After putting together a remarkable four-week winning streak, Wall Street faces a new test of its rally in the coming week with the opening of earnings season.

Although the market has been lifted by optimism that the worst crisis since the Great Depression is easing, the news from corporate America may provide clues about whether and when recovery is coming, say analysts.

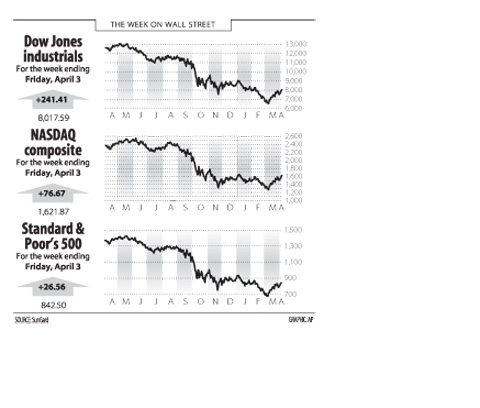

The Dow Jones Industrial Average climbed 3.1 percent in the week to Friday to close at 8,017.59, capping four sizzling weeks that added some 22 percent to the blue-chip index.

The Standard & Poor’s 500 index advanced 3.25 percent to 842.50, capping a 24 percent gain from lows hit on March 9.

The tech-heavy NASDAQ powered higher by 4.96 percent on the week to 1,621.87.

The market managed to shrug off weak economic news in the past few sessions, amid a growing consensus that the worst may be over.

“While the economic news continues to be awful, recent news, including the small incremental bump in auto sales, factory orders and [a purchasing manager survey on] manufacturing, are leading many investors to believe the end of the economic recession is finally coming into sight,” said Fred Dickson, chief market strategist at DA Davidson & Co.

“We are holding to our view that the rate of decline in the economy is beginning to slow, leading us to believe the economy has a good chance of bottoming out this summer,” he said.

Dickson said the rally has gained momentum as short sellers scramble to take profits and cover positions, and money managers with big cash positions “are becoming more nervous about missing the normal big early cycle move that traditionally leads an economic recovery.”

But he said a key test will be upcoming with first-quarter earnings reports that will begin to hit the tape over the next few days.

“That will be a real test to see if the current rally is just a technical rally within the overall context of an ongoing bear market or the first leg of a new bull market,” he said.

“Investors are very focused on what the economy will do in the second and third quarters,” Hugh Johnson at Johnson Illington Advisors said. “To get an idea of what the economy and earnings will do you have to look carefully at these earnings reports.”

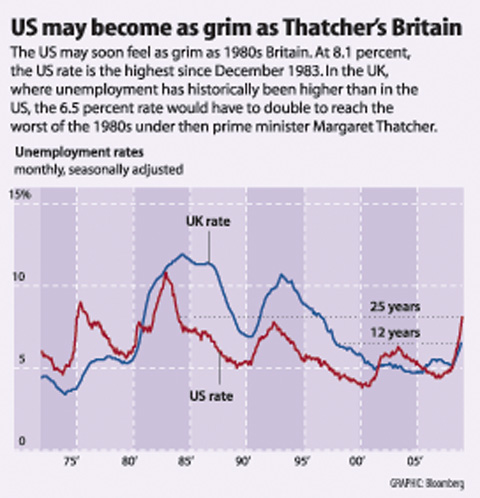

Analysts said the market took in stride Friday’s report showing a rise in the unemployment rate to 8.5 percent as 663,000 jobs were shed.

Douglas Porter, economist at BMO Capital Markets, said the view looking forward is not as bleak as in the rear-view mirror.

“Employment will be among the last major indicators to turn the corner,” he said.

“First, sales must revive, and then be sustained, then business will try to squeeze more out of remaining employees, then add hours to the workweek, and only then add to payrolls. So, even as jobs spiral lower, another broad array of indicators this week suggested that the howling recession winds may be easing a touch.”

Bonds fell sharply for the week on improved appetite for stocks. The yield on the 10-year US Treasury bond rose to 2.907 percent from 2.761 percent a week earlier and that on the 30-year bond increased to 3.721 percent from 3.618 percent. Bond yields and prices move in opposite directions.

The paramount chief of a volcanic island in Vanuatu yesterday said that he was “very impressed” by a UN court’s declaration that countries must tackle climate change. Vanuatu spearheaded the legal case at the International Court of Justice in The Hague, Netherlands, which on Wednesday ruled that countries have a duty to protect against the threat of a warming planet. “I’m very impressed,” George Bumseng, the top chief of the Pacific archipelago’s island of Ambrym, told reporters in the capital, Port Vila. “We have been waiting for this decision for a long time because we have been victims of this climate change for

MASSIVE LOSS: If the next recall votes also fail, it would signal that the administration of President William Lai would continue to face strong resistance within the legislature The results of recall votes yesterday dealt a blow to the Democratic Progressive Party’s (DPP) efforts to overturn the opposition-controlled legislature, as all 24 Chinese Nationalist Party (KMT) lawmakers survived the recall bids. Backed by President William Lai’s (賴清德) DPP, civic groups led the recall drive, seeking to remove 31 out of 39 KMT lawmakers from the 113-seat legislature, in which the KMT and the Taiwan People’s Party (TPP) together hold a majority with 62 seats, while the DPP holds 51 seats. The scale of the recall elections was unprecedented, with another seven KMT lawmakers facing similar votes on Aug. 23. For a

Taiwan must invest in artificial intelligence (AI) and robotics to keep abreast of the next technological leap toward automation, Vice President Hsiao Bi-khim (蕭美琴) said at the luanch ceremony of Taiwan AI and Robots Alliance yesterday. The world is on the cusp of a new industrial revolution centered on AI and robotics, which would likely lead to a thorough transformation of human society, she told an event marking the establishment of a national AI and robotics alliance in Taipei. The arrival of the next industrial revolution could be a matter of years, she said. The pace of automation in the global economy can

All 24 lawmakers of the main opposition Chinese Nationalists Party (KMT) on Saturday survived historical nationwide recall elections, ensuring that the KMT along with Taiwan People’s Party (TPP) lawmakers will maintain opposition control of the legislature. Recall votes against all 24 KMT lawmakers as well as Hsinchu Mayor Ann Kao (高虹安) and KMT legislative caucus whip Fu Kun-chi (傅崐萁) failed to pass, according to Central Election Commission (CEC) figures. In only six of the 24 recall votes did the ballots cast in favor of the recall even meet the threshold of 25 percent of eligible voters needed for the recall to pass,