Wall Street heads into next week packing a better than expected February jobs report that has fired up visions of stronger economic recovery that could prove a turning point for equities.

The US Labor Department’s monthly report revealed on Friday that Mother Nature’s wintry blasts were no match for a US economy gaining steam. Stocks soared on the news, forging gains over the week after last week’s losses.

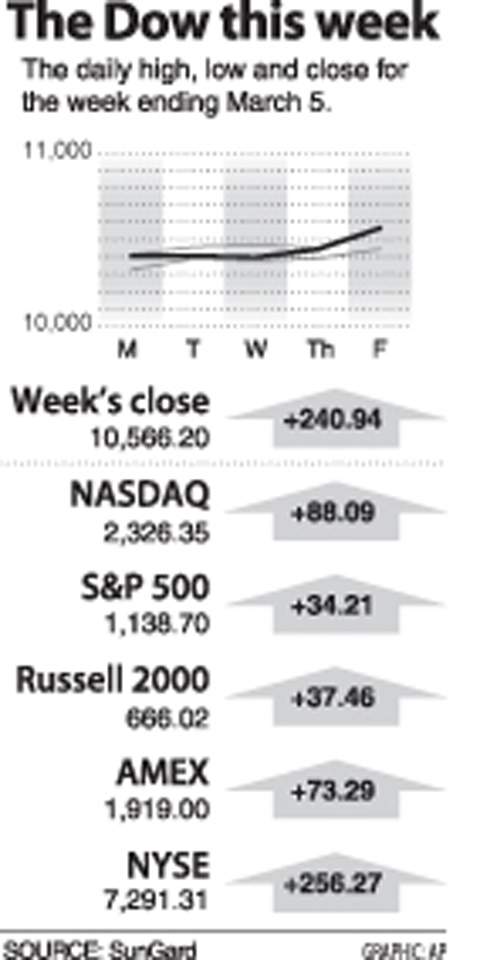

The Dow Jones Industrial Average rose 2.33 percent to close at 10,566.20. It was the first time the blue-chip Dow topped the 10,500-point threshold since January 20.

The technology-rich NASDAQ composite leaped 3.94 percent over the week to 2,326.35, its highest level since September 2008. The broad-market Standard & Poor’s 500 index advanced 3.10 percent to 1,138.70 points.

The market spent much of the past week waiting for the government’s monthly labor market report, largely shrugging off negative news as it braced for the key indicator of economic momentum, which this time delivered a powerful lift to sentiment.

The Labor Department said that nonfarm payrolls fell by 36,000, surprising most analysts who projected 67,000 job losses because of massive snow storms that crippled the country’s northeastern region.

The unemployment rate remained unchanged from 9.7 percent in January, instead of an expected rise to 9.8 percent.

“If this is the kind of jobs report we get with a record blizzard on the East Coast and unusually harsh weather in the Midwest, get ready for a blow-out positive payroll number next month,” said Brian Wesbury at FT Advisors.

Investors got a further boost when the Federal Reserve said consumer credit rose 2.4 percent or US$5 billion in January from December, the first rise since January 2009 and the biggest since July 2008.

“This was seen as a sign that Americans are gaining confidence in the economy. The report also suggested that banks may be more willing to lend money,” Scott Marcouiller at Wells Fargo Advisors said.

The market will find little new economic fuel in the next week to keep the momentum going, which could test the strength of investors’ convictions in the sustainability of the recovery.

The data calendar is relatively light throughout the week until Thursday, when the government reports the January trade balance and weekly initial unemployment claims.

Retail sales is the highlight on Friday, when investors will be looking to see if there is an increase in consumer spending, which accounts for two-thirds of economic activity and is crucial for recovery.

“The January trade balance is expected to widen slightly in response to higher oil prices,” IHS Global Insight economists Brian Bethune and Nigel Gaust said in a client note.

“February retail sales are expected to be close to flat — lower auto sales are expected to be offset by higher sales in other major channels,” they said.

Market action in the week ahead is “difficult to predict” given the dearth of major economic indicators, said Hugh Johnson of Johnson Illington Advisors.

“The mood started to pick up primarily because it looks as though the economy has not been hurt as much by the bad weather as we thought.”

Bonds slumped over the week. The yield on the 10-year Treasury bond rose to 3.682 percent Friday from 3.595 percent a week earlier and that on the 30-year bond climbed to 4.639 percent from 4.529 percent. Bond yields and prices move in opposite directions.

NEXT GENERATION: The four plants in the Central Taiwan Science Park, designated Fab 25, would consist of four 1.4-nanometer wafer manufacturing plants, TSMC said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) plans to begin construction of four new plants later this year, with the aim to officially launch production of 2-nanometer semiconductor wafers by late 2028, Central Taiwan Science Park Bureau director-general Hsu Maw-shin (許茂新) said. Hsu made the announcement at an event on Friday evening celebrating the Central Taiwan Science Park’s 22nd anniversary. The second phase of the park’s expansion would commence with the initial construction of water detention ponds and other structures aimed at soil and water conservation, Hsu said. TSMC has officially leased the land, with the Central Taiwan Science Park having handed over the

AUKUS: The Australian Ambassador to the US said his country is working with the Pentagon and he is confident that submarine issues will be resolved Australian Ambassador to the US Kevin Rudd on Friday said that if Taiwan were to fall to China’s occupation, it would unleash China’s military capacities and capabilities more broadly. He also said his country is working with the Pentagon on the US Department of Defense’s review of the AUKUS submarine project and is confident that all issues raised will be resolved. Rudd, who served as Australian prime minister from 2007 to 2010 and for three months in 2013, made the remarks at the Aspen Security Forum in Colorado and stressed the longstanding US-Australia alliance and his close relationship with the US Undersecretary

‘WORLD WAR III’: Republican Representative Marjorie Taylor Greene said the aid would inflame tensions, but her amendment was rejected 421 votes against six The US House of Representatives on Friday passed the Department of Defense Appropriations Act for fiscal 2026, which includes US$500 million for Taiwan. The bill, which totals US$831.5 billion in discretionary spending, passed in a 221-209 vote. According to the bill, the funds for Taiwan would be administered by the US Defense Security Cooperation Agency and would remain available through Sept. 30, 2027, for the Taiwan Security Cooperation Initiative. The legislation authorizes the US Secretary of Defense, with the agreement of the US Secretary of State, to use the funds to assist Taiwan in procuring defense articles and services, and military training. Republican Representative

TAIWAN IS TAIWAN: US Representative Tom Tiffany said the amendment was not controversial, as ‘Taiwan is not — nor has it ever been — part of Communist China’ The US House of Representatives on Friday passed an amendment banning the US Department of Defense from creating, buying or displaying any map that shows Taiwan as part of the People’s Republic of China (PRC). The “Honest Maps” amendment was approved in a voice vote on Friday as part of the Department of Defense Appropriations Act for the 2026 fiscal year. The amendment prohibits using any funds from the act to create, buy or display maps that show Taiwan, Kinmen, Matsu, Penghu, Wuciou (烏坵), Green Island (綠島) or Orchid Island (Lanyu, 蘭嶼) as part of the PRC. The act includes US$831.5 billion in