Asian stocks rose for the first time in five weeks as Japan and China signaled more measures to buttress their economies from the deepening global recession.

PetroChina Co, the nation’s largest oil producer, climbed 12 percent in Hong Kong after crude oil surged and Chinese Premier Wen Jiabao (溫家寶) said China could boost spending plans any time. Mitsubishi UFJ Financial Group Inc, Japan’s biggest bank, gained 4.5 percent in Tokyo after Japanese Prime Minister Taro Aso ordered more economic stimulus measures. Commonwealth Bank of Australia jumped 12 percent, pacing gains among financial companies, as three US banks said earnings were improving.

“Markets can take comfort that countries with the ability to do so are providing fiscal stimulus, rather than waiting till it’s too difficult to fight the momentum,” said Tim Schroeders, who helps manage about US$2.6 billion at Pengana Capital Ltd in Melbourne. “We’re seeing some money parked in safe havens returning to the market.”

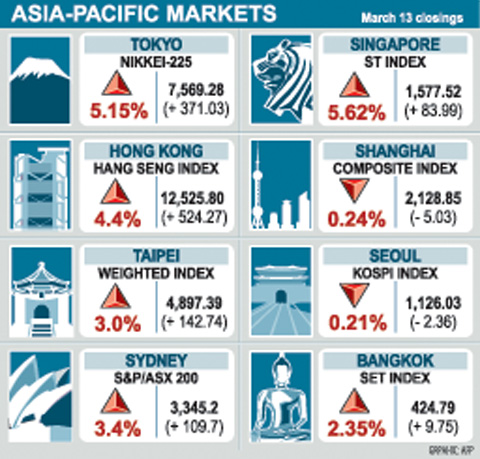

The MSCI Asia-Pacific Index rose 3.9 percent to 74.72 this week, snapping a four-week, 14 percent decline. Japan’s Nikkei 225 Stock Average climbed 5.5 percent to 7,569.28, while Hong Kong’s Hang Seng Index rose 5.1 percent.

Chartered Semiconductor Manufacturing Ltd, the world’s third-biggest maker of customized chips, plunged 48 percent after announcing a US$300 million rights offering. Elpida Memory Inc, Japan’s biggest memory-chip maker, slumped 23 percent after a merger with Taiwanese rivals failed to materialize.

Taiwanese share prices are expected to extend gains next week as more foreign institutional investors return, dealers said.

A stronger New Taiwan dollar against the greenback is likely to prompt foreign investors to buy, they said.

Electronic stocks may continue momentum as investors have embraced high hopes that profitability will improve. The financial sector is also likely to gain.

For the week to Friday, the market rose 243.76 points or 5.24 percent to 4,897.39. Average daily turnover stood at NT$97.19 billion (US$2.82 billion), compared with NT$84.39 billion a week ago.

Since the beginning of last month, the bourse has gained almost 15 percent.

Mega Securities (兆豐證券) analyst Alex Huang (黃國偉) said investors should watch how General Motors resolves its financial difficulties.

“If negative news emerges related to GM, Wall Street may pull back and hurt its foreign counterparts, including Taiwan,” Huang said.

Other markets on Friday:

KUALA LUMPUR: Up 0.6 percent. The Kuala Lumpur Composite Index rose 5.06 points to 843.45.

JAKARTA: Up 1.3 percent. The Jakarta Composite Index rose 17.02 points to 1,327.43.

MANILA: Down 1.2 percent. The composite index lost 23.57 points to 1,856.10.

WELLINGTON: Up 1.28 percent. The benchmark NZX-50 index rose 31.77 points to 2,523.39.

MUMBAI: Up 4.95 percent. The SENSEX rose 412.86 points to 8,756.61. The 30-share index achieved its second straight day of gains on Wall Street’s positive performance.

NEXT GENERATION: The four plants in the Central Taiwan Science Park, designated Fab 25, would consist of four 1.4-nanometer wafer manufacturing plants, TSMC said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) plans to begin construction of four new plants later this year, with the aim to officially launch production of 2-nanometer semiconductor wafers by late 2028, Central Taiwan Science Park Bureau director-general Hsu Maw-shin (許茂新) said. Hsu made the announcement at an event on Friday evening celebrating the Central Taiwan Science Park’s 22nd anniversary. The second phase of the park’s expansion would commence with the initial construction of water detention ponds and other structures aimed at soil and water conservation, Hsu said. TSMC has officially leased the land, with the Central Taiwan Science Park having handed over the

AUKUS: The Australian Ambassador to the US said his country is working with the Pentagon and he is confident that submarine issues will be resolved Australian Ambassador to the US Kevin Rudd on Friday said that if Taiwan were to fall to China’s occupation, it would unleash China’s military capacities and capabilities more broadly. He also said his country is working with the Pentagon on the US Department of Defense’s review of the AUKUS submarine project and is confident that all issues raised will be resolved. Rudd, who served as Australian prime minister from 2007 to 2010 and for three months in 2013, made the remarks at the Aspen Security Forum in Colorado and stressed the longstanding US-Australia alliance and his close relationship with the US Undersecretary

TAIWAN IS TAIWAN: US Representative Tom Tiffany said the amendment was not controversial, as ‘Taiwan is not — nor has it ever been — part of Communist China’ The US House of Representatives on Friday passed an amendment banning the US Department of Defense from creating, buying or displaying any map that shows Taiwan as part of the People’s Republic of China (PRC). The “Honest Maps” amendment was approved in a voice vote on Friday as part of the Department of Defense Appropriations Act for the 2026 fiscal year. The amendment prohibits using any funds from the act to create, buy or display maps that show Taiwan, Kinmen, Matsu, Penghu, Wuciou (烏坵), Green Island (綠島) or Orchid Island (Lanyu, 蘭嶼) as part of the PRC. The act includes US$831.5 billion in

‘WORLD WAR III’: Republican Representative Marjorie Taylor Greene said the aid would inflame tensions, but her amendment was rejected 421 votes against six The US House of Representatives on Friday passed the Department of Defense Appropriations Act for fiscal 2026, which includes US$500 million for Taiwan. The bill, which totals US$831.5 billion in discretionary spending, passed in a 221-209 vote. According to the bill, the funds for Taiwan would be administered by the US Defense Security Cooperation Agency and would remain available through Sept. 30, 2027, for the Taiwan Security Cooperation Initiative. The legislation authorizes the US Secretary of Defense, with the agreement of the US Secretary of State, to use the funds to assist Taiwan in procuring defense articles and services, and military training. Republican Representative