Renewed fears on the US economic recovery have shaken confidence on Wall Street, where stocks registered a fourth straight weekly decline, leaving the market looking for a catalyst to emerge from its malaise.

In the week to Friday, market action was volatile, with the Dow Jones Industrial Average losing 0.55 percent to 10,012.23.

Action was especially tense on Friday, with the blue-chip index plunging to as low as 9,835 before snapping back to hold above the key psychological level of 10,000.

The technology-dominated NASDAQ composite slipped 0.29 percent for the week to 2,141.12 and the broad Standard & Poor’s 500 index shed 0.72 percent to 1,066.19, amid roller-coaster market action.

Several rally attempts over the past week have faltered in the wake of disappointing US economic news and growing concerns about debt problems in Greece that appear to be spreading to other eurozone members.

“You are looking at a slow upturn in the eurozone ... which makes it harder for the rest of the world to grow,” said Jay Bryson, economist at Wells Fargo.

“If this crisis becomes more generalized you may see stock markets continue to retreat, with credit markets getting tougher. In the worst case scenario we could have another downturn,” Bryson said.

Kent Engelke, chief economic strategist at Capitol Securities Management, also cited fears of faltering global growth.

“Markets are concerned about massive deficits and the perceived lack of political and social will to rein in expenditures of the PIGS countries — Portugal, Italy, Greece and Spain,” he said.

Closer to home, markets failed to take comfort from US economic data including a disappointing report showing a loss of a further 20,000 jobs last month.

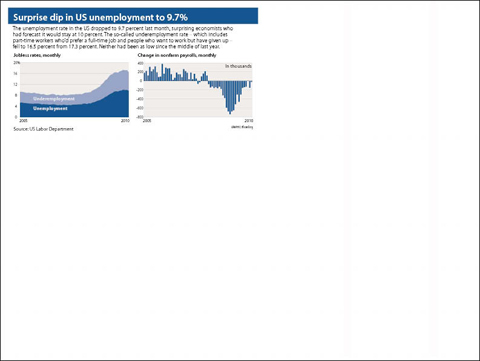

The monthly US Labor Department report contained mixed signals including a drop in the unemployment rate to 9.7 percent from 10 percent in December. However, many said the job market was still far from recovery.

“Taking a big picture viewpoint, the US labor market remains fundamentally weak,” said David Rosenberg, chief economist and strategist at Gluskin Sheff & Associates.

“Despite the clarion calls for recovery from the legions of Wall Street economists and strategists, the reality is that labor market gaps remain very wide; here we are more than two years after the recession officially started and the ranks of the long-term unemployed continue to swell,” Rosenberg added.

Others said the crisis was not quite over yet.

“It remains clear to us that the world simply cannot emerge from the worst financial crisis in modern history without working up a sweat and shaking investors out of any complacency that develops along the way to recovery,” John Stoltzfus at Ticonderoga Securities said.

Some analysts argue that the market is undergoing a normal “correction” and would steady once the selling pressure is exhausted.

“The correcting trend continues, and now that it is into an oversold condition, we watch for signs of a bottom,” Bob Dickey at RBC Wealth Management said. “Given the rapid increase in the bearish sentiment, we are more inclined to believe the correction will end in a selling climax, potentially sparked by a news event.”

Philip Orlando, chief equity strategist at Federated Investors, said “market psychology remains decidedly fragile and negative, as we now find ourselves mired in a sharp correction.”

However, he said he anticipates a recovery fueled by low interest rates, a steadying economy, solid corporate results and the relatively cheap valuation of stocks.

Bonds were favored as a haven from the stock market turmoil. The yield on the 10-year Treasury bond fell to 3.546 percent from 3.609 percent a week earlier and that on the 30-year bond dropped to 4.493 percent from 4.510 percent.

In the coming week, the key economic data will be Thursday’s release of US retail sales figures, while more earnings reports are due, notably from Walt Disney and Coca-Cola.

The paramount chief of a volcanic island in Vanuatu yesterday said that he was “very impressed” by a UN court’s declaration that countries must tackle climate change. Vanuatu spearheaded the legal case at the International Court of Justice in The Hague, Netherlands, which on Wednesday ruled that countries have a duty to protect against the threat of a warming planet. “I’m very impressed,” George Bumseng, the top chief of the Pacific archipelago’s island of Ambrym, told reporters in the capital, Port Vila. “We have been waiting for this decision for a long time because we have been victims of this climate change for

MASSIVE LOSS: If the next recall votes also fail, it would signal that the administration of President William Lai would continue to face strong resistance within the legislature The results of recall votes yesterday dealt a blow to the Democratic Progressive Party’s (DPP) efforts to overturn the opposition-controlled legislature, as all 24 Chinese Nationalist Party (KMT) lawmakers survived the recall bids. Backed by President William Lai’s (賴清德) DPP, civic groups led the recall drive, seeking to remove 31 out of 39 KMT lawmakers from the 113-seat legislature, in which the KMT and the Taiwan People’s Party (TPP) together hold a majority with 62 seats, while the DPP holds 51 seats. The scale of the recall elections was unprecedented, with another seven KMT lawmakers facing similar votes on Aug. 23. For a

Taiwan must invest in artificial intelligence (AI) and robotics to keep abreast of the next technological leap toward automation, Vice President Hsiao Bi-khim (蕭美琴) said at the luanch ceremony of Taiwan AI and Robots Alliance yesterday. The world is on the cusp of a new industrial revolution centered on AI and robotics, which would likely lead to a thorough transformation of human society, she told an event marking the establishment of a national AI and robotics alliance in Taipei. The arrival of the next industrial revolution could be a matter of years, she said. The pace of automation in the global economy can

All 24 lawmakers of the main opposition Chinese Nationalists Party (KMT) on Saturday survived historical nationwide recall elections, ensuring that the KMT along with Taiwan People’s Party (TPP) lawmakers will maintain opposition control of the legislature. Recall votes against all 24 KMT lawmakers as well as Hsinchu Mayor Ann Kao (高虹安) and KMT legislative caucus whip Fu Kun-chi (傅崐萁) failed to pass, according to Central Election Commission (CEC) figures. In only six of the 24 recall votes did the ballots cast in favor of the recall even meet the threshold of 25 percent of eligible voters needed for the recall to pass,