Asian stocks fell this week for the first time in five weeks on concern the region’s central banks would boost efforts to curb inflation and that EU leaders will fail to agree on an aid package for Greece.

Poly Real Estate Group Co fell 3.2 percent in Shanghai on concern local governments in China are stepping up measures to limit land supply. Li & Fung Ltd (利豐), a trading company that supplies Wal-Mart Stores Inc, slumped 11 percent after reporting lower-than-estimated earnings. PetroChina Co (中石油), China’s biggest energy producer, dropped 5.1 percent after agreeing to take over Australia’s Arrow Energy Ltd. Nintendo Co surged 15 percent in Osaka, Japan, after saying it will sell a 3D video-game console that doesn’t require glasses.

“Investors are increasingly jittery about the inflationary outlook and high levels of sovereign debt,” said Tim Schroeders, who helps manage about US$1.1 billion at Pengana Capital Ltd in Melbourne.

The MSCI Asia-Pacific Index fell 0.4 percent in the past week after India unexpectedly increased its benchmark interest rate on March 19 and as European leaders discussed how to rescue debt-stricken Greece. The index climbed on Friday, on speculation Europe will agree on a bailout.

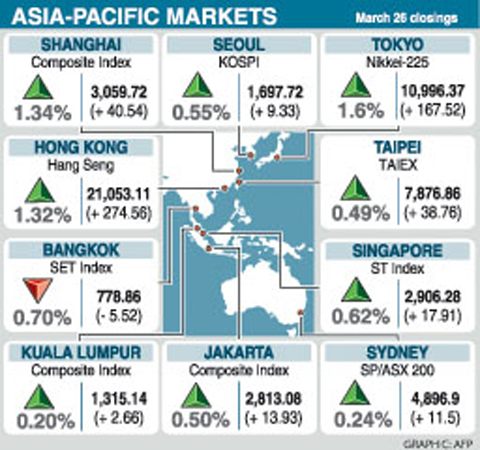

Japan’s Nikkei 225 Stock Average rose 1.6 percent this week to its highest close since October 2008, as a weaker yen boosted the earnings outlook for companies dependent on overseas demand. The market was closed on March 22 for a public holiday.

Hong Kong’s Hang Seng Index fell 1.5 percent this week, and China’s Shanghai Composite Index dropped 0.3 percent. Australia’s S&P/ASX 200 Index gained 0.5 percent, South Korea’s Kospi index gained 0.7 percent.

China’s stocks fell the most in two weeks on Thursday on concern rising trade tensions will hurt the outlook for exports and the government may further tighten policy to curb asset bubbles.

“We’re worried that the currency issue will lead to trade protectionism, which will hurt the global economic recovery,” said Xiao Bo, Beijing-based strategist at Huarong Securities Co. “Government measures to tame inflation are likely to weigh on the market, especially on the property sector.”

The MSCI Asia-Pacific Index has climbed 3.3 percent this year as improving US jobs data, a Federal Reserve pledge to keep borrowing costs low and a Japanese bank-lending program eased concern that budget deficits in Europe will derail the global recovery.

Taiwan’s TAIEX index rose 38.76, or 0.5 percent, to 7,876.86 at the close of Taipei trading on Friday, the third day of gains. The benchmark index fell 0.3 percent this week, the first decline in four weeks.

Gintech Energy Corp (昱晶能源), the nation’s second-largest solar-cell maker, gained 6.4 percent to NT$98, the highest since Dec. 16. Neo Solar Power Corp (新日光) advanced 6.9 percent to NT$76.20, the highest since Jan. 6.

Hon Hai Precision Industry Co (鴻海精密) decreased 1.8 percent to NT$134. The world’s largest contract maker of electronics may buy three Sony television assembly factories in Spain and Slovakia, the Commercial Times reported, citing a Citigroup Inc report on Thursday.

Hon Hai spokesman Edmund Ding (丁祈安) declined to comment. Sony spokesman Hiroshi Okubo declined to comment which TV assembly plants they are planning to sell or whether they are in talks with Hon Hai.

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

A bipartisan group of US representatives have introduced a draft US-Taiwan Defense Innovation Partnership bill, aimed at accelerating defense technology collaboration between Taiwan and the US in response to ongoing aggression by the Chinese Communist Party (CCP). The bill was introduced by US representatives Zach Nunn and Jill Tokuda, with US House Select Committee on the Chinese Communist Party Chairman John Moolenaar and US Representative Ashley Hinson joining as original cosponsors, a news release issued by Tokuda’s office on Thursday said. The draft bill “directs the US Department of Defense to work directly with Taiwan’s Ministry of National Defense through their respective

Tsunami waves were possible in three areas of Kamchatka in Russia’s Far East, the Russian Ministry for Emergency Services said yesterday after a magnitude 7.0 earthquake hit the nearby Kuril Islands. “The expected wave heights are low, but you must still move away from the shore,” the ministry said on the Telegram messaging app, after the latest seismic activity in the area. However, the Pacific Tsunami Warning System in Hawaii said there was no tsunami warning after the quake. The Russian tsunami alert was later canceled. Overnight, the Krasheninnikov volcano in Kamchatka erupted for the first time in 600 years, Russia’s RIA