Wall Street enters the first trading week of the year on a bullish note, but the market remains dogged by concerns on the timing of any interest rate hike by the Federal Reserve amid economy recovery.

The US central bank may shed some light on how the central bank will unwind its unconventional monetary policy that helped jolt the world’s largest economy from prolonged recession.

Fed Chairman Ben Bernanke is scheduled to speak to the American Economic Association forum in Atlanta tiday, while the minutes of the Dec. 15-16 Fed policy-making body meeting will be released on Wednesday.

They could provide more detailed clues on the Fed’s updated outlook for the economy and evolving plans for an eventual “exit” strategy from virtually zero interest rates, with the market flush with liquidity.

“We still expect the Fed to stick to its guns on the current low-interest policy through at least the first half of 2010,” said IHS Global Insight US economists Brian Bethune and Nigel Gault in a joint report.

They cited both inflation and output, which were “running below the Fed’s target,” as well as tight credit conditions and constrained demand for credit.

Wall Street stocks slumped at the close of a turbulent year on Thursday, after positive jobs data sparked concerns that interest rates may rise sooner than anticipated.

However, shares settled only slightly below their 52-week highs with strong gains for the year.

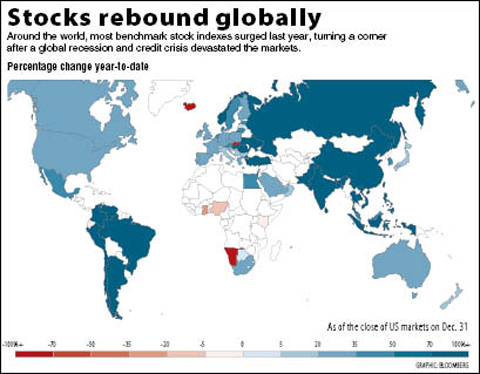

For the holiday-shortened week, the blue-chip Dow Jones Industrial Average lost 0.9 percent to 10,428.05, but gained 18.82 percent over the course of the year.

The technology-rich NASDAQ composite shed 0.7 percent for the week to 2,269.15 and the broad-market Standard & Poor’s 500 index retreated 1 percent to 1,115.10.

The NASDAQ index racked up the largest percentage gain for the year, wrapping up the year with a 43.9 percent jump, while the S&P 500 index jumped 23.5 percent.

Analysts are confident the market will continue its ascent, considering the 2.2 percent US economic growth chalked up in the July-September period — the first quarter of recovery after a year of contraction — as well as rising existing-home sales and durable-goods orders.

For the week, bonds were mixed. The yield on the 10-year Treasury bond rose to 3.843 percent from 3.807 percent a week earlier while that on the 30-year bond dipped to 4.641 percent from 4.687 percent. Bond yields and prices move in opposite directions.

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

SOUTH CHINA SEA? The Philippine president spoke of adding more classrooms and power plants, while skipping tensions with China over disputed areas Philippine President Ferdinand Marcos Jr yesterday blasted “useless and crumbling” flood control projects in a state of the nation address that focused on domestic issues after a months-long feud with his vice president. Addressing a joint session of congress after days of rain that left at least 31 dead, Marcos repeated his recent warning that the nation faced a climate change-driven “new normal,” while pledging to investigate publicly funded projects that had failed. “Let’s not pretend, the people know that these projects can breed corruption. Kickbacks ... for the boys,” he said, citing houses that were “swept away” by the floods. “Someone has

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole