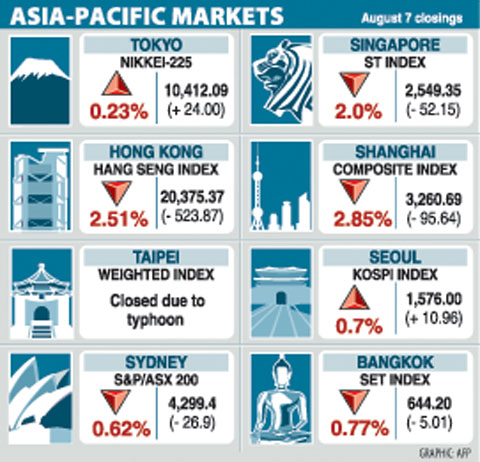

Asian stocks dropped, snapping three weeks of gains, on concern China will curb lending to avert a bubble in equities and after Nikon Corp and DBS Group Holdings Ltd reported declining earnings.

China’s Shanghai Composite Index fell the most since February. Nikon, Japan’s biggest maker of steppers used in microchip production, slumped 12 percent after forecasting a record loss. DBS, Southeast Asia’s biggest bank, sank 7.5 percent in Singapore as provisions for bad loans surged.

HSBC Holdings PLC, Europe’s biggest bank, climbed 8.7 percent in Hong Kong on better-than-estimated profit.

The MSCI Asia-Pacific Index declined 1 percent to 110.74 this week, with about twice as many stocks retreating as gaining. The gauge has climbed 57 percent from its March 9 five-year low on speculation a recovering global economy will boost earnings. Japan’s Nikkei 225 Stock Average added 0.5 percent to a 10-month high, and most Asian benchmark indexes advanced.

“I’m a bit more cautious, as valuations have run ahead of fundamentals following the recent rally,” said Ivan Tham, Singapore-based head of fund management at state-backed Kuwait Finance House, which has about US$24 billion in assets. “There are early indications that the economy is bottoming out.”

Better-than-estimated earnings and economic reports worldwide have driven stocks higher since March, lifting the average valuation of companies on the MSCI Asia-Pacific Index to 24 times estimated profit as of yesterday, near this year’s high of 26 reached in March.

Data this week showed Australian employers unexpectedly added jobs and pointed to improving manufacturing industries in China, Europe and the US.

The Shanghai Composite sank 4.4 percent as the People’s Bank of China said in a quarterly report released on Thursday that it would fine-tune monetary policy, sparking concern the central bank will rein in lending to avert bubbles in equities and property.

Taiwanese share prices are seen consolidating in the week ahead as investors remain cautious over negative economic data, analysts said..

For the week to Thursday, the weighted index fell 209.06 points, or 2.95 percent, to 6,868.65 after a 1.50 percent increase a week earlier. Average daily turnover stood at NT$138.87 billion (US$4.23 billion), compared with NT$146.38 billion a week ago.

Taiwan’s financial markets were closed on Friday as Typhoon Marakot hit. Trading will resume tomorrow.

“The sentiment is cautious as July consumer prices fell steepest in nearly 39 years ... which showed a lackluster consumption willingness,” said the Chinese-language Liberty Times (the Taipei Times’ sister newspaper).

The Taipei bourse is expected to consolidate in the near term although companies with a positive earning outlook are likely to stage a rebound, the paper said.

Taiwan’s consumer price last month fell for the sixth consecutive month by 2.33 percent year-on-year, while June unemployment hit a record high of 5.94 percent, the government said.

EUROPEAN TARGETS: The planned Munich center would support TSMC’s European customers to design high-performance, energy-efficient chips, an executive said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday said that it plans to launch a new research-and-development (R&D) center in Munich, Germany, next quarter to assist customers with chip design. TSMC Europe president Paul de Bot made the announcement during a technology symposium in Amsterdam on Tuesday, the chipmaker said. The new Munich center would be the firm’s first chip designing center in Europe, it said. The chipmaker has set up a major R&D center at its base of operations in Hsinchu and plans to create a new one in the US to provide services for major US customers,

The Ministry of Transportation and Communications yesterday said that it would redesign the written portion of the driver’s license exam to make it more rigorous. “We hope that the exam can assess drivers’ understanding of traffic rules, particularly those who take the driver’s license test for the first time. In the past, drivers only needed to cram a book of test questions to pass the written exam,” Minister of Transportation and Communications Chen Shih-kai (陳世凱) told a news conference at the Taoyuan Motor Vehicle Office. “In the future, they would not be able to pass the test unless they study traffic regulations

BEIJING’S ‘PAWN’: ‘We, as Chinese, should never forget our roots, history, culture,’ Want Want Holdings general manager Tsai Wang-ting said at a summit in China The Mainland Affairs Council (MAC) yesterday condemned Want Want China Times Media Group (旺旺中時媒體集團) for making comments at the Cross-Strait Chinese Culture Summit that it said have damaged Taiwan’s sovereignty, adding that it would investigate if the group had colluded with China in the matter and contravened cross-strait regulations. The council issued a statement after Want Want Holdings (旺旺集團有限公司) general manager Tsai Wang-ting (蔡旺庭), the third son of the group’s founder, Tsai Eng-meng (蔡衍明), said at the summit last week that the group originated in “Chinese Taiwan,” and has developed and prospered in “the motherland.” “We, as Chinese, should never

‘A SURVIVAL QUESTION’: US officials have been urging the opposition KMT and TPP not to block defense spending, especially the special defense budget, an official said The US plans to ramp up weapons sales to Taiwan to a level exceeding US President Donald Trump’s first term as part of an effort to deter China as it intensifies military pressure on the nation, two US officials said on condition of anonymity. If US arms sales do accelerate, it could ease worries about the extent of Trump’s commitment to Taiwan. It would also add new friction to the tense US-China relationship. The officials said they expect US approvals for weapons sales to Taiwan over the next four years to surpass those in Trump’s first term, with one of them saying