Amid a heady rally in anticipation of an economic rebound, Wall Street faces a gut check in the coming week with data on the US employment market expected to show still-grim conditions.

The US equity market has risen sharply for three consecutive weeks in a surprising rebound fueled in large part by upbeat corporate results and encouraging economic data, bringing the indexes to highs for this year.

Yet debate persists on whether this is a bear market rally or the beginning of a recovery for the market and the economy.

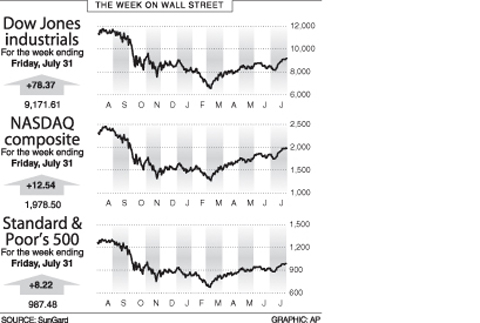

The Dow Jones Industrial Average rose 0.86 percent in the week to Friday to 9,171.61, capping a three-week gain for blue-chips of 12.5 percent and ending last month with a stunning 8.6 percent advance.

The broad-market Standard & Poor’s 500 index added 0.84 percent to 987.48 and the tech-dominated NASDAQ increased 0.64 percent to 1,978.50.

Over the first seven months of the year, the S&P is up 9.3 percent and the NASDAQ has rallied 25.4 percent, while the Dow is up a more modest 4.5 percent.

Analysts say investors are sensing better times ahead, and are putting cash back to work in the stock market.

“The stock market was deeply depressed back in March, and thus the preconditions for a rally were very much in place,” Al Goldman at Wells Fargo Advisors said.

“The economic news started to be ‘less bad’ — a nice change — but the big reason for the market rally has been corporate earnings. Second-quarter earnings have come in well ahead of projections, which increased confidence that our economy was close to the end of the recession. And lately some economic data improved from ‘less bad’ to ‘much better,’” Goldman said.

US President Barack Obama said recently he saw “the beginning of the end” of the recession, with job losses easing and many other indicators improving. A number of analysts agree.

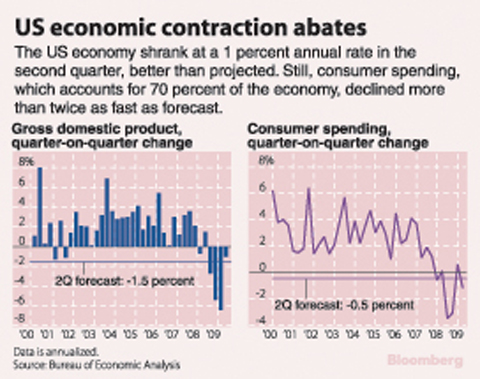

The latest report on GDP showed a 1.0 percent annualized drop in economic activity in the second quarter. It was a fourth consecutive decline but far better than the 6.4 percent drop in the first quarter and indicated momentum may be turning.

In addition to employment figures, the coming week features data on personal income and spending and a survey of the manufacturing sector by the Institute of Supply Management.

Bonds firmed in the past week. The yield on the 10-year Treasury note eased to 3.601 percent from 3.670 percent a week earlier and that on the 30-year bond fell to 4.311 percent from 4.555 percent.

‘ABUSE OF POWER’: Lee Chun-yi allegedly used a Control Yuan vehicle to transport his dog to a pet grooming salon and take his wife to restaurants, media reports said Control Yuan Secretary-General Lee Chun-yi (李俊俋) resigned on Sunday night, admitting that he had misused a government vehicle, as reported by the media. Control Yuan Vice President Lee Hung-chun (李鴻鈞) yesterday apologized to the public over the issue. The watchdog body would follow up on similar accusations made by the Chinese Nationalist Party (KMT) and would investigate the alleged misuse of government vehicles by three other Control Yuan members: Su Li-chiung (蘇麗瓊), Lin Yu-jung (林郁容) and Wang Jung-chang (王榮璋), Lee Hung-chun said. Lee Chun-yi in a statement apologized for using a Control Yuan vehicle to transport his dog to a

BEIJING’S ‘PAWN’: ‘We, as Chinese, should never forget our roots, history, culture,’ Want Want Holdings general manager Tsai Wang-ting said at a summit in China The Mainland Affairs Council (MAC) yesterday condemned Want Want China Times Media Group (旺旺中時媒體集團) for making comments at the Cross-Strait Chinese Culture Summit that it said have damaged Taiwan’s sovereignty, adding that it would investigate if the group had colluded with China in the matter and contravened cross-strait regulations. The council issued a statement after Want Want Holdings (旺旺集團有限公司) general manager Tsai Wang-ting (蔡旺庭), the third son of the group’s founder, Tsai Eng-meng (蔡衍明), said at the summit last week that the group originated in “Chinese Taiwan,” and has developed and prospered in “the motherland.” “We, as Chinese, should never

‘A SURVIVAL QUESTION’: US officials have been urging the opposition KMT and TPP not to block defense spending, especially the special defense budget, an official said The US plans to ramp up weapons sales to Taiwan to a level exceeding US President Donald Trump’s first term as part of an effort to deter China as it intensifies military pressure on the nation, two US officials said on condition of anonymity. If US arms sales do accelerate, it could ease worries about the extent of Trump’s commitment to Taiwan. It would also add new friction to the tense US-China relationship. The officials said they expect US approvals for weapons sales to Taiwan over the next four years to surpass those in Trump’s first term, with one of them saying

INDO-PACIFIC REGION: Royal Navy ships exercise the right of freedom of navigation, including in the Taiwan Strait and South China Sea, the UK’s Tony Radakin told a summit Freedom of navigation in the Indo-Pacific region is as important as it is in the English Channel, British Chief of the Defence Staff Admiral Tony Radakin said at a summit in Singapore on Saturday. The remark came as the British Royal Navy’s flagship aircraft carrier, the HMS Prince of Wales, is on an eight-month deployment to the Indo-Pacific region as head of an international carrier strike group. “Upholding the UN Convention on the Law of the Sea, and with it, the principles of the freedom of navigation, in this part of the world matters to us just as it matters in the