Asian stocks climbed for a sixth week, the longest streak of gains in more than two years, on increasing confidence the worst of the global recession is over.

China Cosco Holdings Co, the world’s largest operator of dry-bulk ships, surged 21 percent on rising Chinese exports and shipping rates. PT Bumi Resources, Asia’s largest exporter of power-station coal, jumped 21 percent in Jakarta as elections strengthened the hold Indonesia’s president has over parliament. JFE Holdings Inc, Japan’s No. 2 steelmaker, soared 22 percent on speculation it won’t make large price cuts and as the government unveiled a record stimulus package.

“We’re probably seeing a bottoming out in the economy,” said Arjuna Mahendran, Singapore-based chief investment strategist for Asia at HSBC Private Bank, which oversees US$494 billion in assets. “The second quarter will be good for stocks as corporate earnings should bounce.”

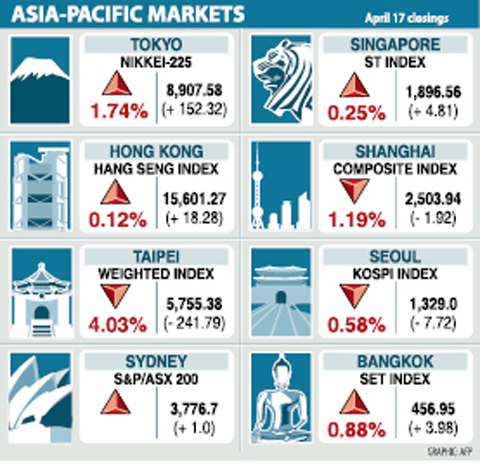

The MSCI Asia-Pacific Index rose 2 percent this week to 89.69, completing the longest stretch of gains since December 2006. Asian markets have rallied 27 percent since the MSCI benchmark dropped to a six-year low on March 9.

Japan’s Nikkei 225 Stock Average lost 0.6 percent. South Korea’s KOSPI index dropped 0.5 percent as brokerages cut recommendations on financial companies. Thailand’s SET Index gained 0.6 percent in a week shortened by new year holidays. The Thai government called a state of emergency following clashes between security forces and protesters in Bangkok.

MSCI’s Asian index plunged by a record 43 percent last year as the credit crunch tipped the world’s largest economies into recession, forcing companies to cut jobs amid slumping profits.

The gauge has rallied 27 percent from a five-year low reached on March 9 amid signs government measures to ease the financial crisis are working. Earnings estimates for companies included in the MSCI benchmark started to rise this month after a year of falling predictions, data compiled by Bloomberg showed.

China’s exports rose 39 percent last month from a month earlier, the customs bureau said on April 10, when Hong Kong markets were shut for a holiday. The Baltic Dry Index, a measure of shipping costs for commodities, jumped 13.8 percent this week. The gauge had slumped as much as 94 percent from a peak in May last year.

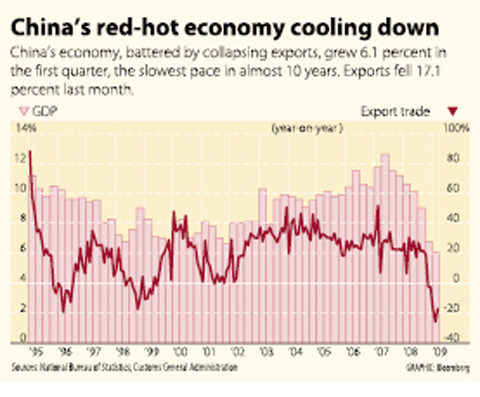

China posted a 6.1 percent annualized growth rate for the first quarter, the slowest rate of expansion in nearly a decade. That may mark the bottom for the world’s third-largest economy as a 4 trillion yuan (US$585 billion) stimulus package cushions the effects of the global recession.

Taiwanese share prices are expected to fall further in the week ahead following steep losses on Friday, with the market having failed to push above the key 6,000 point mark this week, dealers said.

Friday’s decline prompted many investors to be wary of stiff technical resistance ahead of 6,000 points, with the market having gained more than 30 percent since the beginning of last month, they said. Analysts said market sentiment toward the bellwether electronic sector is likely to turn cautious as high-tech heavyweights start to release their first quarter results next week.

However, companies with close business ties to China may attract interest, as they are expected to outperform the broader market, they added.

In the week to Friday, the TAIEX fell 26.58 points, or 0.50 percent, to 5,755.38 after a 4.56 percent increase a week earlier. Average daily turnover stood at NT$168.57 billion (US$4.99 billion), compared with NT$144.05 billion a week ago.

Other markets on Friday:

JAKARTA: Up 0.6 percent. The Jakarta Composite index rose 9.7 points to 1,634.79. The index has risen 24.59 percent over the past month.

MANILA: Up 1.42 percent. The composite index rose 29.47 points to 2,094.13. “Expectations of bad financial figures aren’t coming through,” Eagle Equities president Joseph Roxas said.

WELLINGTON: Up 1.81 percent. The NZX-50 gained 48.13 points to 2,711.29. The focus was on leading stocks and signs of fresh money entering the market, dealers said.

MUMBAI: Up 0.69 percent. The 30-share SENSEX rose 75.69 points to 11,023.09. Stocks shed most intraday gains as investors chose to unwind positions ahead of the weekend, dealers said.

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

SOUTH CHINA SEA? The Philippine president spoke of adding more classrooms and power plants, while skipping tensions with China over disputed areas Philippine President Ferdinand Marcos Jr yesterday blasted “useless and crumbling” flood control projects in a state of the nation address that focused on domestic issues after a months-long feud with his vice president. Addressing a joint session of congress after days of rain that left at least 31 dead, Marcos repeated his recent warning that the nation faced a climate change-driven “new normal,” while pledging to investigate publicly funded projects that had failed. “Let’s not pretend, the people know that these projects can breed corruption. Kickbacks ... for the boys,” he said, citing houses that were “swept away” by the floods. “Someone has

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole