Asian currencies fell this week, led by the South Korean won and Indian rupee, as emerging markets took a beating after Dubai sought to delay debt payments, bolstering demand for safety in US Treasuries and the US dollar.

The MSCI Asia-Pacific Index of local shares slumped to the lowest level in almost eight weeks. The greenback rose against 15 of 16 major currencies on Friday after state-owned Dubai World, with US$59 billion of liabilities, requested a “standstill” agreement from creditors. The Philippine peso dropped after data on Thursday showed third-quarter growth fell short of analysts’ estimates.

“Dubai prompted a wave of risk aversion globally,” said Mitul Kotecha, Hong Kong-based head of global foreign-exchange strategy at Calyon, the investment-banking unit of France’s Credit Agricole SA. “We see Asian currencies a bit vulnerable in this environment. It’s not going to be a huge fallout because Asia looks more solid in terms of fundamentals.”

The won on Friday dropped 1.7 percent to 1,175.35 per US dollar and was down 1.4 percent on the week, the biggest loss in five, according to data compiled by Bloomberg. India’s rupee declined 0.4 percent to 46.6387 and fell 0.01 percent from Nov. 20. Markets in Indonesia, Singapore and Malaysia were closed on Friday.

South Korea’s financial companies were owed a combined US$32 million from Dubai World and its property unit Nakheel PJSC as of the end of September, the MoneyToday newspaper reported, citing the nation’s financial regulator.

The New Taiwan dollar dropped 0.3 percent this week to NT$32.345.

The Philippine peso declined 0.8 percent in Manila on Friday to 47.205 and lost 0.3 percent for the week.

Thailand’s baht was down 0.1 percent from the end of last week at 33.26 per dollar. The Malaysian ringgit declined 0.2 percent to 3.3910 and Indonesia’s rupiah fell 0.7 percent to 9,535 from a week ago. The Singapore dollar dropped 0.1 percent to S$1.3897.

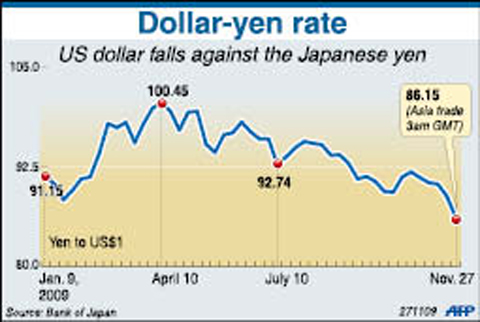

The US dollar dropped to the lowest level versus the yen since July 1995 and fell against the euro as the Federal Reserve’s signal that it would tolerate a weaker greenback encouraged investors to buy higher-yielding assets outside the US.

The US currency touched as low as ¥84.83 on Friday, the weakest in 14 years, spurring speculation Japan would intervene to curtail gains in its currency. For the week, the greenback fell 2.6 percent to ¥86.57, the fifth consecutive weekly decline.

The greenback declined 0.7 percent to US$1.4962 per euro from US$1.4862 last Friday. The yen rose 2 percent to ¥129.41 per euro, from ¥132.09. The US currency fell 2.8 percent to ¥86.49, from ¥88.88.

The US dollar has depreciated 7 percent against the euro, 4.5 percent against the yen and 13 percent versus the pound this year.

NEXT GENERATION: The four plants in the Central Taiwan Science Park, designated Fab 25, would consist of four 1.4-nanometer wafer manufacturing plants, TSMC said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) plans to begin construction of four new plants later this year, with the aim to officially launch production of 2-nanometer semiconductor wafers by late 2028, Central Taiwan Science Park Bureau director-general Hsu Maw-shin (許茂新) said. Hsu made the announcement at an event on Friday evening celebrating the Central Taiwan Science Park’s 22nd anniversary. The second phase of the park’s expansion would commence with the initial construction of water detention ponds and other structures aimed at soil and water conservation, Hsu said. TSMC has officially leased the land, with the Central Taiwan Science Park having handed over the

AUKUS: The Australian Ambassador to the US said his country is working with the Pentagon and he is confident that submarine issues will be resolved Australian Ambassador to the US Kevin Rudd on Friday said that if Taiwan were to fall to China’s occupation, it would unleash China’s military capacities and capabilities more broadly. He also said his country is working with the Pentagon on the US Department of Defense’s review of the AUKUS submarine project and is confident that all issues raised will be resolved. Rudd, who served as Australian prime minister from 2007 to 2010 and for three months in 2013, made the remarks at the Aspen Security Forum in Colorado and stressed the longstanding US-Australia alliance and his close relationship with the US Undersecretary

‘WORLD WAR III’: Republican Representative Marjorie Taylor Greene said the aid would inflame tensions, but her amendment was rejected 421 votes against six The US House of Representatives on Friday passed the Department of Defense Appropriations Act for fiscal 2026, which includes US$500 million for Taiwan. The bill, which totals US$831.5 billion in discretionary spending, passed in a 221-209 vote. According to the bill, the funds for Taiwan would be administered by the US Defense Security Cooperation Agency and would remain available through Sept. 30, 2027, for the Taiwan Security Cooperation Initiative. The legislation authorizes the US Secretary of Defense, with the agreement of the US Secretary of State, to use the funds to assist Taiwan in procuring defense articles and services, and military training. Republican Representative

TAIWAN IS TAIWAN: US Representative Tom Tiffany said the amendment was not controversial, as ‘Taiwan is not — nor has it ever been — part of Communist China’ The US House of Representatives on Friday passed an amendment banning the US Department of Defense from creating, buying or displaying any map that shows Taiwan as part of the People’s Republic of China (PRC). The “Honest Maps” amendment was approved in a voice vote on Friday as part of the Department of Defense Appropriations Act for the 2026 fiscal year. The amendment prohibits using any funds from the act to create, buy or display maps that show Taiwan, Kinmen, Matsu, Penghu, Wuciou (烏坵), Green Island (綠島) or Orchid Island (Lanyu, 蘭嶼) as part of the PRC. The act includes US$831.5 billion in