European stocks ended a four-week losing streak after Citigroup Inc, JPMorgan Chase & Co and Bank of America Corp said they were profitable, fueling speculation the worst of the banking crisis may be over.

Dexia SA, the world’s largest lender to local governments, surged 62 percent, while Deutsche Bank AG and UBS AG climbed at least 19 percent. Fortis, whose state-organized breakup was rejected by shareholders last month, soared 28 percent after BNP Paribas SA made a revised offer for its former banking units in Belgium and Luxembourg. BHP Billiton Ltd led mining stocks higher after gains in Chinese factory spending.

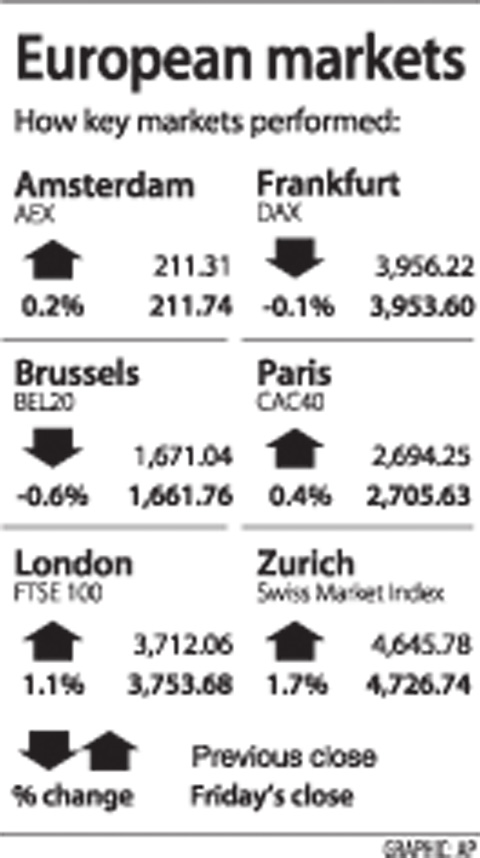

The Dow Jones STOXX 600 Index rose 5.7 percent to 168.57, the steepest weekly advance since the period ended Jan. 2, as banks recovered from the worst year for financial institutions since the Great Depression.

“What set off the rebound was Citigroup saying the start to the year was better,” said Matthieu Giuliani, a fund manager at Palatine Asset Management in Paris, which oversees about US$5.6 billion. “This bit of news shows improvement for earnings of banks. It’s not surprising to see a rebound.”

EUROPEAN TARGETS: The planned Munich center would support TSMC’s European customers to design high-performance, energy-efficient chips, an executive said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday said that it plans to launch a new research-and-development (R&D) center in Munich, Germany, next quarter to assist customers with chip design. TSMC Europe president Paul de Bot made the announcement during a technology symposium in Amsterdam on Tuesday, the chipmaker said. The new Munich center would be the firm’s first chip designing center in Europe, it said. The chipmaker has set up a major R&D center at its base of operations in Hsinchu and plans to create a new one in the US to provide services for major US customers,

The Ministry of Transportation and Communications yesterday said that it would redesign the written portion of the driver’s license exam to make it more rigorous. “We hope that the exam can assess drivers’ understanding of traffic rules, particularly those who take the driver’s license test for the first time. In the past, drivers only needed to cram a book of test questions to pass the written exam,” Minister of Transportation and Communications Chen Shih-kai (陳世凱) told a news conference at the Taoyuan Motor Vehicle Office. “In the future, they would not be able to pass the test unless they study traffic regulations

‘A SURVIVAL QUESTION’: US officials have been urging the opposition KMT and TPP not to block defense spending, especially the special defense budget, an official said The US plans to ramp up weapons sales to Taiwan to a level exceeding US President Donald Trump’s first term as part of an effort to deter China as it intensifies military pressure on the nation, two US officials said on condition of anonymity. If US arms sales do accelerate, it could ease worries about the extent of Trump’s commitment to Taiwan. It would also add new friction to the tense US-China relationship. The officials said they expect US approvals for weapons sales to Taiwan over the next four years to surpass those in Trump’s first term, with one of them saying

BEIJING’S ‘PAWN’: ‘We, as Chinese, should never forget our roots, history, culture,’ Want Want Holdings general manager Tsai Wang-ting said at a summit in China The Mainland Affairs Council (MAC) yesterday condemned Want Want China Times Media Group (旺旺中時媒體集團) for making comments at the Cross-Strait Chinese Culture Summit that it said have damaged Taiwan’s sovereignty, adding that it would investigate if the group had colluded with China in the matter and contravened cross-strait regulations. The council issued a statement after Want Want Holdings (旺旺集團有限公司) general manager Tsai Wang-ting (蔡旺庭), the third son of the group’s founder, Tsai Eng-meng (蔡衍明), said at the summit last week that the group originated in “Chinese Taiwan,” and has developed and prospered in “the motherland.” “We, as Chinese, should never