US stocks managed to chalk up back-to-back weeks of gains for the first time in 10 months after the US Federal Reserve provided an unexpected boost to sentiment with an aggressive move to pump up liquidity.

But with investors locking in profits on Friday amid waning enthusiasm over the central bank’s decision to inject another US$1 trillion into the financial system to prop up the economy, analysts said the market was expected to remain cautious.

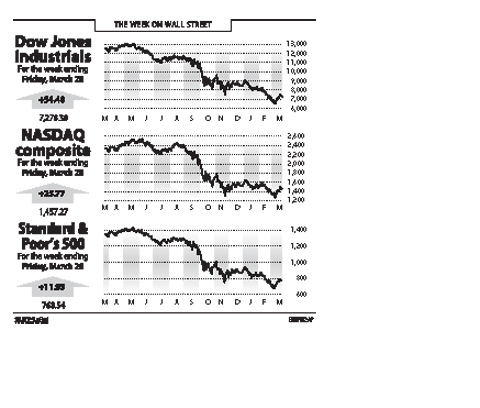

Over the week, the Dow Jones Industrial Average of 30 blue-chips added 0.75 percent to end at 7,278.38 — the first back-to-back weekly gains since May last year — despite two consecutive solid days of red ink on on Thursday and Friday.

The technology-heavy NASDAQ composite rose 1.8 percent to 1,457.27, while the broad-market Standard & Poor’s 500 Index was up 1.58 percent to 768.54 for the week.

“As the market has already experienced two periods of panic selling — late November and early March — we believe the downside risk is limited,” Wachovia Securities chief market strategist Al Goldman said amid increasing investor optimism about the global economy.

Investors are at their most optimistic about the global economy since December 2005, according to the Merrill Lynch Survey of Fund Managers for this month, although a prolonged banking crisis seems to be stopping them from putting cash into equities.

US share prices rose the past week after fresh data showed new US home construction and building permits saw a surprise jump last month from 50-year low levels in a positive sign for the moribund home market at the epicenter of the global financial crisis.

The market turned more buoyant after US Federal Reserve Chairman Ben Bernanke made a surprise announcement on Wednesday on buying up to US$300 billion in Treasury bonds and an additional US$850 billion in other debt in a bid to cut lending costs and fire up the sluggish economy.

But the enthusiasm died down by the end of the week as investors feared that the move carried a huge inflation risk as the more than US$1 trillion in new money might have to be paid for one way or the other, through taxes or higher inflation.

“One conclusion is that the Fed is simply printing money to provide liquidity. By definition this action is always inflationary,” Fred Dickson of DA Davidson & Co said. “What remains to be seen is how long it will take to show up in the prices consumers and businesses pay for goods.”

Although the market is not expecting any bombshells the coming week, it may have to contend with some weak economic numbers.

“We are expecting, however, another string of dismal economic reports,” IHS Global Insight economists said in a report.

They said all indicators pointed to another plunge in existing home sales for last month even if new home sales could stage a modest rebound from an all-time low in January.

A US economic contraction, at 6.2 percent the last quarter, could also be revised to show an even larger drop, the IHS Global Insight report said, forecasting 6.7 percent against an analysts consensus of 6.6 percent.

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

SOUTH CHINA SEA? The Philippine president spoke of adding more classrooms and power plants, while skipping tensions with China over disputed areas Philippine President Ferdinand Marcos Jr yesterday blasted “useless and crumbling” flood control projects in a state of the nation address that focused on domestic issues after a months-long feud with his vice president. Addressing a joint session of congress after days of rain that left at least 31 dead, Marcos repeated his recent warning that the nation faced a climate change-driven “new normal,” while pledging to investigate publicly funded projects that had failed. “Let’s not pretend, the people know that these projects can breed corruption. Kickbacks ... for the boys,” he said, citing houses that were “swept away” by the floods. “Someone has

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole