Dow Jones & Co Inc has been talking to potential buyers about the sale of its stock market index business, including the Dow Jones industrial average, the company’s Wall Street Journal reported on its Web site.

WSJ.com, citing people familiar with the matter, reported on Friday that Goldman Sachs was leading the discussions on behalf of Dow Jones, a division of Rupert Murdoch’s News Corp since it was purchased in 2007 for US$5.7 billion.

Since then, Murdoch has come under criticism for paying such a hefty price for a publishing company whose businesses have suffered from the sharp drop in ad sales. Earlier this year, News Corp wrote down US$2.8 billion in Dow Jones’ value.

Even though the index business is not dependent on advertising — making it a steadier revenue source during downturns — industry analysts never felt it was much favored by Murdoch, a passionate backer of newspapers and one of the best-known media moguls.

Indeed, a number of analysts expected him to consider a sale of the index business soon after striking the deal for Dow Jones. Representatives for News Corp declined to comment.

Potential buyers might include McGraw-Hill Co’s Standard & Poor’s, Russell Indexes, MSCI Inc, Bloomberg, Pearson PLC’s Financial Times and Thomson Reuters Corp. All of those companies declined to comment.

The Wall Street Journal, in its report, said the process was still in its early stages, and could result in an arrangement other than a sale, like a joint venture.

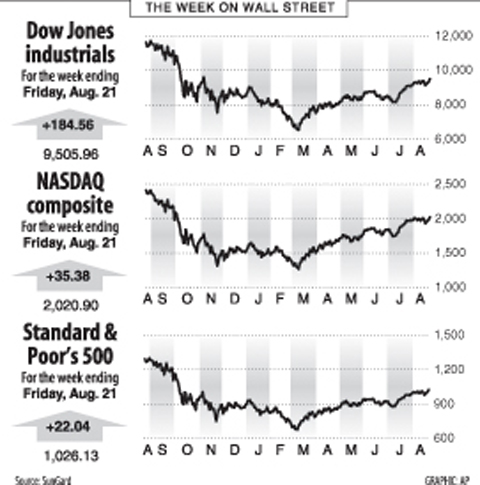

Anchored by the Dow Jones industrial average, the best-known measurement of US stocks, the company’s indexes business creates and licenses trading indexes.

Dow Jones Indexes has more than 700 licensees and a supporting staff of more than 160. It has offices in New York, Boston, Los Angeles, Princeton, London, Paris, Stockholm, Zurich, Madrid, Frankfurt, Hong Kong and Beijing.

Charles Dow, Edward Jones and Charles Bergstresser introduced the index in 1884, and today it contains such corporate blue-chips as General Electric Co, IBM and McDonald’s Corp.

Because the name is so well known — even if the index itself has been somewhat eclipsed by broader measurements like the Standard & Poor’s 500 in recent years — any buyer would face a dilemma: Change the name and use it for branding; or keep it, stick with tradition and miss out on the opportunity to market a new brand.

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

SOUTH CHINA SEA? The Philippine president spoke of adding more classrooms and power plants, while skipping tensions with China over disputed areas Philippine President Ferdinand Marcos Jr yesterday blasted “useless and crumbling” flood control projects in a state of the nation address that focused on domestic issues after a months-long feud with his vice president. Addressing a joint session of congress after days of rain that left at least 31 dead, Marcos repeated his recent warning that the nation faced a climate change-driven “new normal,” while pledging to investigate publicly funded projects that had failed. “Let’s not pretend, the people know that these projects can breed corruption. Kickbacks ... for the boys,” he said, citing houses that were “swept away” by the floods. “Someone has

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole