Asian stocks posted their biggest weekly rally since August 2007 as the US and Japan stepped up measures to ease the financial crisis and revive economic growth.

Mitsubishi UFJ Financial Group Ltd, Japan’s biggest bank, jumped 17 percent in Tokyo after the Federal Reserve joined the Bank of Japan in buying government debt. Commonwealth Bank of Australia, the nation’s largest mortgage lender, rose 12 percent in Sydney after the Reserve Bank of Australia said it has scope to further cut rates. PetroChina Ltd, China’s biggest oil producer, rose 4 percent as crude rose to a three-month high.

“The liquidity injections from the Fed and the Bank of Japan have boosted sentiment in the market,” said Daphne Roth, Singapore-based head of Asia equity research at ABN Amro Private Bank, which manages US$27 billion of Asian assets. “People may start to take profit on this bear-market rally. We’re still a long way from the end of this crisis.”

The MSCI Asia-Pacific Index rose 6.4 percent to 79.53 this week, adding to last week’s 3.9 percent advance.

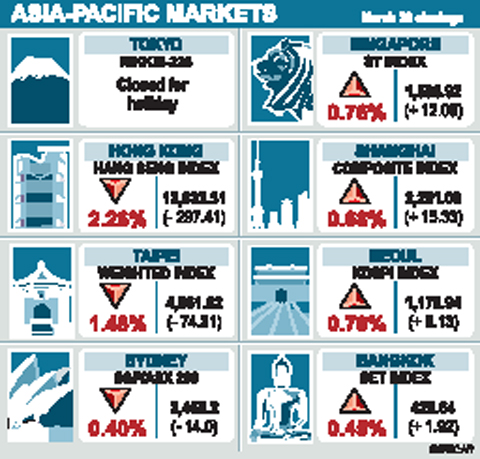

Japan’s Nikkei 225 Stock Average climbed 5 percent in a holiday-shortened week. Hong Kong’s Hang Seng Index rose 2.5 percent. South Korea’s Kospi Index jumped 4 percent.

Standard Chartered PLC, the UK’s second-largest bank by market value, gained 11 percent in Hong Kong after saying it does not need to raise capital.

Taiwanese share prices are expected to move in a narrow range in the week ahead after the index fell below the 5,000-point level following recent gains, dealers said on Friday.

Foreign institutional investors may continue to unload the electronic sector to take advantage of past technical rebounds with high tech heavyweights seen to bear heavier pressure, they said.

Financial stocks are likely to face further selling amid ongoing worries about rising bad loans in an economic meltdown at home and abroad, they added.

However, raw material stocks are likely to gain as these firms are benefiting from a stronger New Taiwan dollar, which is reducing the cost of imports, they said.

Tourism shares may benefit from hopes that warming cross-strait ties will encourage more Chinese tourists to visit the island, dealers said.

There is still resistance to overcome ahead of 5,000 points, while any downside may be capped at around 4,750 points, dealers said.

For the week to Friday, the weighted index rose 64.23 points, or 1.31 percent, to 4,961.62 after a 5.24 percent increase a week earlier.

Average daily turnover stood at NT$110.08 billion (US$3.25 billion), compared with NT$97.19 billion a week ago.

“Institutional investors have started adjusting portfolios, shifting funds from high tech stocks to old economy ones,” Grand Cathay Securities (大華證券) analyst Mars Hsu said.

Hsu expected select steel and food stocks to show their resilience against technical resistance.

“But, gains among old economy stocks are unlikely to be significant enough to help the broader market stand well above the 5,000 point mark,” the analyst said.

Other regional markets on Friday:

KUALA LUMPUR: Up 0.54 percent. The Kuala Lumpur Composite Index rose 4.64 points to 856.82.

JAKARTA: Up 1.4 percent. The Jakarta Composite Index rose 19.29 points to 1,360.89.

MANILA: Up 3.01 percent. The composite index rose 53.64 points to 1,833.90.

WELLINGTON: Down 1.30 percent. The NZX-50 index fell 34.18 points to 2,599.03.

MUMBAI: Down 0.39 percent. The SENSEX index fell 35.07 points to 8,966.68. Shares recovered from the day’s low on overseas fund buying and hopes that India’s central bank may lower rates as inflation heads toward zero, dealers said.

CHAMPIONS: President Lai congratulated the players’ outstanding performance, cheering them for marking a new milestone in the nation’s baseball history Taiwan on Sunday won their first Little League Baseball World Series (LLBWS) title in 29 years, as Taipei’s Dong Yuan Elementary School defeated a team from Las Vegas 7-0 in the championship game in South Williamsport, Pennsylvania. It was Taiwan’s first championship in the annual tournament since 1996, ending a nearly three-decade drought. “It has been a very long time ... and we finally made it,” Taiwan manager Lai Min-nan (賴敏男) said after the game. Lai said he last managed a Dong Yuan team in at the South Williamsport in 2015, when they were eliminated after four games. “There is

Chinese Nationalist Party (KMT) lawmakers have declared they survived recall votes to remove them from office today, although official results are still pending as the vote counting continues. Although final tallies from the Central Election Commission (CEC) are still pending, preliminary results indicate that the recall campaigns against all seven KMT lawmakers have fallen short. As of 6:10 pm, Taichung Legislators Yen Kuan-heng (顏寬恒) and Yang Chiung-ying (楊瓊瓔), Hsinchu County Legislator Lin Szu-ming (林思銘), Nantou County Legislator Ma Wen-chun (馬文君) and New Taipei City Legislator Lo Ming-tsai (羅明才) had all announced they

Nvidia Corp CEO Jensen Huang (黃仁勳) yesterday visited Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), as the chipmaker prepares for volume production of Nvidia’s next-generation artificial intelligence (AI) chips. It was Huang’s third trip to Taiwan this year, indicating that Nvidia’s supply chain is deeply connected to Taiwan. Its partners also include packager Siliconware Precision Industries Co (矽品精密) and server makers Hon Hai Precision Industry Co (鴻海精密) and Quanta Computer Inc (廣達). “My main purpose is to visit TSMC,” Huang said yesterday. “As you know, we have next-generation architecture called Rubin. Rubin is very advanced. We have now taped out six brand new

POWER PLANT POLL: The TPP said the number of ‘yes’ votes showed that the energy policy should be corrected, and the KMT said the result was a win for the people’s voice The government does not rule out advanced nuclear energy generation if it meets the government’s three prerequisites, President William Lai (賴清德) said last night after the number of votes in favor of restarting a nuclear power plant outnumbered the “no” votes in a referendum yesterday. The referendum failed to pass, despite getting more “yes” votes, as the Referendum Act (公民投票法) states that the vote would only pass if the votes in favor account for more than one-fourth of the total number of eligible voters and outnumber the opposing votes. Yesterday’s referendum question was: “Do you agree that the Ma-anshan Nuclear Power Plant