Asian stocks rose for the second week, capping the MSCI Asia-Pacific Index’s biggest annual gain since 2003, after China raised its economic growth figures and Japan said industrial production increased.

“The global economy is just about bottoming out,” said Masaru Hamasaki, chief strategist at Tokyo-based Toyota Asset Management Co, which oversees the equivalent of US$14 billion. “I don’t expect huge economic growth, but I do see things recovering.”

The MSCI Asia-Pacific Index rose 0.7 percent to 120.45 in a holiday-shortened week. The gauge climbed 34 percent last year, its biggest annual gain since 2003, on signs government spending and lower interest rates are bolstering economies.

Japan’s Nikkei 225 Stock Average rose 0.5 percent in the country’s three-day trading week, after factory output increased in November from October and the government said on Dec. 25 that gross domestic product will probably expand 1.4 percent in the year starting April 1.

The Nikkei 225 has plunged 73 percent since it climbed to an intraday record of 38,957.44 on the final business day of 1989, the world’s worst performer in the period. Japan’s broader TOPIX index rose 5.6 percent this year, the lowest return among benchmark equity gauges for the world’s 10 largest markets.

Hong Kong’s Hang Seng Index and Australia’s S&P/ASX 200 Index both climbed 1.7 percent this week.

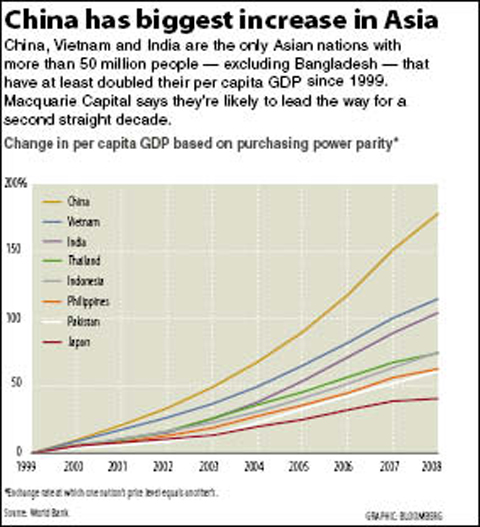

The Shanghai Composite Index advanced 4.3 percent this week as China raised its 2008 growth estimate to 9.6 percent from 9 percent on Dec. 25, and said last year’s quarterly figures will also increase.

“Consumer stocks are good bets as they will receive most of the government support next year,” Wei Wei, an analyst at West China Securities Co in Shanghai, said on Monday. Chinese central bank Governor Zhou Xiaochuan (周小川) said on Thursday the People’s Bank of China would maintain a “moderately loose” monetary policy.

The Shanghai Composite Index rallied 80 percent last year as government spending and a credit boom helped the nation’s economy recover from its steepest slump in more than a decade.

Taiwanese share prices are expected to see further upside in the week ahead on positive sentiment over the outlook for this year after the market gained 78.3 percent over the year, dealers said.

Foreign institutional investors are likely to rebuild their portfolios at the beginning of a new year, they said, adding high liquidity may continue to boost the market.

The market is expected to challenge 8,300 points or even go higher next week amid optimism over the global economic recovery. For the week to Thursday, the weighted index rose 215.52 points, or 2.70 percent, to 8,188.11 after a 2.82 percent increase a week earlier.

“After the market stood above the key 8,000 point level (for the first time since mid-June 2008) earlier this week, more and more investors are looking into a good 2010,” Grand Cathay Securities Corp (大華證券) analyst Mars Hsu said.

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

SOUTH CHINA SEA? The Philippine president spoke of adding more classrooms and power plants, while skipping tensions with China over disputed areas Philippine President Ferdinand Marcos Jr yesterday blasted “useless and crumbling” flood control projects in a state of the nation address that focused on domestic issues after a months-long feud with his vice president. Addressing a joint session of congress after days of rain that left at least 31 dead, Marcos repeated his recent warning that the nation faced a climate change-driven “new normal,” while pledging to investigate publicly funded projects that had failed. “Let’s not pretend, the people know that these projects can breed corruption. Kickbacks ... for the boys,” he said, citing houses that were “swept away” by the floods. “Someone has

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole