European stocks rose last week, led by construction companies and commodity producers, on speculation a US stimulus plan will prevent a prolonged recession in the world’s largest economy.

Lafarge SA, the biggest cement maker, and Holcim Ltd climbed at least 11 percent as US president-elect Barack Obama said he was planning the most extensive public-works spending package since the 1950s.

Rio Tinto Group, the third-largest mining company, surged 42 percent after saying it will reduce debt. Gains in the Dow Jones Stoxx 600 Index were limited after the Senate rejected a US$14 billion plan to rescue US carmakers.

GRAPHIC: AP

The STOXX 600 added 4.4 percent to 198.22, bringing the rebound from this year’s low last month to 8.8 percent as governments from the US to India announced packages to buoy the global economy and prevent earnings from tumbling.

“Stimulus plans offer oxygen as we face an accumulation of bad news,” said Pierre Nebout, a fund manager at Edmond de Rothschild Asset Management in Paris, which oversees US$3.9 billion in stocks.

“The market welcomes them,” he said in a Bloomberg Television interview.

The STOXX 600 has tumbled 46 percent this year as almost US$1 trillion in bank losses and writedowns froze credit markets and pushed the US, Europe and Japan into the first simultaneous recessions since World War II.

National benchmark indexes rose in all 18 western European markets this week except Iceland.

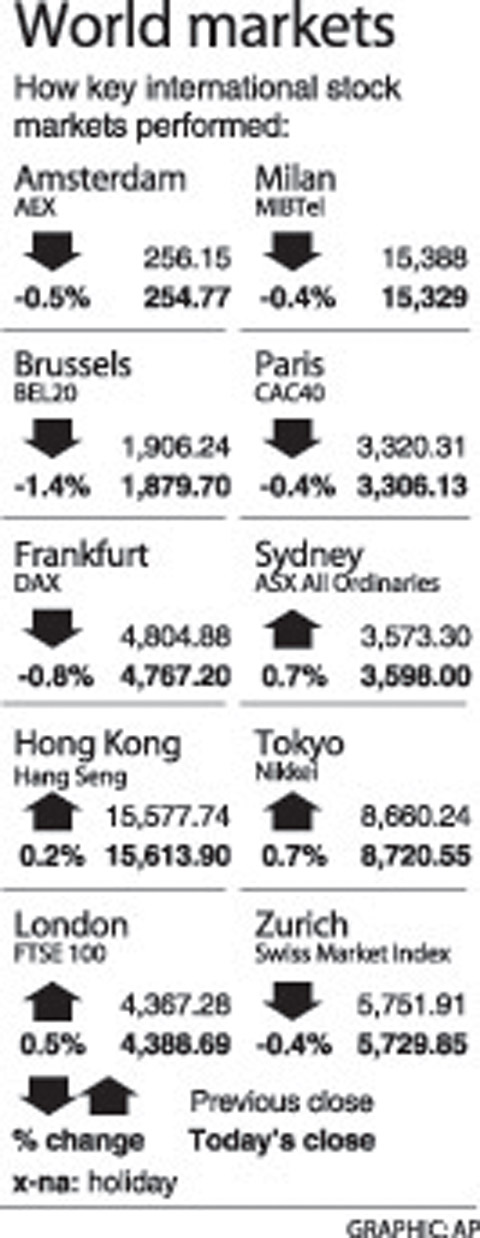

Germany’s DAX Index added 6.4 percent. France’s CAC 40 climbed 7.6 percent and the UK’s FTSE 100 increased 5.7 percent.

Lafarge gained 11 percent.

Holcim, the world’s second-biggest cement maker, advanced 19 percent. Lafarge gets 24 percent of its sales in North America, while Holcim generates almost 20 percent of revenue there.

Obama said on Dec. 6 he would boost investment in roads, bridges and public buildings to create and preserve 2.5 million jobs.

That’s the largest public works program since US president Dwight Eisenhower created the interstate highway system.

Mining stocks climbed 17 percent as a group this week, the best-performing industry in the STOXX 600.

Rio Tinto surged 42 percent after the company said it would cut 14,000 jobs and slash spending next year to reduce debt as the global financial crisis curbs demand for metals.

Lonmin Plc, the third-largest platinum producer, and Vedanta Resources Inc, the mining company controlled by billionaire Anil Agarwal, each soared 29 percent.

The STOXX 600 pared its weekly gain, losing 2.7 percent on Friday after the US Senate’s rejection of a rescue for carmakers in the US.

The bailout plan was thwarted when a bid to cut off debate on the bill the House passed on Thursday fell short of the required 60 votes.

The Bush administration will “evaluate our options in light of the breakdown in Congress,” spokesman Tony Fratto said.

EUROPEAN TARGETS: The planned Munich center would support TSMC’s European customers to design high-performance, energy-efficient chips, an executive said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday said that it plans to launch a new research-and-development (R&D) center in Munich, Germany, next quarter to assist customers with chip design. TSMC Europe president Paul de Bot made the announcement during a technology symposium in Amsterdam on Tuesday, the chipmaker said. The new Munich center would be the firm’s first chip designing center in Europe, it said. The chipmaker has set up a major R&D center at its base of operations in Hsinchu and plans to create a new one in the US to provide services for major US customers,

The Ministry of Transportation and Communications yesterday said that it would redesign the written portion of the driver’s license exam to make it more rigorous. “We hope that the exam can assess drivers’ understanding of traffic rules, particularly those who take the driver’s license test for the first time. In the past, drivers only needed to cram a book of test questions to pass the written exam,” Minister of Transportation and Communications Chen Shih-kai (陳世凱) told a news conference at the Taoyuan Motor Vehicle Office. “In the future, they would not be able to pass the test unless they study traffic regulations

GAINING STEAM: The scheme initially failed to gather much attention, with only 188 cards issued in its first year, but gained popularity amid the COVID-19 pandemic Applications for the Employment Gold Card have increased in the past few years, with the card having been issued to a total of 13,191 people from 101 countries since its introduction in 2018, the National Development Council (NDC) said yesterday. Those who have received the card have included celebrities, such as former NBA star Dwight Howard and Australian-South Korean cheerleader Dahye Lee, the NDC said. The four-in-one Employment Gold Card combines a work permit, resident visa, Alien Resident Certificate (ARC) and re-entry permit. It was first introduced in February 2018 through the Act Governing Recruitment and Employment of Foreign Professionals (外國專業人才延攬及雇用法),

‘A SURVIVAL QUESTION’: US officials have been urging the opposition KMT and TPP not to block defense spending, especially the special defense budget, an official said The US plans to ramp up weapons sales to Taiwan to a level exceeding US President Donald Trump’s first term as part of an effort to deter China as it intensifies military pressure on the nation, two US officials said on condition of anonymity. If US arms sales do accelerate, it could ease worries about the extent of Trump’s commitment to Taiwan. It would also add new friction to the tense US-China relationship. The officials said they expect US approvals for weapons sales to Taiwan over the next four years to surpass those in Trump’s first term, with one of them saying