghu, Wuciou (烏坵), Green Island (綠島) or Orchid Island (Lanyu, 蘭嶼) as part of the PRC. The act includes US$831.5 billion in