Asian stocks rose last week, led by energy and raw-materials producers, after oil and metal prices rallied, and on speculation governments will step up measures to bolster the global economy.

CNOOC Ltd (中國海洋石油) rallied 14 percent and BHP Billiton Ltd, the world’s largest mining company, gained 6 percent as metals and oil climbed. Satyam Computer Services Ltd, an Indian software company, rallied 30.6 percent as the company’s chairman moved to restore investor confidence and as the Economic Times of India said Hewlett-Packard Co may buy a stake.

“There’s a bit of cautious optimism the new year might bring something better,” said Shane Oliver, head of investment strategy at AMP Capital Investors, which holds US$61 billion in Sydney. “Mining stocks were pushed down this year as investors realized the world was going to be dragged into some sort of recession. Growth should pick up through the second half of 2009.”

The MSCI Asia-Pacific Index advanced 3.1 percent to 90.12 this week. Measures of energy and raw-materials stocks had the biggest gains among the broader index’s 10 industry groups. The energy and materials gauges lost more than half their value last year, the MSCI Asia-Pacific’s worst performers, on concern the global economy sliding into recession would hurt commodity demand.

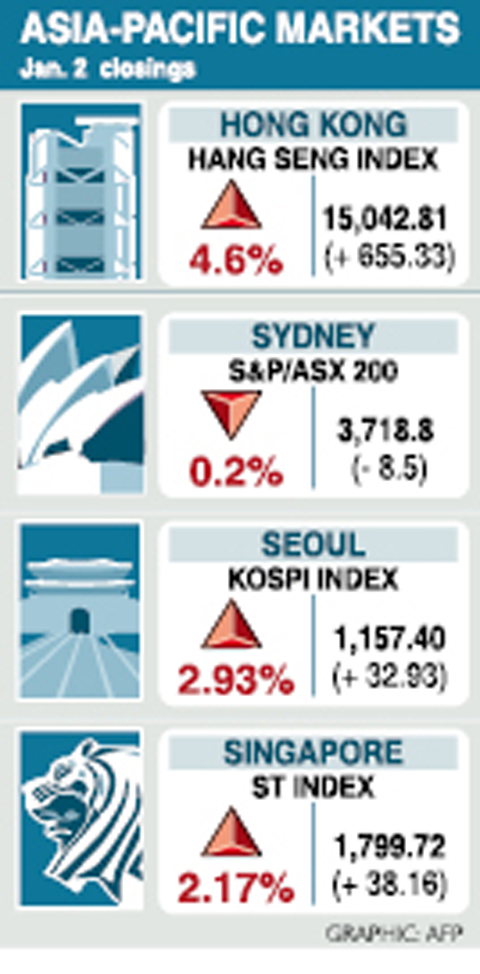

Japan was shut for the last three days of the week for the new year, with most markets closed on Thursday. Hong Kong’s Hang Seng Index climbed 4.6 percent on Friday for the best start to a year since at least 1970.

The Asian benchmark index lost 43 percent last year, the worst year in its two-decade history, as the collapse of the US housing market caused losses at financial institutions worldwide to swell to more than US$1 trillion.

Stock markets worldwide lost US$30 trillion in value last year, with only three of 89 major equity indexes tracked by Bloomberg posting gains. MSCI’s Asian gauge trades at about 13 times estimated profit, down more than one-fifth from a year ago.

Growth in the global economy will slow to 2.2 percent this year from last year’s 3.7 percent, the IMF said on Nov. 6. The IMF said a growth rate of 3 percent or less is “equivalent to a global recession.”

An index of Australian manufacturing contracted for a seventh month last month, an industry report released in Canberra on Friday showed. Singapore’s economy may shrink more than previously forecast this year, the government said.

The global slowdown has prompted governments worldwide including the US and Japan to slash interest rates and announce stimulus packages. South Korean President Lee Myung-bak pledged on Friday to keep devising measures to counter the slowdown.

Fubon Financial Holding Co (富邦金控), Taiwan’s No. 2 financial services company, surged 7.7 percent to NT$23.90. ProMOS Technologies Inc (茂德科技), Taiwan’s most unprofitable memory-chip maker, soared 16 percent to NT$2.43.

The government plans to spend NT$200 billion (US$6.1 billion) to help key industries through the global crisis, Premier Liu Chao-shiuan (劉兆玄) said on Tuesday.

Tokyo, Taipei, Shanghai, Bangkok, Manila, Jakarta and New Zealand were closed on Friday for public holidays and will reopen tomorrow.

Other regional markets:

KUALA LUMPUR: Malaysian shares rose 2 percent. The Kuala Lumpur Composite Index rose 17.61 points to close at 894.36. Advancing stocks outnumbered declines 392 to 139.

MUMBAI: Indian shares closed 0.55 percent higher. The benchmark 30-share SENSEX index closed 54.76 points higher at 9,958.22.

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

SOUTH CHINA SEA? The Philippine president spoke of adding more classrooms and power plants, while skipping tensions with China over disputed areas Philippine President Ferdinand Marcos Jr yesterday blasted “useless and crumbling” flood control projects in a state of the nation address that focused on domestic issues after a months-long feud with his vice president. Addressing a joint session of congress after days of rain that left at least 31 dead, Marcos repeated his recent warning that the nation faced a climate change-driven “new normal,” while pledging to investigate publicly funded projects that had failed. “Let’s not pretend, the people know that these projects can breed corruption. Kickbacks ... for the boys,” he said, citing houses that were “swept away” by the floods. “Someone has

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole