Wall Street’s stunning comeback from 12-year lows over the past week has sparked some hope for battered investors, but whether the rebound is genuine remains a topic of heated debate.

Some market watchers say a positive outlook from the battered banking sector and tentative signs of stability in some economic reports suggests the worst may be over for the economy and the stock market.

“Stocks have come a long way in a few days,” said Al Goldman, chief market strategist at Wachovia Securities. “The market has already discounted almost every conceivable problem. Thus, any additional evidence that the economy is close to bottoming will keep this market headed higher into year-end — we believe the economic storm is at its peak and will soon begin to moderate.”

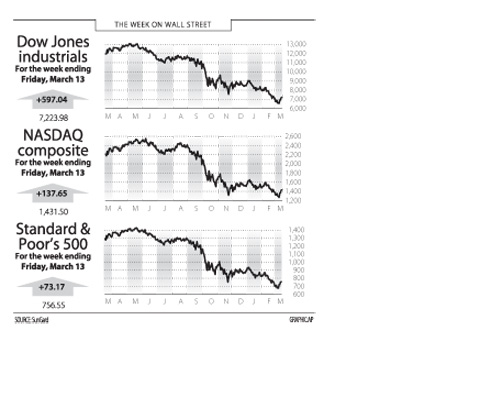

The Dow Jones Industrial Average of 30 blue-chips surged 9.0 percent on the week to end Friday at 7,223.98, roaring back from a 12-year low. The broad-market Standard & Poor’s 500 bounced back from a nearly 13-year low, rallying 10.7 percent in the week to 756.55.

The technology-heavy NASDAQ composite climbed 10.6 percent over the week to end at 1,431.50.

Despite the snapback, the Dow index is down 17.7 percent for this year, with the S&P off 16.2 percent and the NASDAQ 9.2 percent.

With a bear market still in force, many analysts say caution is warranted.

“For the time being, we continue to believe the stock market indices will remain volatile with sharp rallies being followed by corrections as market sentiment continues to be shaped by the daily economic, corporate and political news flow,” said Fred Dickson, strategist at DA Davidson & Co.

Dickson said until the market breaks out above the current trading range, “we will view the market action as a very welcome bear market short-covering rally rather than the beginning of the next long-term bull market.”

More pessimistic, economist Nouriel Roubini of New York University said there was a chance the global recession deepens into a depression, which would make the latest rebound another “sucker rally.”

“If a near depression were to take hold globally, a 40 to 50 percent further fall in US and global equities from current levels could not be ruled out,” Roubini said.

Kent Engelke, chief economic strategist at Capitol Securities Management, said he saw a possible upside surprise.

“Is this rally sustainable or is it just a dead cat bounce?” he said. “There is almost a 100 percent consensus that it is the latter and the lows will be revisited in short time, a pattern steep in precedence of the last 18 months.”

But he argued that “it has been my experience when everyone expects something to happen normally the inverse occurs.”

“I believe if the financials are indeed stabilizing and if there is a change in mark to market accounting, the odds are significant that we have experienced this cycle’s lows,” he added.

Sherry Cooper, chief economist at BMO Capital Markets, said two bits of news on the regulatory front have also brightened the mood.

She said officials and lawmakers seem to be moving toward easing the “mark-to-market” accounting rules that require banks to recognize losses quickly instead of holding them to await a recovery.

Bonds fell in the week. The yield on the 10-year US Treasury bond rose to 2.918 percent from 2.828 percent a week earlier and that on the 30-year bond increased to 3.671 percent from 3.503 percent. Bond yields and prices move in opposite directions.

The economic calendar in the coming week is light, with data due on housing starts and consumer prices. More significantly, the US Federal Reserve opens a two-day meeting on Tuesday expected to signal its intent next week to act even more aggressively in opening up credit markets to spark recovery from recession.

NEXT GENERATION: The four plants in the Central Taiwan Science Park, designated Fab 25, would consist of four 1.4-nanometer wafer manufacturing plants, TSMC said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) plans to begin construction of four new plants later this year, with the aim to officially launch production of 2-nanometer semiconductor wafers by late 2028, Central Taiwan Science Park Bureau director-general Hsu Maw-shin (許茂新) said. Hsu made the announcement at an event on Friday evening celebrating the Central Taiwan Science Park’s 22nd anniversary. The second phase of the park’s expansion would commence with the initial construction of water detention ponds and other structures aimed at soil and water conservation, Hsu said. TSMC has officially leased the land, with the Central Taiwan Science Park having handed over the

AUKUS: The Australian Ambassador to the US said his country is working with the Pentagon and he is confident that submarine issues will be resolved Australian Ambassador to the US Kevin Rudd on Friday said that if Taiwan were to fall to China’s occupation, it would unleash China’s military capacities and capabilities more broadly. He also said his country is working with the Pentagon on the US Department of Defense’s review of the AUKUS submarine project and is confident that all issues raised will be resolved. Rudd, who served as Australian prime minister from 2007 to 2010 and for three months in 2013, made the remarks at the Aspen Security Forum in Colorado and stressed the longstanding US-Australia alliance and his close relationship with the US Undersecretary

‘WORLD WAR III’: Republican Representative Marjorie Taylor Greene said the aid would inflame tensions, but her amendment was rejected 421 votes against six The US House of Representatives on Friday passed the Department of Defense Appropriations Act for fiscal 2026, which includes US$500 million for Taiwan. The bill, which totals US$831.5 billion in discretionary spending, passed in a 221-209 vote. According to the bill, the funds for Taiwan would be administered by the US Defense Security Cooperation Agency and would remain available through Sept. 30, 2027, for the Taiwan Security Cooperation Initiative. The legislation authorizes the US Secretary of Defense, with the agreement of the US Secretary of State, to use the funds to assist Taiwan in procuring defense articles and services, and military training. Republican Representative

TAIWAN IS TAIWAN: US Representative Tom Tiffany said the amendment was not controversial, as ‘Taiwan is not — nor has it ever been — part of Communist China’ The US House of Representatives on Friday passed an amendment banning the US Department of Defense from creating, buying or displaying any map that shows Taiwan as part of the People’s Republic of China (PRC). The “Honest Maps” amendment was approved in a voice vote on Friday as part of the Department of Defense Appropriations Act for the 2026 fiscal year. The amendment prohibits using any funds from the act to create, buy or display maps that show Taiwan, Kinmen, Matsu, Penghu, Wuciou (烏坵), Green Island (綠島) or Orchid Island (Lanyu, 蘭嶼) as part of the PRC. The act includes US$831.5 billion in