The euro dropped to within US$0.01 of an 11-month low against the US dollar this week as rising yields on Greece’s debt fueled speculation the nation would default, damping investor appetite for the European currency.

The Australian and New Zealand dollars gained as stocks gained for the sixth straight week, spurring investor demand for currencies linked to growth. The euro trimmed its five-day losses on Friday as Europe said it was ready to rescue Greece. Data next week may show a rise in core US consumer prices slowed, dimming chances for an interest-rate increase.

“The market had no confidence in Greece and thought default was imminent,” said Richard Franulovich, a senior currency strategist at Westpac Banking Corp in New York.

The euro dropped 1.5 percent to ¥125.79, from ¥127.75 on April 2, a loss trimmed by a rise of 0.8 percent on Friday. The European currency weakened less than 0.1 percent to US$1.35, compared with US$1.3504 on April 2, after climbing 1 percent on Friday. It reached US$1.3283 on Thursday, less than US$0.01 above the US$1.3268 of May 7 last year.

The US dollar depreciated 1.5 percent, the biggest weekly drop since Feb. 26, to ¥93.18.

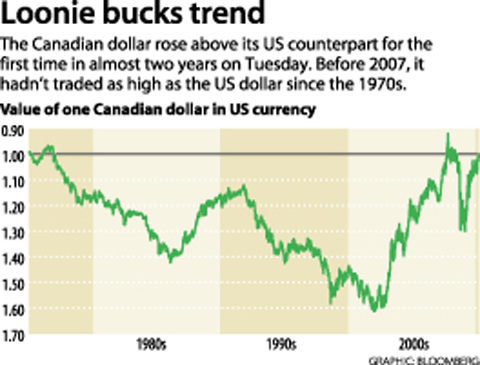

The Canadian dollar strengthened to parity with its US counterpart this week for the first time in 20 months on speculation the nation’s central bank will raise borrowing costs faster than the Federal Reserve.

Canada’s currency, nicknamed the loonie, gained 0.8 percent this week to C$1.0027 per US dollar and strengthened on Wednesday to as much as C$0.9978.

The pound climbed against the dollar for a second straight week. A report showed UK producer prices rose last month faster than economists predicted, adding to signs the recovery is gathering pace. The currency appreciated 1.1 percent to US$1.5370.

Asian currencies extended the year’s gains this week, led by Malaysia’s ringgit and the Indian rupee, on mounting speculation China is moving closer to loosening its grip on the exchange rate.

The New Taiwan dollar rose the most in a month on speculation China will resume gains in the yuan and as international investors plowed more funds into local stocks.

“People are watching the development in the yuan,” said Tarsicio Tong, a currency trader at Union Bank of Taiwan (聯邦銀行) in Taipei. “There’s some hot money coming in.”

The NT dollar appreciated 0.3 percent to NT$31.615 against its US counterpart as of the 4pm close on Friday, according to Taipei Forex Inc. The currency rose 0.5 percent this week.

Tong said the central bank would slow gains in the currency. The NT dollar reached NT$31.534 on Friday, the strongest level since Sept. 8, 2008.

The ringgit strengthened 1.8 percent this week to 3.1900 per US dollar in Kuala Lumpur, according to data compiled by Bloomberg. India’s rupee climbed 1.4 percent to 44.2938 and South Korea’s won appreciated 0.7 percent to 1,118.15.

The Thai baht rose to a 22-month high as speculation the yuan will strengthen helped counter concern that anti-government protests will escalate. The baht strengthened 0.3 percent for the week to 32.25 per US dollar and reached 32.24, the strongest level since May 2008.

Elsewhere, the Singapore dollar increased 0.3 percent in the five days to S$1.3928, the Indonesian rupiah gained 0.5 percent to 9,033 and the Philippine peso advanced 0.5 percent to 44.96.

LONG FLIGHT: The jets would be flown by US pilots, with Taiwanese copilots in the two-seat F-16D variant to help familiarize them with the aircraft, the source said The US is expected to fly 10 Lockheed Martin F-16C/D Block 70/72 jets to Taiwan over the coming months to fulfill a long-awaited order of 66 aircraft, a defense official said yesterday. Word that the first batch of the jets would be delivered soon was welcome news to Taiwan, which has become concerned about delays in the delivery of US arms amid rising military tensions with China. Speaking on condition of anonymity, the official said the initial tranche of the nation’s F-16s are rolling off assembly lines in the US and would be flown under their own power to Taiwan by way

OBJECTS AT SEA: Satellites with synthetic-aperture radar could aid in the detection of small Chinese boats attempting to illegally enter Taiwan, the space agency head said Taiwan aims to send the nation’s first low Earth orbit (LEO) satellite into space in 2027, while the first Formosat-8 and Formosat-9 spacecraft are to be launched in October and 2028 respectively, the National Science and Technology Council said yesterday. The council laid out its space development plan in a report reviewed by members of the legislature’s Education and Culture Committee. Six LEO satellites would be produced in the initial phase, with the first one, the B5G-1A, scheduled to be launched in 2027, the council said in the report. Regarding the second satellite, the B5G-1B, the government plans to work with private contractors

MISSION: The Indo-Pacific region is ‘the priority theater,’ where the task of deterrence extends across the entire region, including Taiwan, the US Pacific Fleet commander said The US Navy’s “mission of deterrence” in the Indo-Pacific theater applies to Taiwan, Pacific Fleet Commander Admiral Stephen Koehler told the South China Sea Conference on Tuesday. The conference, organized by the Center for Strategic and International Studies (CSIS), is an international platform for senior officials and experts from countries with security interests in the region. “The Pacific Fleet’s mission is to deter aggression across the Western Pacific, together with our allies and partners, and to prevail in combat if necessary, Koehler said in the event’s keynote speech. “That mission of deterrence applies regionwide — including the South China Sea and Taiwan,” he

‘OF COURSE A COUNTRY’: The president outlined that Taiwan has all the necessary features of a nation, including citizens, land, government and sovereignty President William Lai (賴清德) discussed the meaning of “nation” during a speech in New Taipei City last night, emphasizing that Taiwan is a country as he condemned China’s misinterpretation of UN Resolution 2758. The speech was the first in a series of 10 that Lai is scheduled to give across Taiwan. It is the responsibility of Taiwanese citizens to stand united to defend their national sovereignty, democracy, liberty, way of life and the future of the next generation, Lai said. This is the most important legacy the people of this era could pass on to future generations, he said. Lai went on to discuss