Wall Street is struggling with renewed fears about the economic outlook and at the same time feeling a chill from a tougher stand from the White House on banks and financial market regulation.

The market was hammered over the past week by worries about the US outlook and trouble in China, where an overheating economy may prompt a credit squeeze that hurts the rest of the global economy.

Also hurting the mood was a tough proposal from US President Barack Obama to curb the size and scope of banks, and growing opposition to US Federal Reserve Chairman Ben Bernanke’s renomination.

In the coming week, markets will deal with the outcome of a Federal Reserve policy meeting, as well as the drama surrounding the Bernanke confirmation. A slew of earnings reports are also expected.

On the economic front, data is expected to show a strong gain in US economic activity in the fourth quarter, but analysts say the figures will likely be skewed by a bounce in inventory activity.

Over the holiday-shortened week, the Dow Jones Industrial Average tumbled 4.12 percent to 10,172.98, in a sharp pullback from 15-month highs.

The tech-rich NASDAQ composite sank 3.61 percent to 2,205.29 the broad Standard & Poor’s 500 index slumped 3.90 percent to 1,091.76.

The recent volatility “is a reflection of how much uncertainty that continues to swirl with respect to the economic landscape and the shape that financial market regulation will take,” said Diana Petramala, economist at TD Bank Financial Group.

Petramala said the markets were roiled by the proposals by Obama to cap the size and scope of bank activity, a plan unveiled after the White House called for a new tax on big financial institutions.

“There is still a question mark around what the future holds for the US banking sector,” she said.

“Adding to investor angst this week was the notion that a global recovery could be slower than expected,” especially with China appearing to be moving to cool activity, she said.

Petramala said data on Thursday on US gross domestic product could show a strong growth rate in the economy of 5 percent, but cautioned that “over half of the bounce in economic activity looks to have been due to a large inventory swing and not to sustainable economic drivers.”

Despite the renewed skittishness, some analysts said Wall Street is seeing an overdue correction, which could take some of the speculative froth out of the market and set the stage for more gains.

“The market seems to want to take a breather, so it found negative spin this week,” said Linda Duessel at Federated Investors.

“At a moment when most everyone is looking for a correction, there probably shouldn’t be a serious one,” she said.

Bob Dickey at RBC Wealth Management said traders have been using the current corporate earnings season to lock in profits, after having pushed up the market in anticipation of positive profit reports.

“The market continues to trade in its backward fashion of pulling back on the good news of so many companies beating their fourth quarter earnings expectations,” Dickey said.

This phenomenon “can help to explain why the market has rallied so strongly over the past nine months and is now giving some back in the face of apparent good news,” he said.

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

SOUTH CHINA SEA? The Philippine president spoke of adding more classrooms and power plants, while skipping tensions with China over disputed areas Philippine President Ferdinand Marcos Jr yesterday blasted “useless and crumbling” flood control projects in a state of the nation address that focused on domestic issues after a months-long feud with his vice president. Addressing a joint session of congress after days of rain that left at least 31 dead, Marcos repeated his recent warning that the nation faced a climate change-driven “new normal,” while pledging to investigate publicly funded projects that had failed. “Let’s not pretend, the people know that these projects can breed corruption. Kickbacks ... for the boys,” he said, citing houses that were “swept away” by the floods. “Someone has

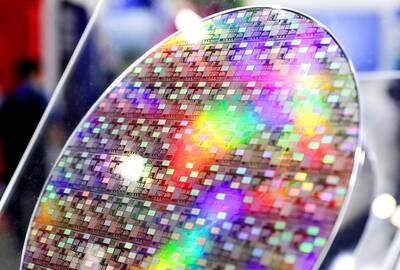

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole